Uncertainty over Fed’s independence is another negative for USD

USD: Fed independence questions another source of uncertainty

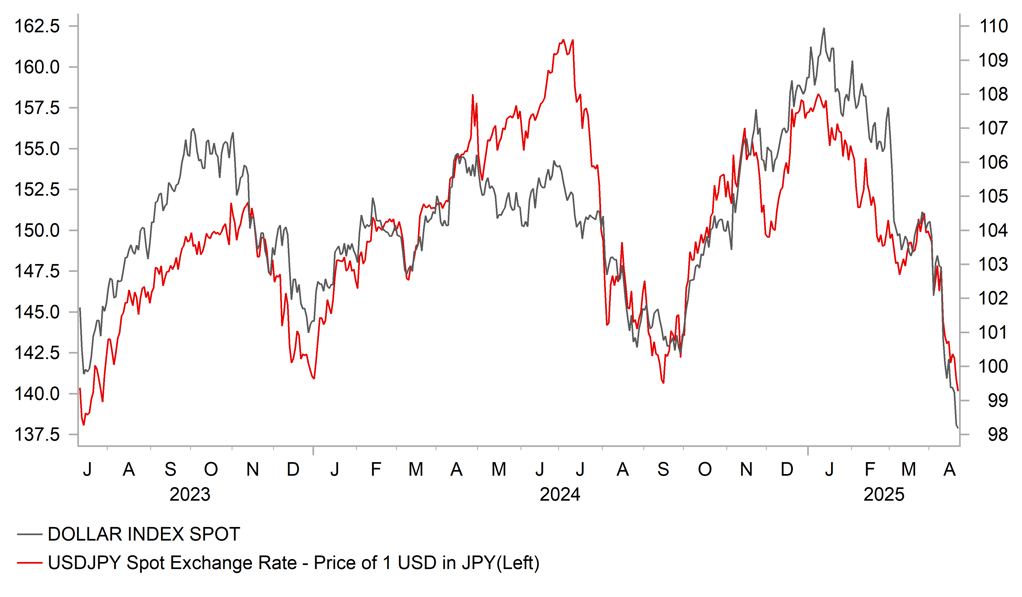

The US dollar has weakened sharply at the start of the week in response to heightened investor fears over the threat to the Fed’s independence when setting monetary policy. It has resulted in USD/JPY falling back below the 140.00-level for the first time since September of last year. US dollar weakness has been broad-based and has coincided with a further sell-off in US equity and bond markets. The S&P 500 equity index closed down by -2.4% yesterday and the 30-year US Treasury yield has risen back above 4.90% as it moves closer to the highs from earlier this month at just above 5.00%. The triple selling of the US dollar, US bonds and US equities highlights that threats to the Fed’s independence are further undermining investor confidence in US assets alongside President Trump’s tariff policies which are encouraging a reallocation out of US assets in the near-term.

It fits with our view that the risk premium that has been priced into the US dollar since the announcement of President Trump’s reciprocal tariff plans is unlikely to diminish over the near-term and Trump’s comments last week in response to the speech by Fed Chair Powell in Chicago could add another layer of uncertainty and increase further that risk premium priced into the US dollar. The topic of Fed independence under Trump’s presidency is not new but his comments last week were the clearest yet on how unhappy Trump is. The end to his tenure “cannot come fast enough” will no doubt fuel concerns not necessarily over Trump trying to remove Powell from office – that’s unlikely – but over the choice made on who take over and over the Trump administration trying to interfere in Fed operations in other ways.

THREAT TO FED’S INDEPENDENCE REINFORCING USD SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

Those concerns over Trump trying to remove Powell from office have been heightened over the weekend after National Economic Council Director Kevin Hassett stated that the “president and his team will continue to study that” when asked by a reporter if removing Powell was an option. He went on to add that “if you think that it’s unacceptable for President Trump to be frustrated with the policy history of the Fed, than I think that you got some explaining to do”. Fed Chair Powell’s term as Fed chair is set to expire in May 2026 while his 14-year term as governor is scheduled in end in 2028.

