EUR external balance has improved notably

USD: Low volatility keeps carry in vogue

Moves in foreign exchange today have been relatively modest with no top tier data to drive the market and due to a continued lack of conviction on possible divergence in central bank policy outlook. The higher for longer mantra from the Fed in recent months has been taken on by the RBA with the minutes from the May meeting, released today, highlighting the increased concerns within the RBA over rising inflation risks. As was acknowledged at the time of the meeting announcement on 7th May, the RBA discussed raising the key policy rate indicating the distance the RBA remains from cutting rates. There has been little reaction to the minutes with as much focus on the fact that the RBA wants to avoid “excessive fine-tuning” in its policy decisions.

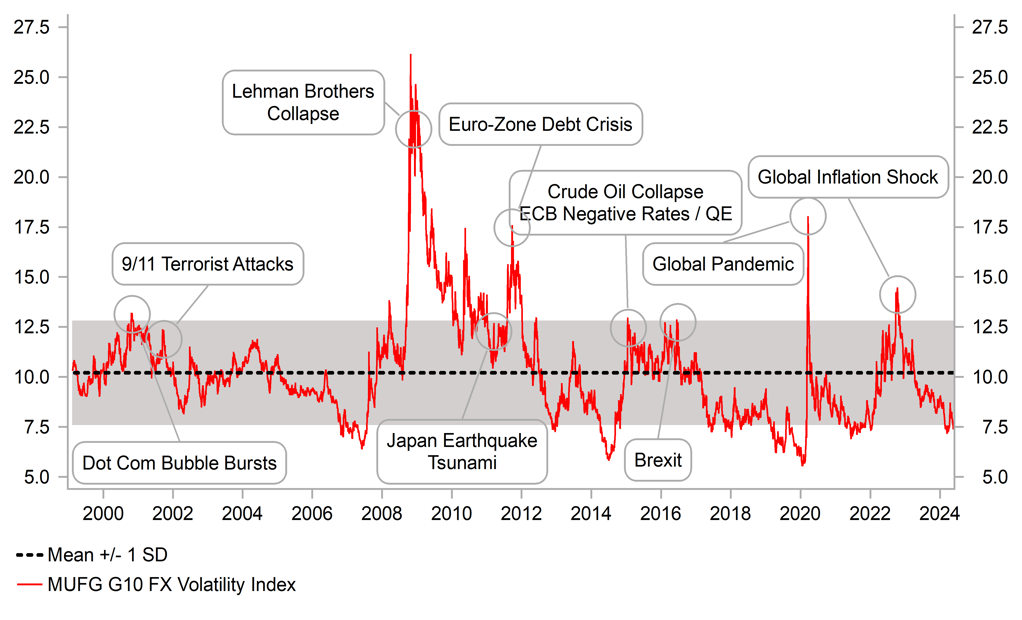

But what remains clear for now is that while there are differences in key central bank policy expectations, those differences are not enough to fuel big FX moves. Since the start of 2023, EUR/USD has been trading within a 1.0500-1.1000 range for approximately 90% of the time. G10 FX volatility is falling once again as the markets start to ponder lower Fed policy rates that would bring the Fed back more in line with

the pricing of some of the other main central banks in G10. The differences in cumulative easing remains relatively minor with the Fed priced to cut by 40bps by year-end compared to 56bps from the BoE and 67bps by the ECB. We think each of the three central banks will cut by more than currently priced but based on current communications and the economic data available, current market pricing is reasonable. Fed President Mester was the latest to question the likelihood of the Fed cutting three times this year – something Mester is on record as previously supporting. It seems very clear that the median dot profile at the Fed meeting in June will likely drop for three rate cuts to two.

We would argue the Fed could still end up cutting three times but the key point here is that the major central banks look set to cut by two-to-three times, with some commencing in the summer and this is largely what is currently priced. As long we avoid the scenario of the Fed having to revisit the prospect of rate hikes, the likelihood is that FX volatility will remain low. Cuts from the ECB, BoC and probably the BoE while the Fed waits, say until September, will only reinforce current low volatility conditions and the continued favouring of carry. We believe as long as global growth conditions do not deteriorate, the scope for the dollar to strengthen will remain limited.

MUFG G10 FX VOLATILITY INDEX BACK BELOW 1STD DEV OF LT AVERAGE

Source: Macrobond, Bloomberg & MUFG Research

EUR: Current account data should highlight some positives

The ECB will today release its monthly balance of payments statistics for March and we should again see evidence that both the current account position in the euro-zone and the portfolio flows have notably improved since the post-covid period and the period following the invasion of Ukraine by Russia. The current account surplus came in at EUR 29.5bn in February following a EUR 39.3bn surplus in January, which was the fourth largest surplus on record. Remarkably, the euro-zone has gone from a record deficit of EUR 31.9bn in August 2022 to the fourth largest in January – a period of just 17mths. This is another example of the euro-zone having come out the other side of the huge energy price shock that severely hit the euro in 2022-23. If you annualise the surplus over the last three months the euro-zone has hit an annualised surplus of EUR 400bn compared to a three-month annualised deficit at the worst point in 2022 of EUR 274bn. The consensus is for a surplus of EUR 30bn in March.

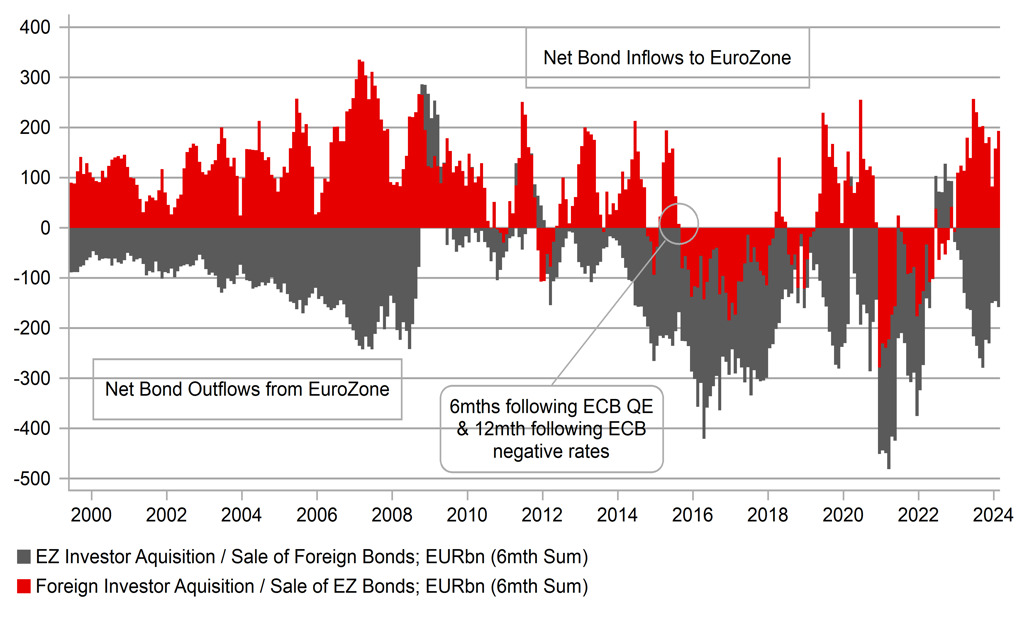

On the financial account side of the balance of payments there has also been an improvement. As can be seen above, there was a very clear and notable shift away from the euro-zone bond markets by foreign investors once the ECB adopted negative rates in 2014 and followed that with QE in early 2015. From the middle of 2015 onwards, the euro-zone recorded very sharp net bond outflows with foreign investors selling euro-zone bonds and euro-zone investors buying foreign bonds. Only in the year ahead of covid and immediately after covid did we see foreign investor demand for euro-zone bonds. Excluding the covid period given the extraordinary global market conditions through some of that period, the current period of demand for euro-zone bonds is the strongest and most sustained since ECB negative rates and QE were adopted in 2014-15.

It’s difficult to predict month to month, but taking today’s data and going forward, it seems likely that the balance of payments data will continue to highlight the improved external position for the euro-zone. Certainly, on an annualised basis, a current account surplus in the region of EUR 400bn is a positive and tends to align with currencies conveying safe-haven characteristics. Historically, the euro does perform well in risk events – while it may weaken versus the dollar it tends to outperform most of the rest of G10 (usually CHF outperforms, sometimes yen but that’s less likely now). That’s an added positive for EUR going forward after that safe-haven status was lost during the Russia-induced energy price shock of 2022-23.

FOREIGN INVESTORS HAVE RETURNED TO EURO-ZONE BOND MARKETS FOLLOWING THE REMOVAL OF NEGATIVE RATES

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:00 |

Treasury Secretary Yellen Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Current Account |

Mar |

30.2B |

29.5B |

! |

|

EC |

09:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

US |

09:20 |

Fed Governor Kroszner Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Construction Output (MoM) |

Mar |

-- |

1.83% |

! |

|

EC |

10:00 |

Trade Balance |

Mar |

19.9B |

23.6B |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

May |

-20 |

-23 |

! |

|

CA |

13:30 |

Common CPI (YoY) |

Apr |

2.8% |

2.9% |

!! |

|

CA |

13:30 |

Core CPI (MoM) |

Apr |

-- |

0.5% |

!!! |

|

CA |

13:30 |

Core CPI (YoY) |

Apr |

-- |

2.0% |

!! |

|

CA |

13:30 |

CPI (YoY) |

Apr |

2.7% |

2.9% |

!! |

|

CA |

13:30 |

CPI (MoM) |

Apr |

0.5% |

0.6% |

!!! |

|

CA |

13:30 |

Median CPI (YoY) |

Apr |

2.7% |

2.8% |

! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Apr |

2.9% |

3.1% |

! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

6.3% |

! |

|

US |

14:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

14:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:10 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

16:45 |

Fed V Chair for Supervision Barr Speaks |

-- |

-- |

-- |

!! |

|

UK |

18:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg