Yen ending week on softer footing after central bank updates

JPY: Stronger Japan CPI report fails to support the yen

The yen is finishing the week on a softer footing with USD/JPY rising back above 149.50 after hitting a low yesterday at 148.18. The pair is currently on course for the second consecutive week of modest gains. The yen has been undermined this week by the BoJ’s cautious policy update (click here) when they expressed more unease over elevated overseas uncertainties which were described as “rising quickly”. The BoJ will be in a better position to assess the outlook for Japan’s economy and monetary policy at their next meeting on 1st May after President Trump announces his plans in early April for “reciprocal tariffs” and sector specific tariffs on autos, semi-conductors and pharmaceuticals. He has indicated that details for broad-based and potentially more disruptive tariffs will be released on 2nd April. In the interim the BoJ is understandably reluctant to send a stronger signal over the timing of the next rate hike which has been weighing modestly on the yen this week. We still expect the BoJ to deliver another rate hike in July but acknowledge that it could be delivered sooner in May or June.

There was further encouragement overnight for the BoJ to continue to normalize monetary policy. The release of the latest CPI report from Japan for February revealed that headline inflation slowed less than expected to 3.7% down from 4.0% in January compared to the consensus forecast for a deeper pullback to 3.5%. The resumption of government subsidies on electricity and gas cut 0.3 ppts from headline inflation and fresh food prices subtracted a further 0.16ppts. However, the core-core measure of inflation which excludes fresh food and energy picked up modestly by 0.1ppt to an annual rate of 2.6%. There was also only a modest slowdown in services inflation by 0.1ppt to 1.3% in February although that was mainly due to an unfavourable base effect. Overall, the report is broadly in line with the BoJ’s current outlook for Japan’s economy meeting their conditions for further monetary tightening. Alongside recent stronger wage negotiation results for the upcoming fiscal year, the BoJ should have more confidence that inflation can be sustained closer to their 2.0% target. The developments support our view that the recent yen sell-off is likely to prove short-lived. The yen is still the best performing major currency so far this year.

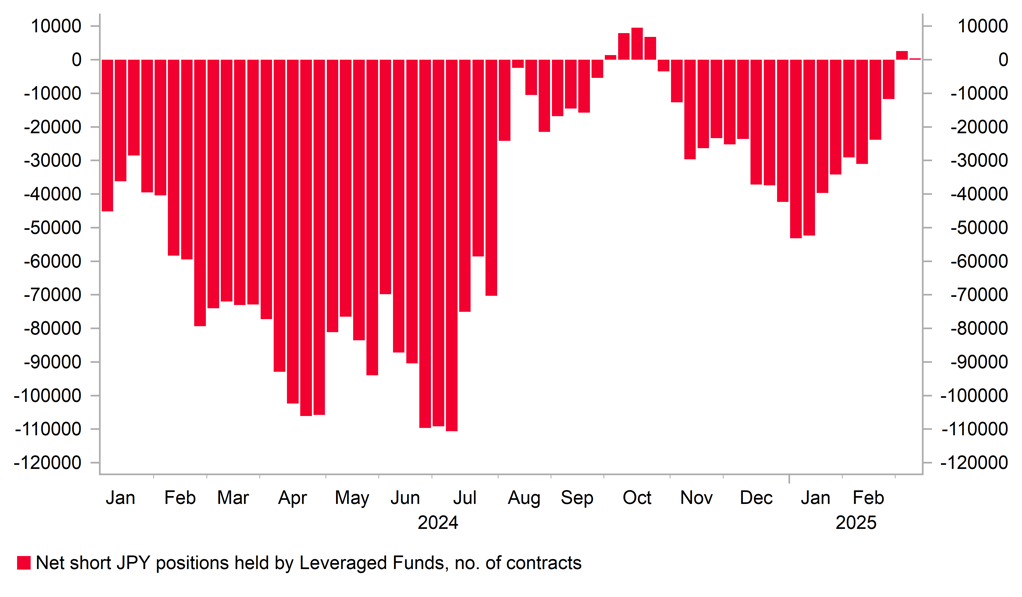

LEVERAGED FUNDS ARE NO LONGER SHORT JPY

Source: Bloomberg, Macrobond & MUFG GMR

European FX: Impact from BoE, SNB & Riksbank policy updates

There was a busy schedule of European central bank policy updates yesterday including the latest meetings from the BoE, Riksbank and SNB. The policy updates have had only a modest impact on the FX market. At yesterday’s MPC meeting (click here), the BoE signalled that they are less confident over continuing quarterly rate cuts reflecting heightened uncertainty over the economic outlook. The majority of MPC members stated that there was no presumption that monetary policy was on a pre-set path over the “next few meetings”. It highlights that it is not a done deal that the BoE will stick to the current path of quarterly rate cuts by lowering rates by a further 25bps in May. We still expect the BoE to deliver another rate cut in May but expect it to become more challenging to stick to quarterly rate cuts by the August MPC meeting when headline inflation is expected to pick-up to a peak of around 3.75% in Q3. It is a view shared by the UK rate market which is still pricing in around 17bps of cuts for the May MPC meeting but only 32bps in total by the August MPC meeting. A more cautious approach to further BoE easing that keeps UK rates higher for longer is a supportive development for the pound.

While the BoE is still planning to lower rates further both the SNB and Riksbank have likely reached the end of their easing cycle at least in the near-term. The SNB delivered another 25bps rate cut yesterday as expected lowering their policy rate to 0.25%. With the policy rate close to the zero bound again, market participants were watching closely to see the updated policy guidance. SNB President Martin Schlegel stated that “this rate cut has an expansionary impact. In that sense, the probability of additional policy easing is naturally lower”. He did not completely rule out further rate cuts to the zero bound or back into negative territory but we are assuming that it is not the base case scenario. It would likely require another negative shock and/or a significant strengthening of the Swiss franc to encourage a return to negative rates in Switzerland. Fortunately for the SNB, the Swiss franc has weakened recently in response to the improving outlook for growth in Europe triggered both by plans for a significant loosening of fiscal policy in Germany and building optimism over a ceasefire agreement between Ukraine and Russia. In contrast to the Swiss franc, the Swedish krona has benefitted the most from those factors and has been the best performing G10 currency this year. The significantly stronger krona provides an offset to the upside inflation surprise in Sweden at the start of this year. The Riksbank indicated yesterday that it views the recent pick-up in inflation as temporary and is happy to leave rates on hold at the current level of 2.25% in the coming years. After recent outsized gains for the krona, there is a higher risk of a reversal lower in the month ahead.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

M3 Money Supply |

Feb |

-- |

1,152.9B |

! |

|

GE |

09:00 |

German Buba Mauderer Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Current Account |

Jan |

-- |

38.4B |

! |

|

EC |

09:00 |

Current Account n.s.a. |

Jan |

-- |

50.5B |

! |

|

EC |

10:00 |

EU Leaders Summit |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Mar |

-30 |

-28 |

!! |

|

CA |

12:30 |

Retail Sales (MoM) |

Jan |

-0.4% |

2.5% |

!! |

|

US |

13:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

EC |

15:00 |

Consumer Confidence |

Mar |

-13.0 |

-13.6 |

! |

Source: Bloomberg