The Federal Reserve Act of 1913 establishing the Fed stipulates that members of the Board of Governors, appointed by the president and confirmed by the Senate to staggered 14-year terms, can only be removed for “cause”. There is no direct legal precedent since no president has ever tried to fire the Fed chair. Market participants will be closely watching the upcoming decision from the Supreme Court after President Trump raised an emergency petition to endorse his decision to fire board members of two other independent agencies, the National Labor Relations Board and the Merit Systems Protection Board. It is a direct challenge to a 90-year old Supreme Court precedent limiting the power of the president to dismiss independent agency board members except in cases of neglect or malfeasance. If that precedent falls, it is thought that a decision to fire Powell could become a lot easier for President Trump. Fed Chair Powell has repeatedly stressed though that firing the Fed chair is not permitted by law.

Treasury Secretary Scott Bessent also stated last week that the administration would increase its focus on selecting a new Fed Chair before the end of the year and there are risks that the choice could undermine confidence in Fed independence. Kevin Warsh (a former Fed Governor), Kevin Hassett (the current Director of the National Economic Council) and Arthur Laffer (economist, famous for arguing that tax cuts can lead to increased tax revenues) are three names that have been cited as possible candidates.

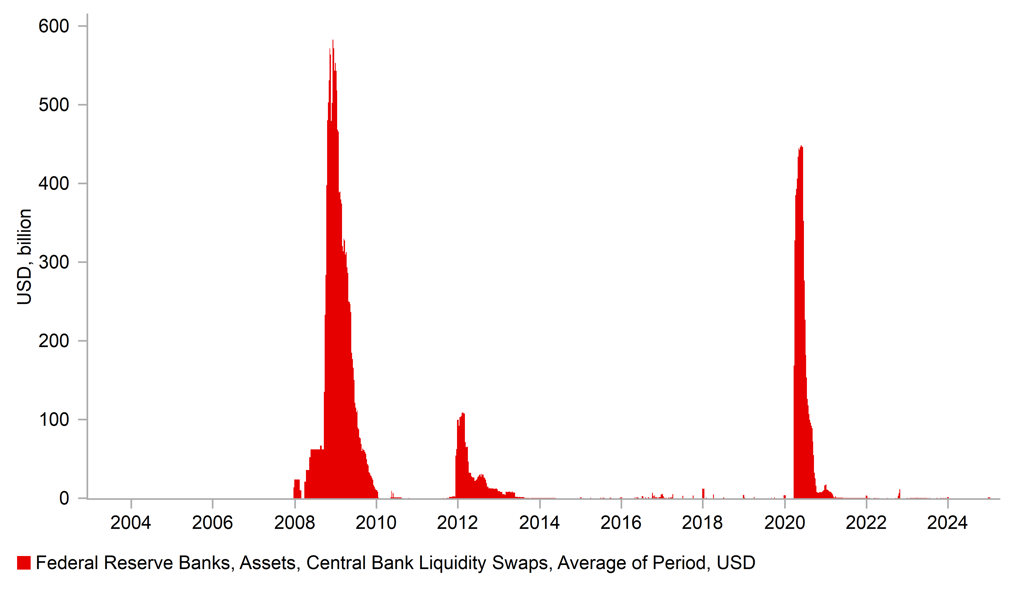

The financial markets would be most content with Kevin Warsh but given his hawkishness from when previously at the Fed does not make him an obvious contender. A pick of someone close to President Trump would certainly raise investor concerns over increased White House interference in policy deliberations. There has also been increasing speculation over political pressure being put on the Fed to curtail he use of dollar swap lines – a key source of global dollar liquidity during times of financial market stress. ECB President Lagarde was asked at last week’s press conference whether she was concerned over the reliability of these lines – Lagarde dodged answering the question directly.

The issue now for the financial markets since the ‘Liberation Day’ reciprocal tariff announcements is that if Trump was willing to adopt tariff rates of that level and now at 145% on China, then the bar for shocking the markets in other ways is that much lower. This means Fed independence uncertainty could certainly escalate and further undermine confidence in the US dollar. It leaves the US dollar vulnerable to further weakness in the near-term

USAGE OF USD SWAP LINES THAT ARE NOW BEING QUESTIONED

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Survey of Professional Forecasters |

!! |

|||

|

EC |

10:00 |

Govt Debt/GDP Ratio |

2024 P |

-- |

87.4% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Apr P |

- 15.1 |

- 14.5 |

!! |

|

EC |

15:00 |

ECB's Lagarde on CNBC |

!!! |

|||

|

US |

15:00 |

Richmond Fed Manufact. Index |

Apr |

- 7.0 |

- 4.0 |

!! |

Source: Bloomberg