Rising US yields continue to offer more support for the USD

USD: China currency support and higher US yields

The foreign exchange market has remained stable overnight with most major FX pairs largely unchanged. After hitting an intra-day high yesterday of 6.3155, USD/CNY has traded back below the 6.3000-level overnight. Bloomberg has reported that China is stepping up its efforts to help slow the pace of renminbi weakness by pushing up funding costs in the offshore market that is intended to squeeze short positions while it has continued to set a stronger than expected daily fixes. The PBoC set the daily fix at 7.1992 compared with the average estimate of 7.3103 in Bloomberg’s survey. According to Bloomberg, offshore funding costs have increased in recent days as local banks have refrained from providing more of the currency in the swap market. It resulted in renminbi one-month forward points jumping the most in offshore trading since 2017. While the measures are helping to slow the pace of renminbi weakness in the near-term, they are unlikely to reverse the weakening trend on a sustained basis until there is a significant improvement of investor confidence in China’s economic outlook.

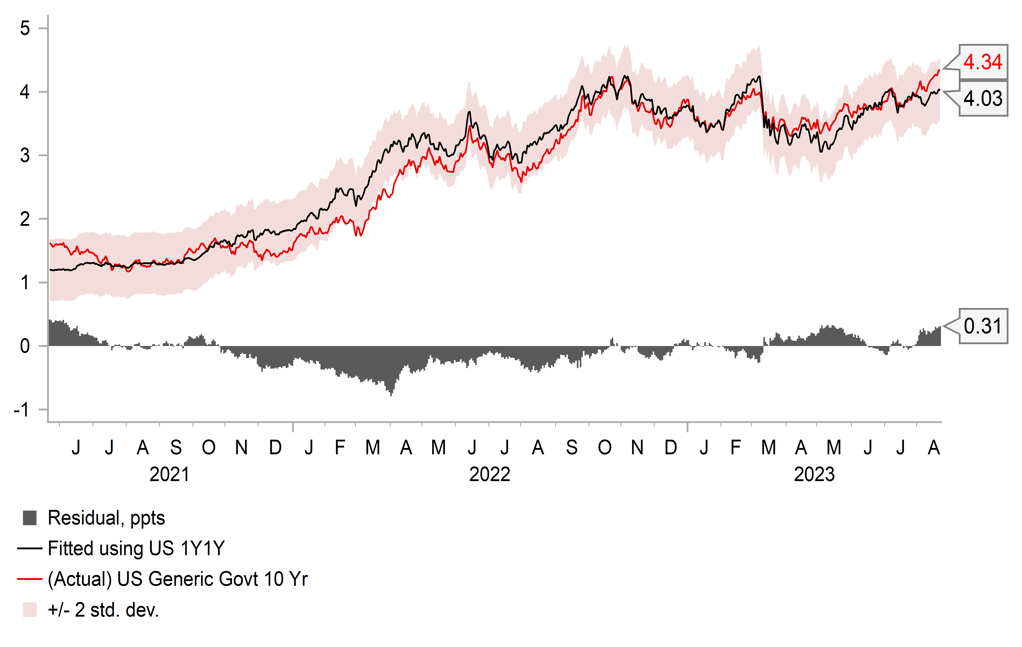

The other main market development at the start of this week has been the continued sell-off at the long end of the bond market. The 10-year US Treasury bond yield rose to a fresh high overnight at 4.36% after breaking above the high from November of last year at 4.34%. The recent adjustment higher in long-term US yields has coincided with the strong rebound for the US dollar. After hitting an intra-day low of 3.94% on 10th August, the 10-year US Treasury yield has increased by just over 40bps in recent weeks. Over the same period the dollar index has increased by around 1.5%. The adjustment higher in US yields has mainly been driven by the longer end of the curve while shorter yields have remained better anchored resulting in bear steeping of the curve.

There has been a strong run of positive US economic surprises over the last couple of months which has dampened fears over a sharper slowdown for the US economy. It is reflected in the upward revisions to the outlook for the US economy. The Bloomberg consensus forecast for US GDP growth this year has almost doubled from around 1.1% in early June to 2.0% at present. The resilience of the US economy to higher rates continues to surprise market participants, and has prompted market participants to scale back expectations for rate cuts next year. The implied yield on the December 2024 Fed Fund futures contract has increased by around 35bps to 4.41% from the low earlier this month. Even after the recent scaling back of rate cut expectations, market participants are still expecting around 100bps of cuts next year. The sharper than expected slowdown in US inflation and lagged impact of monetary tightening are expected to create room for the Fed to make policy less restrictive in 2024. In the near-term though the resilience of the US economy and higher long-term US yields are proving more support for the US dollar.

LONG-TERM US YIELDS CONTINUE TO MOVE HIGHER

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: A summer setback

Emerging market currencies have continued to weaken against the USD over the past week. It has resulted in our MUFG EM FX index giving back all of the year to date gains against the USD. It has been a bad month for emerging currencies. The worst performing EM currencies so far in August have been the COP (-5.8% vs. USD), ZAR (-5.4%), BRL (-5.1%), KRW (-4.5%), CLP (-3.6%) and MYR (-3.1%). While the HUF is the only EM currency to strengthen against the USD which marks a partial reversal of the losses sustained in July.

There have been two main drivers of the recent sell-off for emerging market currencies. Firstly, market participants are becoming more concerned over the economic slowdown in China. Economic growth continued to disappoint at the start of Q3 after disappointing expectations in Q2 which is challenging consensus expectations for a pick-up in growth in the 2H of this year. Domestic policymakers have responded by announcing further rate cuts over the past week but stimulus measures have not proven sufficient so far to stabilize investor confidence in the CNY and Chinese assets. The PBoC has also been setting the daily USD/CNY fix well below spot to help slow the pace of CNY weakness in the near-term. In the week ahead, market participants will be watching closely for further measures to support the domestic housing market and/or fiscal stimulus announcements. Without more meaningful stimulus, the more tightly-linked commodity and Asian currencies remain vulnerable to further weakness.

The second driver of emerging market currency weakness has been the recent adjustment higher in US yields at the long-end of the curve that has helped to encourage a stronger USD. Incoming activity data has revealed that the US economy is proving more resilient than expected to higher rates which is encouraging market participants to scale back expectations for Fed rate cuts next year. Slowing US inflation has though made the US rate market reluctant to price in further rate hikes. The main event in the week ahead for assessing the outlook for Fed policy will be the keynote speech from Chair Powell on Friday at the Jackson Hole symposium. Without clearer evidence of slower US growth, the Fed is likely to be reluctant to signal an end to their rate hike cycle. We still expect the Fed to leave rates on hold in September but it will depend on the incoming economic data in the month ahead. The main upside risk for the USD would be if Chair Powell pushes back more strongly against rate cut expectations for next year. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Current Account |

Jun |

-6.9B |

9.1B |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Aug |

-13 |

-9 |

!! |

|

US |

12:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

Existing Home Sales |

Jul |

4.15M |

4.16M |

!!! |

|

US |

15:00 |

Richmond Manufacturing Index |

Aug |

-7 |

-9 |

! |

|

US |

19:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

19:30 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

NZ |

23:45 |

Retail Sales (QoQ) |

Q2 |

-2.6% |

-1.4% |

!! |

Source: Bloomberg