USD sell-off extends further alongside improvement in investor risk sentiment

USD: FOMC minutes fail to dampen improving global investor risk sentiment

The US dollar has continued to weaken overnight resulting in the dollar index falling back towards support from the 200-day moving average that comes in at around 103.70. The main market moving events overnight have been the release of the latest minutes from the Fed’s January FOMC meeting and the earnings report from Nvidia who reported stronger than expected revenues thereby reinforcing investor optimism in the rise of artificial intelligence. Nvidia stated that revenues will be about USD24 billion in the current quarter exceeding the consensus forecast on Bloomberg from analysts who had been expecting revenues of USD21.9 billion on average. In the fiscal fourth quarter which ended on 28th January, Nvidia’s revenue more than tripled to USD22.2 billion. Nvidia’s Chief Executive Officer Jensen Huang stated that “generative AI has kicked off a whole investment cycle” that will lead to a doubling of the world’s data centre installed base over the next five years, and represent an annual market opportunity in the hundreds of billions. Nvidia’s share price has already increased in value by over a third this year. The ongoing improvement in global investor risk sentiment was also evident overnight in Japan where the Nikkei 225 index closed above the previous record high from back in January 1990. The high beta G10 currencies of the AUD, NZD, CAD, NOK and SEK have strengthened the most against the US dollar overnight benefitting from the boost to investor risk sentiment.

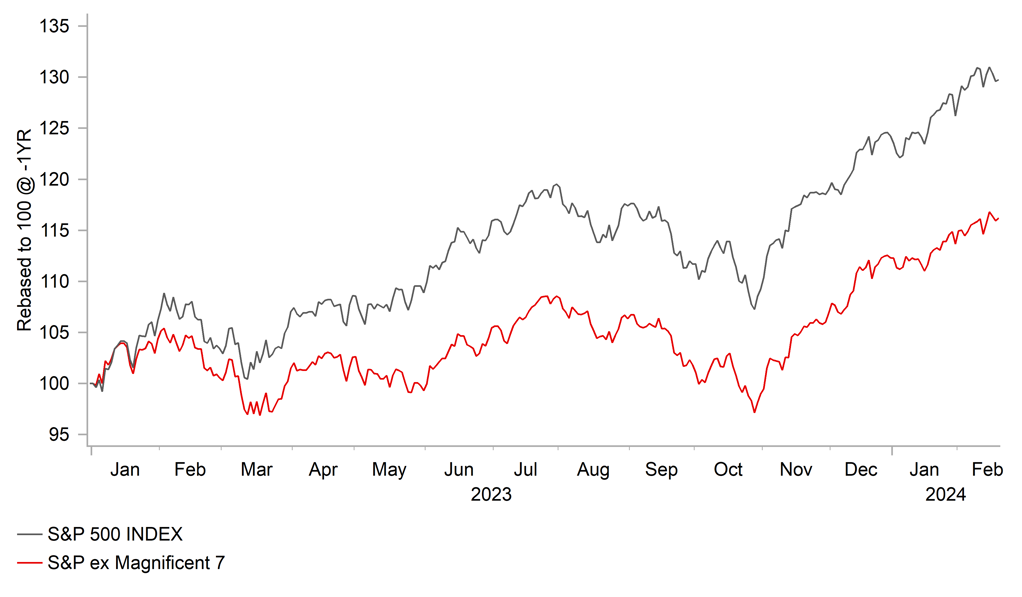

The other main development overnight was the release of the latest minutes from the January FOMC meeting. The minutes signalled that the Fed is cautious over cutting rates too soon with officials wanting to see more confirmation that slower inflation will be sustained. “Most” Fed officials “noted the risks of moving too quickly to ease the stance of policy” while emphasizing the “importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent”. In contrast, only a “couple” of officials emphasized downside risks associated with staying too tight for too long. Fed officials saw risks to inflation and employment as “moving into better balance but remained “highly attentive” to inflation. “some” officials noted that the risk that “progress to price stability could stall”, and “several” were concerned about financial conditions easing too much. The overall tone of the minutes appears better aligned with current US rate market pricing which is expecting the first rate cut to be delivered in June. While an earlier cut in May can’t be ruled out, the US rate is now pricing in only around 8bps of cuts. The hawkish repricing of the outlook for Fed policy and for other major central banks at the start of this year has not been sufficient to derail the rebound in global equity markets.

AI INVESTOR OPTIMISM IS HELPING TO BOOST RISK SENTIMENT

Source: Bloomberg, Macrobond & MUFG GMR

GBP: PMI surveys to test optimism over UK recovery at start of this year

The main economic data releases today will be the latest PMI surveys from Europe for February to better assess cyclical economic performance at the start of this year. In recent months there has a clear improvement in business confidence in the UK which has helped to ease concerns over the release of Q4 GDP data showing the UK economy fell into technical recession at the end of last year. After hitting a low of 48.5 in September, the composite PMI survey for the UK has since increased for three consecutive months to a reading of 52.9 in January. When speaking before lawmakers earlier this week, BoE Governor Bailey noted that the UK economy was currently experiencing a “very small recession” and was now showing “distinct signs of recovery” He also highlighted that the UK labour market has proven relatively resilient with the economy close to full employment. The comments indicate that the BoE is unlikely to significantly bring forward plans for rate cuts based on weaker growth at the end of last year. The UK rate market is currently hedging its bets between the first rate cut being delivered in June or in August. For the UK rate market to move to price in an earlier rate cut, the BoE’s optimism over a pick-up in growth at the start of this year would need to questioned. An unexpected pullback in business confidence in today’s PMI survey is a potential banana skin for the pound. We have maintained our short EUR/GBP trade idea but are more wary of downside risks for the pound in the near-term after the pair failed to break below support at the 0.8500-level earlier this month.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

S&P Global Composite PMI |

Feb |

48.5 |

47.9 |

!! |

|

UK |

09:30 |

Composite PMI |

-- |

52.9 |

52.9 |

!!! |

|

EC |

10:00 |

CPI (YoY) |

Jan |

2.8% |

2.9% |

!!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

217K |

212K |

!!! |

|

US |

14:45 |

Services PMI |

Feb |

52.4 |

52.5 |

!!! |

Source: Bloomberg