Limited FX market impact so far from Biden’s decision to withdraw re-election bid

CNY: Lower rates & a weaker currency in response to slowing growth

The Chinese renminbi has weakened modestly during the Asian trading session resulting in USD/CNH moving back up to the 7.3000-level, and closer to the high from earlier this month at 7.3114 on 3rd July. Similarly, USD/CNY has moved back towards the top of the +/- 2.0% daily trading band which comes in at 7.2760. The renminbi has been undermined at the start of this week by the surprise decision from the PBoC to lower interest again. The seven-day reverse repo rate, a key short-term policy rate, was lowered by 10bps to 1.70% for the first time in almost a year. The unexpected policy adjustment follows recent evidence of slowing growth momentum in China which threatens the government’s ability to meet their annual growth target of about 5% for this year. The release of the latest GDP report last week revealed that growth slowed to an annual rate of 4.7% in Q2 and there was evidence of a more marked slowdown in retail sales growth in June.

The decision to resume lowering rates will encourage market expectations that the renminbi will weaken further in the near-term even as the Fed appears to be moving closer to cutting rates as well. Last week’s Third Plenum (click here) disappointed any market participants who had been looking for a fresh signal that further fiscal stimulus is on the way. It leaves lower rates and a weaker domestic currency as the main adjustment mechanisms for China’s economy in the near-term. The developments support our view that USD/CNY will continue to rise back towards the highs from last autumn between 7.3000 and 7.3500. The risk of a bigger adjustment lower for the renminbi after the US election has increased recently as well alongside the increasing likelihood of former Present Trump winning re-election. Donald Trump has proposed imposing a 60% tariff on all imports from China, as well as potentially higher tariffs on EVs from China across the aboard. The probability of Trump winning the election according to PredictIt has declined over the past week but remains elevated at 60%.

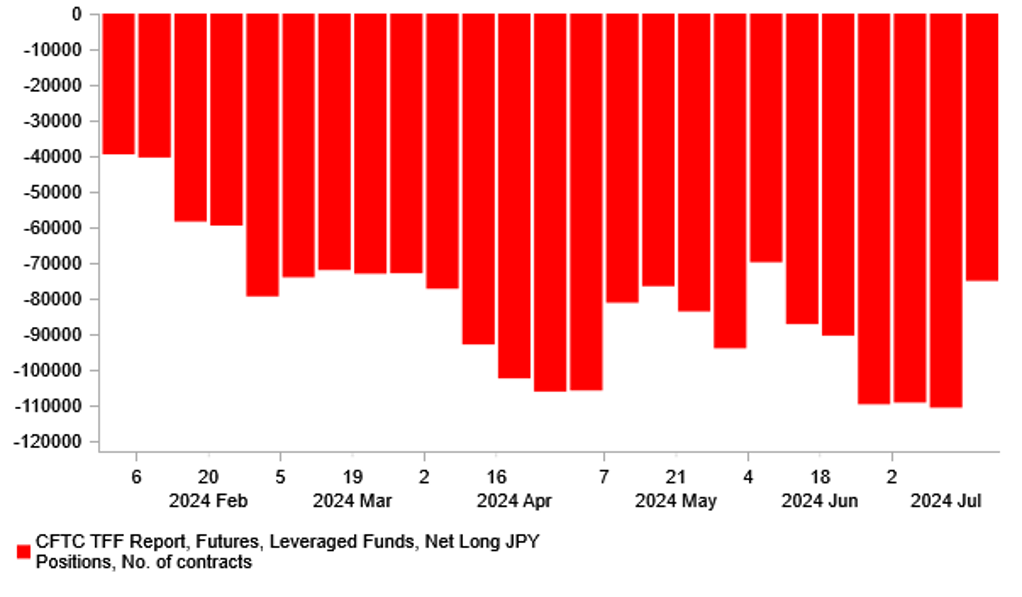

LEVERAGED FUNDS CUT BACK JPY SHORTS IN WEEK ENDING 16TH JULY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Election risk back in focus as Biden withdraws

The main event over the weekend was the announcement from President Biden that he has withdrawn his bid to win a second term. He stated that he will serve out his term and endorsed Vice President Kamala Harris to take his place as the Democratic nominee. While his decision to withdraw appeared increasingly likely in recent weeks, it has injected fresh uncertainty into US politics ahead of November’s election. It now remains to be seen whether the Democrats will unite around Vice President Harris to become the Presidential nominee. Democratic delegates are not bound to vote for any particular candidate at the convention in late August (19th-22nd). Former President Bill Clinton, former Secretary of State Hillary Clinton and Senator Elizabeth Warren have all threw their support behind Kamala Harris who is the clear front-runner to step in at the last minute to face off against former President Trump. Other leading alternative candidates including California Governor Gavin Newsom, Michigan Governor Gretchen Whitmer, Illinois Governor J.B. Pritzker, and Pennsylvania Governor Josh Shapiro have all endorsed Kamala Harris according to Bloomberg which has reduced the likelihood of a challenge to become the Democrat nominee.

If Kamala Harris is officially chosen as the Democrat nominee she has work to do to narrow former President Trump’s lead in the polls ahead of the November election. According to the Hill, Trump would still hold a 2 percentage point lead over Harris based on the aggregate of national polls (47% vs. 45%). That would be around the same as Tump’s 2.5 point lead over Biden (46% vs. 43.5%). Kamala Harris’ favourability in the polls sits at around 38% compared to 41% for Biden. The good news for Harris is that Trump’s lead over her has narrowed from around 8.0 points at the start of this year. A CBS News poll released last week found Harris performing better than Biden against Trump, with Harris behind by 3 points and Biden trailing by 5 points. Overall the latest developments appear unlikely to significantly alter market expectations that Trump is on track to win re-election at the current juncture unless his lead in the polls starts to narrow in the coming months. We would view a tighter run race as less favourable for the US dollar.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

08:00 |

M3 Money Supply |

Jun |

-- |

1,136,149.0B |

! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

!! |

|

CH |

11:00 |

FDI |

Jun |

-- |

-28.20% |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Chicago Fed National Activity |

Jun |

-- |

0.18 |

! |

Source: Bloomberg