Election risk in focus for FX markets as USD consolidates at higher levels

USD: FX market to continue to weigh up US election risks in week ahead

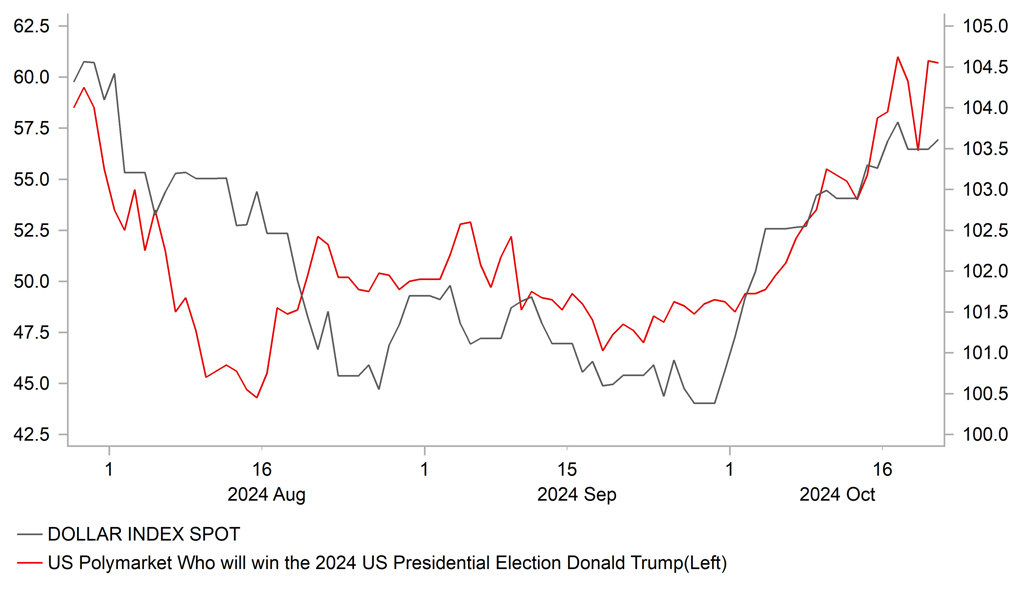

It has been a quiet start to the week for the foreign exchange market with the FX majors largely unchanged overnight. The US dollar has been consolidating at higher levels since late last week after the dollar index failed to break above resistance from the 200-day moving average which comes in at around 103.80. Similarly, US yields have lost upward momentum in recent weeks with the 2-year US Treasury yield struggling to break above 4.0%. US rate market participants are currently comfortable with the outlook for the Fed to cut rates two more times this year by 25bps in November and December and then to deliver a further 100bps of cuts next year. Last week’s much stronger retail sales report for September did not significantly alter market expectations for Fed easing even though it provided further evidence that the US economy is continuing to hold up well to higher rates. The Atlanta Fed’s GDPNow estimate for economic growth in Q3 is currently at 3.4% which is well above the Bloomberg consensus forecast of 2.1%. There are no major US economic data releases in the week ahead to drive a change in market expectations for Fed policy. Instead market attention is likely to be increasingly focused on the incoming opinion polls and betting odds as we move closer to the US election on 5th November. The US dollar has been deriving support in recent weeks from building market speculation that Donald Trump is on course to be re-elected as President. According to PolyMarket, the probability of Trump winning has risen to just above 60%. It is backed up by the latest opinion polls which show that the lead for Kamal Harris over Donald Trump at the national level has narrowed to levels where she is expected to win the popular vote but not the Electoral College. Similarly, Donald Trump now holds narrow leads in many of the key battleground states. We continue to believe there is room for the US dollar to strengthen further in the run up to the US election if there is no change in current momentum which is favouring a Trump victory.

At the same time, the US dollar has been deriving support from other G10 central banks speeding up plans for monetary easing while the Fed is expected to slow down the pace of easing at the next FOMC meeting in November. The BoC is expected to speed up the pace of easing in the week ahead by delivering a larger 50bps rate cut. An outcome which is already fully priced in by the Canadian rate market. The main downside risks for the Canadian dollar would be if the BoC indicated that they would be willing to deliver a second back-to-back 50bps rate cut in December as well. The market is currently priced for smaller 25bps cut in December. We will also be listening closely to comments from BoE officials in the week ahead including Governor Bailey for any further encouragement that they are becoming more willing to speed up rate cuts in light of the weaker inflation and wage data in September. The government’s reported plans to implement additional fiscal tightening in the autumn budget play into market expectations for the BoE to speed up rate cuts. We continue to expect the BoE to deliver back to back 25bps rate cuts in November and December. The Canadian dollar and pound have though held up relatively well over the past week while the Scandi currencies have underperformed. It supports our current long USD/NOK trade recommendation (click here).

USD SUPPORTED BY RISING PROBABILITY OF TRUMP VICTORY

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Polls add to political uncertainty in Japan ahead of election

The yen has underperformed since the LDP leadership election on 27th September. USD/JPY has since risen back up to the 150.00-level after trading closer to the 145.00-level prior to the LDP leadership election. Initial comments from new LDP leader and Prime Minister Ishiba calling for the BoJ not to raise rates in the current environment have helped to weaken the yen over the past month alongside the BoJ’s own guidance indicating that they have more time to consider whether to raise rates further heading into year end.

The LDP’s decision to choose Ishiba as their new leader and his decision to immediately call a snap election on 27th October has been brought into question by opinion polls released over the week which have captured market attention. A Kyodo News poll revealed that 22.6% of respondents backing Ishiba’s ruling LDP party in the election with their lead narrowing over the Constitutional Democratic Party narrowing to 8.5ppts from 14ppts in the survey taken a week earlier. More worryingly for the LDP, another poll by the Asahi newspaper showed that they are likely to lose their majority in the Lower House of parliament and may not even secure a majority with its long-running coalition partner Komeito. A big blow which could even threaten Ishiba’s position as Prime Minister. Both polls did show though that around 40% of respondents are still undecided. Our base case view is still for the current government to retain their majority although smaller than at present.

More political uncertainty in Japan could weigh further on the yen although we expect the bigger impact to be from the upcoming US election. An election victory for Donald Trump would encourage higher US yields and a stronger US dollar helping to lift USD/JPY back into the mid-to-high 150.00’s before the end of this year.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

11:00 |

IMF Meetings |

-- |

-- |

-- |

! |

|

US |

13:55 |

Fed Logan Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

US Leading Index (MoM) |

Sep |

-0.3% |

-0.2% |

!! |

|

US |

18:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

22:05 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

|

US |

23:40 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg