JPY supported by comments from BoJ Governor Ueda

JPY: BoJ Governor Ueda leaves door open for December hike

The yen has strengthened overnight resulting in USD/JPY falling back below the 155.00-level. The stronger yen has been encouraged by comments from BoJ Governor Ueda who stated that it is not possible to predict the outcome from the December policy meeting. He emphasized that there is still a lot of data to be released before they make their policy decision in December. After the lack of a clear signal in a key note speech from Governor Ueda at start of this week over a December rate hike, market participants including ourselves had become more confident that the BoJ would wait until January of next year at the earliest to deliver another rate hike. However, the comments overnight will breathe fresh life into speculation over an earlier hike before the end of this year providing more support for the yen. He also added that the BoJ “do take seriously into account exchange rate movements in forming our economic and inflation outlook, including the question of what’s causing the exchange rate changes that are taking place at the moment”. We are currently forecasting the next BoJ rate hike in January but acknowledge that those plans could be brought forward if the yen continues to weaken sharply as it has done in recent months.

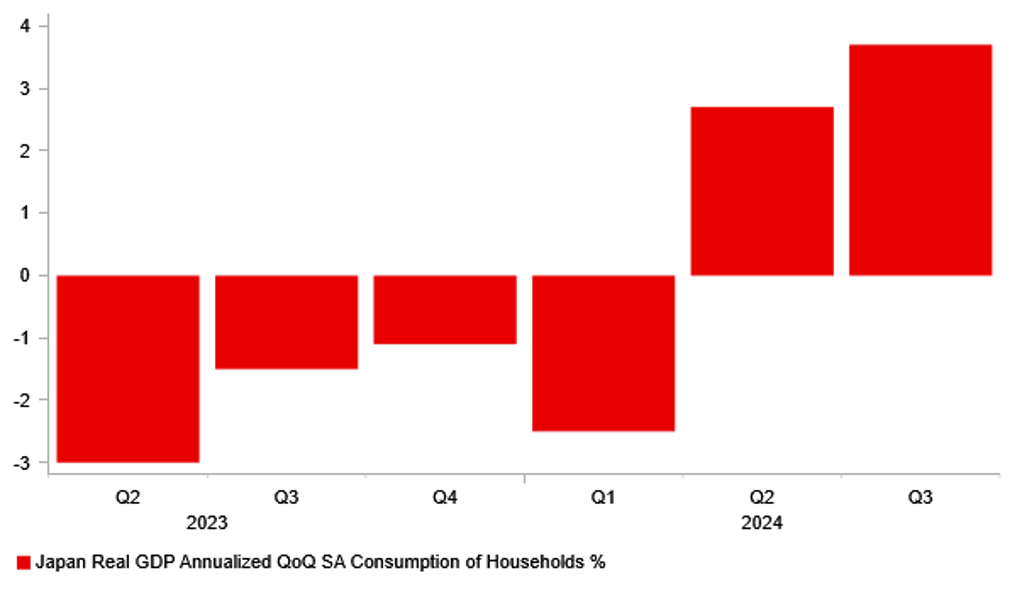

It has also been reported overnight by Kyodo news that Prime Minister Ishiba’s cabinet is set to approve a JPY39 trillion economic support package including subsidies to offset high electricity, gas and gasoline prices and to deliver cash handouts to low-income households. It will include a plan to raise the tax-free income threshold which was a demand from the DPP party. After losing their majority in the lower house of parliament, the LDP and Komeito have secured support from the DPP to pass the stimulus package. According to the report, the Cabinet plans to formalize stimulus measures tomorrow with a plan to have a supplementary budget for the current fiscal year passed through parliament by the end of the year. The supplementary budget is expected to total JPY13.9 trillion. The economic support package is a supportive development for private consumption and will help keep the BoJ to on track to keep raising rates. Private consumption has proven stronger than expected in recent quarters and was boosted by one-off income tax cut and higher wage growth in Q3.

STRONGER HOUSEHOLD CONSUMPTION IS SUPPORTIVE FOR BOJ HIKE

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB sticks to dovish guidance following stronger wage growth

The euro has been consolidating at lower levels over the past week resulting in EUR/USD trading within a narrow range between 1.0500 and 1.0600. It still leaves the euro as one of the worst performing G10 currencies this month alongside the Swedish krona. Both currencies have been hit harder by the US election victory for Donald Trump which has increased likelihood of another trade war that will add to downside risks to the already weak growth outlook in Europe. The Riksbank delivered a larger 50bps rate cut this month after it was disappointed by the lack of clear evidence over economic recovery with Sweden’s economy still in recession. While the euro-zone economy has performed better with growth coming in stronger than expected in Q3, the ECB has become more concerned that risks to their inflation outlook are beginning to shift to the downside. The election victory for Donald Trump will reinforce those concerns especially if he follows through by imposing higher tariffs on imports from the EU next year. Trump’s decision to pick Howard Lutnick to be the next Commerce Secretary and to give him special responsibility for the office of the US Trade Representative gives a strong indication that Trump plans to follow through with his tariff plans. During the election campaign, Howard Lutnick served as spokesman for some of Trump’s most controversial plans including wide-ranging tariffs and the elimination of income tax.

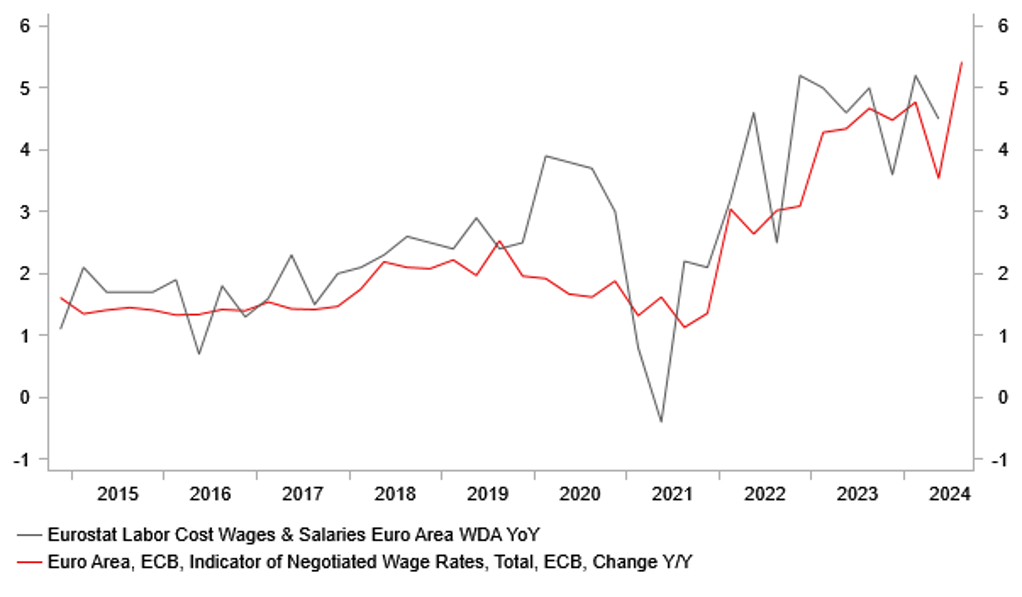

European markets are initially viewing potential trade disruption as more of a negative growth shock for Europe rather than an inflation shock unlike in the US. A view that was shared overnight by ECB Governing Council member Francois Villeroy de Galhau who stated that potential trade levies aren’t expected to significantly derail the ECB’s easing plans. He still believes that risks to the inflation outlook and growth are “shifting to the downside”. At the same time, he downplayed the release of much stronger negotiated wage data from the euro-zone for Q3. He stated “let me stress that the latest rise in negotiated wages in the third quarter is a somewhat backward-looking indicator, mainly driven by the lagged effects of past negotiations in Germany….and it was already taken into account in our September projections”.

The dovish comments support current market expectations for the ECB to lower rates for the third consecutive meeting in December, and to keep lowering rates towards 2.00% next year. The latest negotiated wage data from the euro-zone revealed growth accelerated to 5.4%Y/Y in Q3 up from 3.5% in Q2 which is well above the 3% increase in overall wage growth considered by policymakers to be consistent with price stability. Wage growth in Germany was the strongest since 1993 up 8.8%Y/Y in Q3. The ECB expects wage growth to slow more sharply next year. More persistent wage growth alongside a weaker euro and retaliatory EU tariffs are three potential upside risks to the inflation outlook that could make the ECB become more cautious over continuing to cut rates in the year ahead.

ECB DOWNPLAYS STRONGER WAGE GROWTH AS LAGGING INDICATOR

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

2.9% |

2.8% |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Nov |

-25 |

-27 |

!! |

|

EC |

12:00 |

Construction Output (MoM) |

Sep |

-- |

0.10% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

220K |

217K |

!! |

|

US |

13:30 |

Philadelphia Fed Manufacturing Index |

Nov |

6.3 |

10.3 |

!! |

|

UK |

14:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales |

Oct |

3.94M |

3.84M |

!! |

|

US |

15:00 |

US Leading Index (MoM) |

Oct |

-0.3% |

-0.5% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Nov |

-12.0 |

-12.5 |

! |

|

EC |

15:30 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

17:25 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

JP |

23:30 |

National CPI (YoY) |

Oct |

-- |

2.5% |

!!! |

Source: Bloomberg