USD sell-off continues ahead of FOMC minutes

USD: Dovish rate market repricing looking through higher for longer guidance

The US dollar has continued to weaken overnight with weakness most evident against the yen and other Asian currencies. It has resulted in USD/JPY and USD/CNY falling to intra-day lows 147.25 and 7.1310 respectively. It is the first time that USD/CNY has fallen back below the daily fixing rate set today at 7.1406 since July which provides another indication that the tide is continuing to turn against the US dollar in the near-term. The US dollar has continued to weaken overnight undermined by the ongoing pullback in US yields. The 10-year US Treasury bond yield has fallen to 4.38% as it moves further below the high from last month at 5.02%. The main focus today will be the release of the latest FOMC minutes from the policy meeting on 1st November. At the November FOMC meeting Fed Chair Powell indicated that the Fed was less confident that the they needed to hike rates as previously planned in December, and emphasized that upcoming policy decisions would be data dependent. The recent softer US CPI and nonfarm payrolls have since reinforced market expectations that the Fed’s tightening cycle is over. It is unlikely that the minutes from the November FOMC meeting will materially alter those expectations, but they are also unlikely to encourage market participants to price in earlier rate cuts. Richmond Fed President Barkin who is a voting member on the FOMC this year spoke yesterday and acknowledged that overall and core inflation numbers are “coming down nicely”. He indicated that the future moves of inflation are the key data points to watch. He remains concerned though that inflation will prove “stubborn, and that makes the case for me being higher for longer”. Overall, his comments send a cautionary signal to market participants over the risk of getting too carried away about the timing and scale of Fed cuts likely to be delivered next year.

A similar message was also delivered yesterday by BoE Governor Bailey who warned that MPC members are “on watch for further signs of inflation persistence that may require interest rates to rise again”. He reiterated again that it was “far too early to be thinking about rate cuts” with services inflation “much too high” and wage growth still “elevated”. The comments pushback against the dovish repricing that is taking place in the UK rate market. The first 0.25 point BoE rate cut is now priced in by June and there is a total of almost 0.75 points of cuts priced in by the end of next year. Market participants are willing to look through the higher rates for longer mantra of major central banks in anticipation that slowing inflation and growth will encourage policymakers to change their tune next year. The main immediate challenge to the dovish repricing in the UK rate market will be the release of the government’s fiscal statement this week. Comments at the start of this week from Prime Minister Sunak and Chancellor Hunt have strongly indicated that tax cuts are likely to be delivered for businesses and households which unless offset by spending cuts will act to reduce the BoE’s room to loosen monetary policy next year. The fiscal announcement could lift short-term UK yields and the pound.

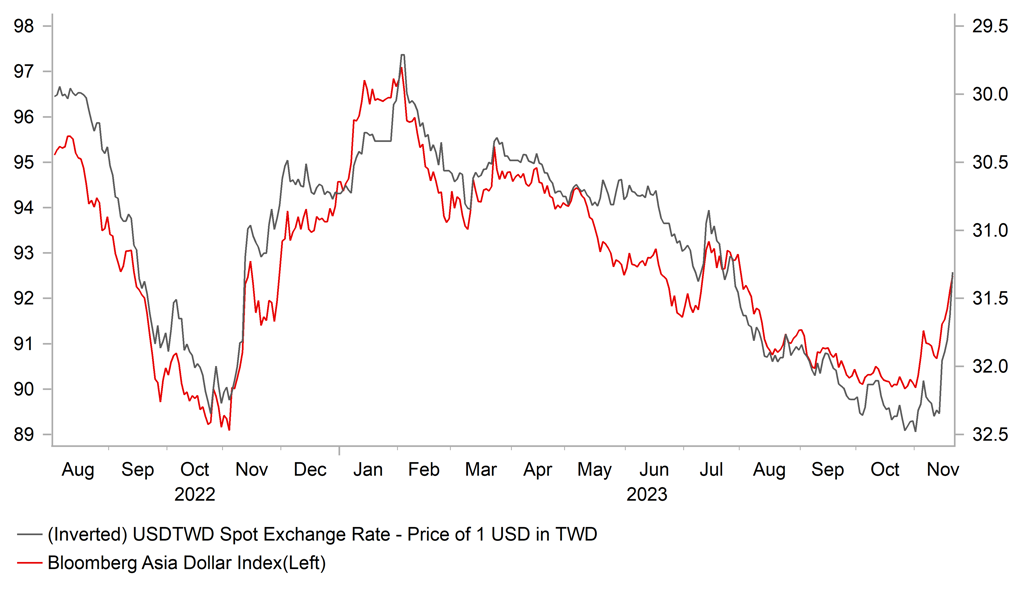

ASIAN CURRENCIES REBOUNDING LIKE LATE LAST YEAR

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: A year-end rebound is well underway

Emerging market currencies have continued to benefit over the past week from the ongoing sell-off for the USD. After peaking in the first week of October, the dollar index has since declined by around -3.9%. The biggest beneficiaries amongst emerging market currencies over the past week have been the CLP (+5.4% vs. USD), PLN (+4.4%), RUB (+3.9%), MXN (+3.1%), TWD (+2.9%), CZK (+2.9%) and KRW (+2.8%). In contrast, the only emerging market currencies that failed to strengthen against the USD were the ARS (-1.1% vs. USD) and TRY (-0.7%).

The broad-based USD sell-off was reinforced last week by the release of softer US economic data including importantly the CPI report for October that provided further evidence that inflation pressures continue to normalize. There has also been tentative evidence (retail sales & IP reports for October) that growth in the US is beginning to moderate in early Q4 after the unsustainable surge in Q3. The data flow has made US rate market participants more confident that the Fed’s hiking cycle is over, and speculation is intensifying over rate cuts next year that is placing downward pressure on US yields. We are not expecting the release of the November FOMC minutes and/or comments from Fed speakers including New York Fed President Williams in the week ahead to derail the dovish repricing of Fed policy expectations.

Emerging market currencies in particular Asian currencies are benefitting as well from the easing back of China-related risks. The latest monthly activity data for October revealed further evidence that growth in China has picked-up since the summer in response to policy stimulus. In addition, the latest political developments in Taiwan (click here) should help to ease geopolitical risks in the region. It has increased the likelihood that the upcoming elections in January could result in improved relations between Taiwan and China that creates a more favourable backdrop for Asian currencies. We expect Asian currencies to strengthen further in the near-term although the lack of investor enthusiasm over improving growth in China cautions against expecting gains as strong as this time last year.

Within EMEA, there has been evidence of stronger growth amongst Central European economies in Q3 while inflation is falling more quickly than expected. GDP growth picked up in both Hungary and Poland by 0.9%Q/Q and by 1.4% respectively in Q3. Headline inflation in Hungary fell sharply to 9.9% in October as it moved further above the January peak of 25.7%. It has supported expectations that the NBH will continue to lower their policy rate this week by a further 0.75 point to 11.50%. The erosion of the yield pick-up in Hungary is gradually eroding the carry appeal of the HUF. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:05 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

UK |

10:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

UK |

10:15 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

UK |

10:15 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

UK |

10:15 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

CPI (YoY) |

Oct |

3.2% |

3.8% |

! |

|

US |

15:00 |

Existing Home Sales |

Oct |

3.90M |

3.96M |

!!! |

|

EC |

16:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

17:15 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!! |

Source: Bloomberg