US dollar recovers with help from rest of the world

USD: Monetary easing & global growth concerns trigger rebound

The depreciation of the US dollar in response to the FOMC press conference by Fed Chair Powell has not lasted long and the DXY index earlier in Asia trading broke above the pre-FOMC high as investors likely look at developments globally and see limited scope for sustained US dollar selling. The BoJ meeting was an event risk for the dollar and while the BoJ hiked, the cautious communication has failed to trigger any upturn in JPY demand. We still see the BoJ decision as an important turning point for the yen but time and a series of data will be required before the BoJ is possibly back in play to hike again. Nationwide inflation data today was a touch weaker than expected underlining the need for time before BoJ rate hike speculation will re-emerge.

The BoE MPC vote that revealed the two voters for a hike previously abandoning that stance has fuelled renewed GBP selling – see below. In addition, BoE Governor Bailey is interviewed in the FT today and has stated that rate cuts “are in play” at future meetings and expressed optimism that second-round effects would not come through from the labour market. It read to us like an interview in which Bailey was more than happy to feed speculation of a rate cut by June – which is now close to fully priced.

The dollar is also stronger today after USD/CNY broke higher through the 7.2000 level – that may not sound significant but it is given the PBoC throughout this year and since last November has clearly been stopping that from taking place. The break higher was triggered by the PBOC fix today that signalled a willingness to allow a slide. The decision may have been influenced by the yen reaction to the BoJ rate hike and was reinforced by PBoC comments suggesting more RRR cuts to come. The Hang Seng China Enterprise index is down over 2.0% today.

Finally of course the SNB cut rate yesterday – see below – and the RBA earlier this week shifted its guidance on future hikes was softened.

The price action for the dollar in our view continues to point to the prospect of the dollar remaining in a relatively tight trading range. There is a strong expectation implied in forward market pricing of a synchronised easing of monetary policy this year, at least amongst the key central banks. The Fed, ECB, BoE, BoC, and SNB are all priced at about 20bps of easing by June and have similar cumulative amounts of easing priced for 2024 as a whole (75-95bps). It points to DXY for now remaining in a 102-105 trading range that has prevailed so far this year.

USD/CNY BREAKS ABOVE 7.2000 FOR FIRST TIME SINCE NOVEMBER

Source: Bloomberg & MUFG GMR

GBP: BoE shifts a little more toward a first rate cut

We covered the policy announcement from the MPC in an FX Focus piece yesterday (here) and we concluded that the MPC vote, statement and minutes of the meeting was a marginal bearish event for GBP. The drop in GBP/USD was also a reflection of a broader recovery of the dollar and GBP/G10 crosses were mostly indicating no more than a 0.3%-0.4% depreciation of the pound. Still, the 2-year swap rate did end a little lower than we would have assumed – down 9bps at 4.40%, the lowest level since the beginning of February, and has declined further this morning. The understandable element triggering some of that market reaction was the vote switching from 6-2-1 to 8-0-1 with the two voters for a hike (Mann and Haskel) abandoning that call. That alone helps strengthen the case for a potentially sooner cut than expected. The OIS pricing for a June rate cut increased from 15bps to 20bps.

Going forward, we believe it remains a close call but do now see a higher chance of a June cut verus our original call for August being the starting month for cuts. There was a reference in the minutes to the degree of division that exists amongst the 8 MPC members that voted for rates to be kept unchanged – certainly for some of this group a “further accumulation of evidence on inflation persistence would be required” before they voted for a rate cut and the amount of evidence required differed within that group. So the sense from that reference is that the bulk of members will have differing views on reaching the threshold to cut and this implies potentially more than one meeting.

Still, one development after we wrote our piece yesterday was the reports from the BBC from an interview with Governor Bailey who acknowledged that the May meeting would allow for a reappraisal of the view that inflation would rebound in H2 2024. Of course there are reappraisals whenever a Monetary Policy Report is released but the implication in this reported comment was that it may mean a lower inflation profile.

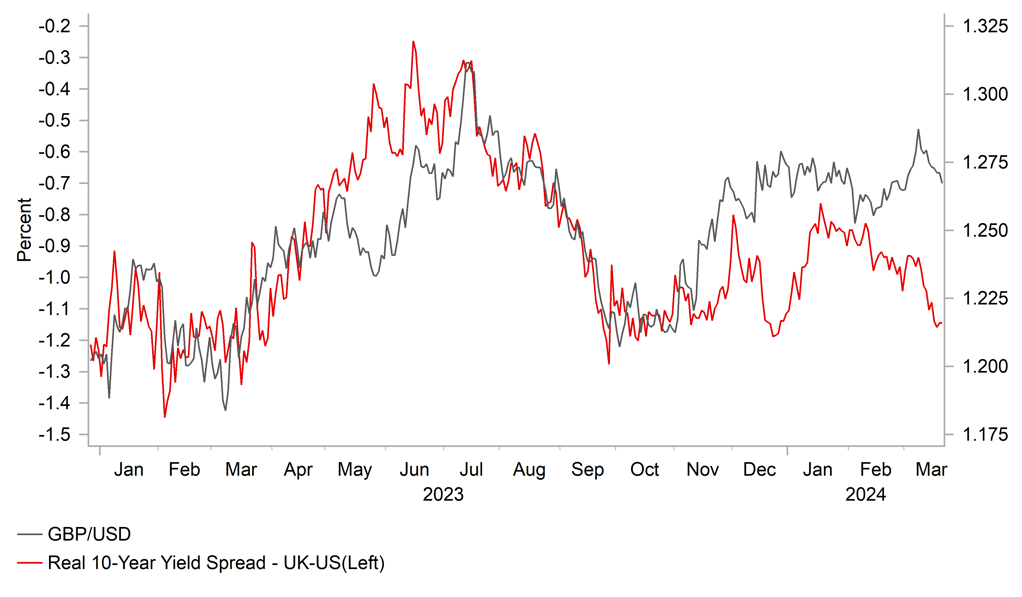

The pound could therefore suffer further over the short-term if the markets conviction on a June rate cut grows further and with that the potential extent of rate cuts in total delivered this year. The EU-UK 2-year rate spread is moving in favour of higher EUR/GBP and real yield UK-US spreads also point to the potential for broader GBP underperformance after a period of outperformance year-to-date.

UK-US REAL 10YR YIELD SPREAD VERSUS GBP/USD

Source: Macrobond & Bloomberg

CHF: SNB takes the lead, CHF underperformance ahead

We had highlighted the risk of a cut from the SNB arguing that the sharp decline in YoY inflation warranted action. The one-per-quarter meeting schedule made a move yesterday more likely given by the time of the next meeting a number of other G10 central banks could have cut and the SNB lagging behind other key central banks made no sense.

The inflation projections published by the SNB yesterday certainly reinforces the prospect of more cuts to come. From Q1 2025 through to Q4 2026 the SNB forecasts YoY CPI at 1.2% and then 1.1%. The SNB’s price stability definition is simply “a rise of CPI of less than 2%” so there is a downside symmetric bias to the definition. But past behaviour suggests the SNB is unhappy with YoY CPI falling below 1.0% so we could quickly have the SNB back in a scenario of fretting over deflation risks more than inflation risks. SNB President Jordan also made clear the balance sheet could be utilised and that CHF selling intervention (or buying) could be used going forward. We have a short CHF/JPY trade view in our FX Weekly, which was part based on the SNB risk and we see scope for further depreciation.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Buba Nagel Speaks |

-- |

-- |

-- |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Mar |

85.9 |

85.5 |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Mar |

-20 |

-20 |

!! |

|

CA |

12:30 |

Core Retail Sales (MoM) |

Jan |

-0.4% |

0.6% |

!! |

|

CA |

12:30 |

Retail Sales (MoM) |

Jan |

-0.4% |

0.9% |

!! |

|

US |

13:00 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

|

GE |

13:00 |

German Buba Nagel Speaks |

-- |

-- |

-- |

!! |

|

CA |

15:00 |

Budget Balance |

Jan |

-- |

-4.47B |

! |

|

EC |

17:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

20:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg