Another UK CPI upside surprise points to possible 50bp hike by BoE

GBP: Growth concerns will temper pound gains

We have just had the release of the May CPI report in the UK and once again it’s a bad report with the MoM gain in CPI of 0.7% bigger than the 0.4% expected. As a result, the annual rate remained unchanged at 8.7% instead of declining to 8.4% as expected. Worse still, it is underlying inflation pressures causing the upside surprise with the core CPI YoY rate accelerating from 6.8% to 7.1%, a new cyclical high. All other advanced economies has started to record slower underlying inflation YoY growth rates. This is a bad print – the BoE anticipated a YoY gain for Q2 2023 of 8.22% in its May forecasts - we will have a Q2 YoY inflation rate notably higher than that unless there is a very large downside surprise in the June data.

Looking at the details, Clothing & Footwear recorded a strong 1.3% MoM gain while Household increased 1.1% MoM. Communications gained 0.9%; Recreation 0.7%, and Restaurant & Hotels increased 1.0%. There was at least some good news with food and non-alcoholic beverages slowing from 19.1% to 18.4% confirming other data source suggesting food inflation has peaked. But services inflation accelerated once again from 6.9% to 7.4% - a very sharp increase and at this juncture of the tightening will alarm the BoE.

Given the BoE forecast for Q2 2023 of 8.22% and after two consecutive 8.7% readings our calculation indicate the MoM inflation rate would have to drop marginally in order for the BoE to hit its Q2 forecast. The OIS market yesterday indicated about 30bps of tightening was priced for tomorrow. That has now leapt to 37bps and we suspect throughout today that might drift further higher in response to this data.

There will no doubt be a reluctance of the BoE to switch back to a faster pace of tightening and there will be concerns of that looking panicky and also looking like the BoE itself believes it is losing control of inflation.

But unfortunately, that is to a degree the reality. The BoE may still lean to the side of caution and go 25bps arguing that the lag effects mean tightening will soon start to have a clearer impact. The good news today was in the PPI data which revealed much stronger evidence of disinflation. The PPI Output YoY rate slowed from 5.4% to 2.9% with some big MoM declines. Our call for tomorrow was 25bps but we lean slightly more in favour of 50bps now given this terrible inflation print. Like before, more aggressive action should help boost GBP near-term but investor concerns will likely build over the growth implications which will limit the scale of appreciation at higher levels, possibly approaching the 1.3000-level in GBP/USD. But we are already on the fine line of high inflation / BoE policy action lifting GBP and high inflation / perceived BoE policy mismanagement undermining the pound.

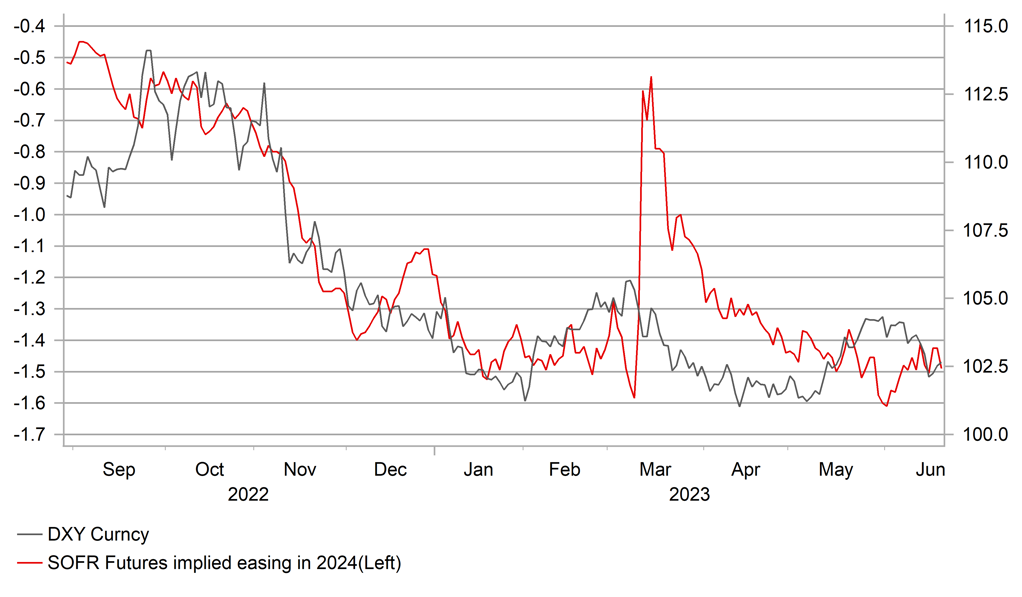

FED RATE CUT EXPECTATIONS IN 2024 HAS HELPED WEAKEN THE DOLLAR

Source: Macrobond

USD: Powell semi-annual to throw light on FOMC message

The 2-year UST note yield is currently up about 30bps this month and the gains largely preceded the FOMC meeting last Wednesday with the markets anticipating a hawkish bias to the meeting. In the week since that meeting, the 2-year yield has not advanced further but has maintained the gains – a scenario that we are sure has been deemed by the FOMC as a successful outcome. The FOMC want to try and maintain tight financial conditions and hence are talking tough and signalling via the dots profile two further rate increases this year. The success has been evident by the markets removing the previous easing priced for this year but the market has only half-heartedly priced further rate hikes this year – less than one 25bp hike is priced.

Later today Fed Chair Powell will deliver his semi-annual testimony to Congress. Given this is coming so soon after the FOMC press conference, it will be difficult for Powell to deliver a different message. But of course nuance and tone mean everything and hence there is scope for Powell to alter expectations if he so wishes. But just like last week, it will be difficult today to explain the background for pausing but also explain why the FOMC will hike twice further. As we said here last week, a pause is a pause and that must be a signal of being more content with the inflation outlook. The semi-annual may be broadly similar in message and tone to the FOMC press conference statement but the Q&A could be more important than usual today given members of the House Financial Services Committee are likely to push him on this conflict between the act of pausing and the act of signalling more hikes to come.

Everybody is expecting a strong “higher for longer” message from Powell but it is hard to envisage this message resonating with the markets in a dramatically different way to last week – which we would sum up as “sceptical acceptance” with the incoming data between now and the July meeting being the true determinant of whether the FOMC hikes again or not. With just one NFP and CPI report before that July meeting we can’t say with much confidence that the FOMC will not hike, but by September we be much more confident of the FOMC being done hiking by then. The US economy is not as strong as made out by FOMC members and that should be apparent by then.

In the meantime, beyond some modest US dollar and rates moves back and forth, the markets will likely await key data points to determine Fed action – the PCE inflation next week, the ISM and NFP the following week and the CPI the week after.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

Nationwide HPI (YoY) |

-- |

-- |

-3.4% |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Jun |

-18 |

-17 |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

7.2% |

! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Apr |

0.3% |

-0.3% |

!! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

May |

0.0% |

-0.1% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Apr |

0.2% |

-1.4% |

!!! |

|

GE |

14:45 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

EC |

14:45 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!!!! |

|

NZ |

16:00 |

GlobalDairyTrade Price Index |

-- |

-2.4% |

-0.9% |

!! |

|

US |

16:40 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

!! |

|

US |

21:00 |

FOMC Member Mester Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg