JPY gains as yields fall with focus shifting to Ueda & Powell

JPY: US yields keep USD/JPY from rebounding

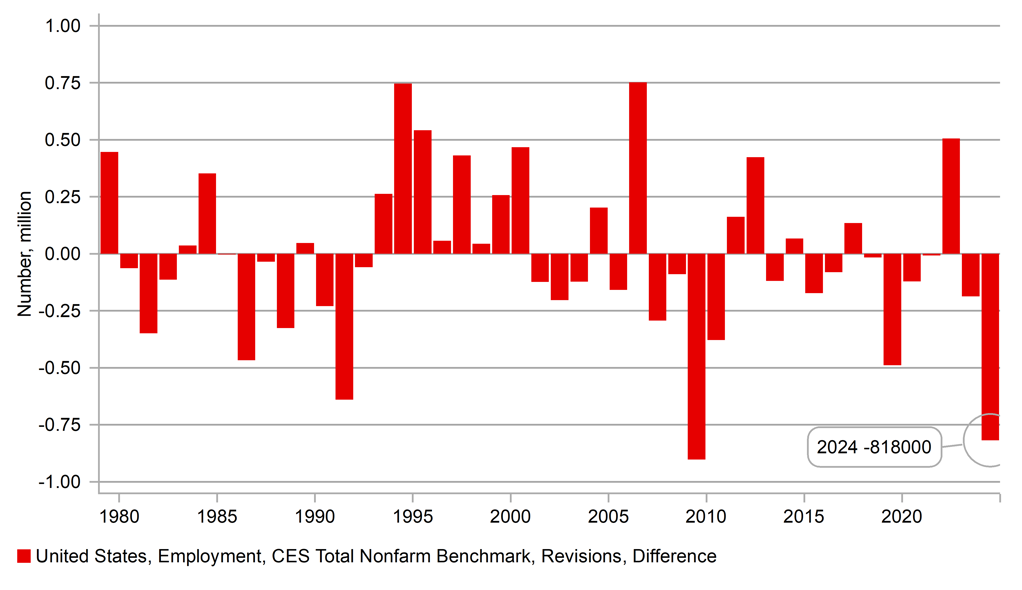

The 2-year UST note yield fell back below the 3.90% level in response to the initial estimate for the benchmark revision of the non-farm payrolls and with that move took USD/JPY back below the 145-level for the first time since early August when we had the market turmoil driven in part by the liquidation of yen carry positions. The benchmark revision estimate of -818k (for 12mths to March 2024) was larger than many had expected and indeed was the largest since the record downward revision in 2009. Given the big downward revisions tend to be around times of economic downturns, the estimate yesterday only reinforced the expectations that the Fed will commence cutting rates at the next FOMC meeting on 18th September.

The release of the FOMC minutes from the July meeting also reinforced those expectations. While it was largely expected the minutes would show a shift to signalling an ease, the signal was very strong with the “vast majority” believing that if the data continued to come in as expected then a rate cut would be justified. “Some” members were also concerned over labour market conditions transitioning to “a more serious deterioration” which to us only reinforces the importance of the employment statistics and it is data in that area of the economy that could trigger expectations of the need for more aggressive front-loaded easing if warranted.

The USD/JPY rate continues to perform as we expected with signs of greater sensitivity to downside risks that likely reflects market participants’ renewed appetite for buying the yen on dips given the speed of the 20-big-figure drop that took place in July into early August. We believe there are still considerable more structural yen shorts in the market that were left exposed to appreciation risk that are now being hedged to a greater extent and as long as Fed rate cut expectations remain strong USD/JPY will struggle to sustain any rallies.

While Powell will get most focus tomorrow, USD/JPY will also be influenced by BoJ Governor Ueda’s appearance in the Diet tomorrow (0930 Tokyo time) after Diet members called for Governor Ueda to explain the action of the BoJ following the market turmoil. We’d expect in that context for Ueda to argue strongly the case for adjusting the policy stance but equally Ueda will likely emphasise caution ahead similar to the comments from Deputy Governor Uchida. The risk is that Ueda emphasises caution to reassure the Diet which could allow for some yen depreciation but with Powell later tomorrow any yen sell-off will likely be contained.

NONFARM PAYROLL BENCHMARK REVISION – 2ND LARGEST ON RECORD

Source: Macrobond & Bloomberg

EUR: Advance PMIs in focus for Europe

On a year-to-date basis there are only two G10 currencies that have advanced versus the US dollar – the pound and the euro. This clearly reflects the macro benefits for the UK and the euro-zone of getting through the unprecedented energy price shock that hit in 2022 after Russia’s invasion of Ukraine and resulted in recessionary conditions throughout most of 2022 and 2023. Growth is now recovering – which is more evident in the UK than in the euro-zone – and this has helped the pound and the euro to recover from depressed levels.

But for the euro-zone there are increased uncertainties over the sustainability of this rebound. Today’s advance PMIs will be important and after a sharp rebound in the Services PMI February through April, since then through July we have had three consecutive more moderate declines. Another decline in the August reading today and it will look concerning and will certainly reinforce the expectations (fully priced) for a 25bp rate cut at the next meeting on 12th September. We see the activity data as more important than the wage data in shaping expectations of an ECB rate cut. We do also get the quarterly negotiated wage data from the ECB today as well and while the wage data is remaining more elevated and increasing the risks of core inflation remaining sticky at higher levels, the view of the ECB for now is that these wage gains have more scope in being met by wider profit margins by companies rather than through price increases. That view of the ECB could of course change but not at this stage and another cut in September remains highly likely. A big upside surprise in the PMI readings though would create greater uncertainty.

Today the ECB will also release the minutes from the last ECB meeting in July. Based on the communications from Lagarde on 18th July, at the last meeting, there seems a greater risk of the minutes revealing a larger number cautioning on the speed in which the policy rate would be cut. Lagarde was very cautious and non-committal emphasising the meeting-by-meeting approach to policy decisions going forward. Still, given what has unfolded since, mixed economic data and the market turmoil and strengthening of the euro, a rate cut is warranted.

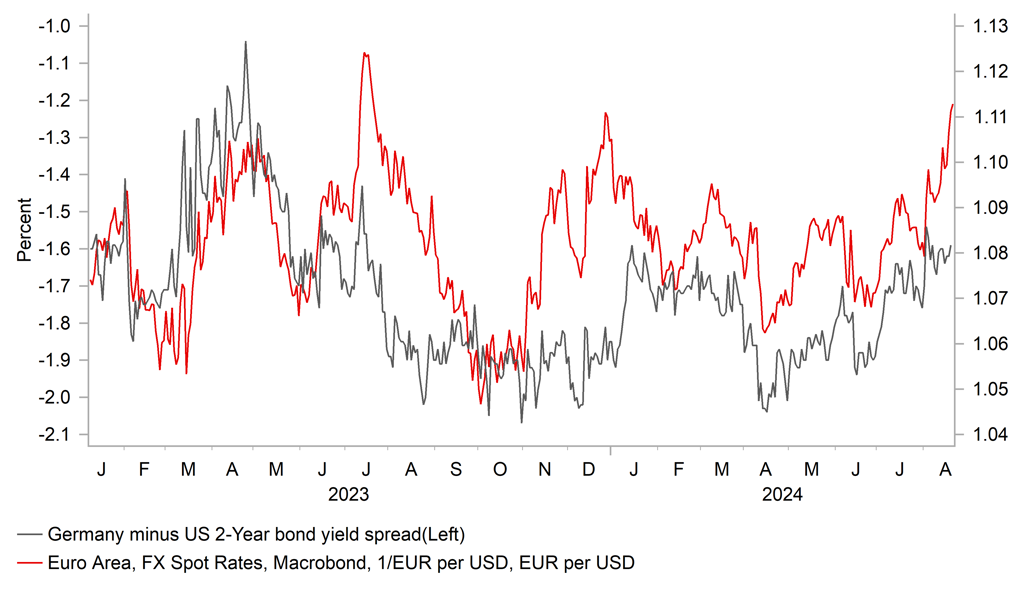

The move higher in EUR/USD continues to exceed our expectations and looking further ahead, while we will likely see some corrections back lower, the outlook remains more positive. We highlighted in the FX Daily Snapshot on Tuesday (here) that rate cut expectations over a 12mth period look excessive – the market implied expected real policy rate by mid-2025 is just 0.25% - and hence we see greater risks of rate cut expectations being removed which will act to provide EUR with further support.

EUR/USD VERSUS GERMANY-US 2YR BOND YIELD SPREAD OVER A 2YR PERIOD – EUR/USD GETTING AHEAD OF ITSELF

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French Composite PMI |

Aug |

49.1 |

49.1 |

!! |

|

GE |

08:30 |

German Composite PMI |

Aug |

49.2 |

49.1 |

!! |

|

GE |

08:30 |

German Manufacturing PMI |

Aug |

43.4 |

43.2 |

!! |

|

GE |

08:30 |

German Services PMI |

Aug |

52.3 |

52.5 |

!!! |

|

EC |

09:00 |

Manufacturing PMI |

Aug |

45.7 |

45.8 |

!! |

|

EC |

09:00 |

S&P Composite PMI |

Aug |

50.1 |

50.2 |

!! |

|

EC |

09:00 |

Services PMI |

Aug |

51.7 |

51.9 |

!!! |

|

UK |

09:30 |

Composite PMI |

Aug |

52.9 |

52.8 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

Aug |

52.1 |

52.1 |

!! |

|

UK |

09:30 |

Services PMI |

-- |

52.8 |

52.5 |

!!! |

|

EC |

10:00 |

EZ Negotiated Wages Q/Q |

Q2 |

4.70% |

4.70% |

!!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Aug |

-26 |

-32 |

!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!!!! |

|

US |

13:00 |

Jackson Hole Symposium |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Chicago Fed National Activity |

Jul |

-- |

0.05 |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

232K |

227K |

!!! |

|

US |

14:45 |

Manufacturing PMI |

Aug |

49.5 |

49.6 |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Aug |

53.5 |

54.3 |

!! |

|

US |

14:45 |

Services PMI |

Aug |

54.0 |

55.0 |

!!! |

|

US |

15:00 |

Existing Home Sales (MoM) |

Jul |

-- |

-5.4% |

!! |

|

US |

15:00 |

Existing Home Sales |

Jul |

3.93M |

3.89M |

!!! |

Source: Bloomberg