GBP & NZD outperform CAD driven by expectations for policy divergence

NZD/CAD: Widening policy divergence between BoC and RBNZ

The New Zealand dollar has been the best performing G10 currency overnight following the RBNZ’s latest policy meeting. It has resulted in the NZD/USD rate rising sharply up to an intra-day high of 0.6152 and the AUD/NZD rate falling sharply to an intra-day low of 1.0861. Alongside the Norwegian krone, the New Zealand dollar (+4.1% MTD vs. USD) has also been one of the best performing G10 currencies so far this month. The main trigger for the kiwi to strengthen further overnight was the RBNZ’s hawkish policy update. The RBNZ updated projections for the policy rate signalled a higher probability of another rate hike. The updated projections now show the average OCR peaking at 5.65% this year compared to 5.60% in February implying a 60% probability of another 25bps hike. RBNZ Governor Orr told reporters that a rate hike was “a real consideration” at this meeting, and that the Committee has limited tolerance for further upside inflation surprises.

It follows a similar discussion by the RBA at their latest policy meeting that leaves the Antipodean central banks amongst the most hawkish currently within the G10. At the same time, the updated projections signalled that the policy rate will remain higher for longer and is not expected to be lowered until later next year. The RBNZ’s hawkish projections push back strongly against market expectations for the RBNZ to begin cutting rates later this year. At the same time the RBNZ raised their estimate of the long run neutral policy rate by 25bps to 2.75%. It still implies that the current policy rate of 5.50% is highly restrictive which remains one of the key reasons why we and other market participants don’t think the RBNZ will wait so long before cutting rates. New Zealand’s economy has already slowed sharply over the past year and there is building evidence that labour market conditions are easing which will help to further slow inflation. At this stage, the RBNZ is not as convinced and they pushed back the timing of when inflation is expected to fall back to within their 1-3% target band by three months to Q4 of this year, and returning to the 2.0% target by six months until mid-2026. Overall, the RBNZ’s hawkish policy update should help to provide support for the kiwi in the near-term which was already benefitting from the recent improvement in external market conditions.

In contrast to the hawkish repricing of RBNZ policy expectations, the Canadian rate market has moved to price in a higher probability of an earlier rate cut from the BoC. The probability of the BoC beginning to cut rates as soon as at their next policy meeting in June rather than in July was risen to just over 50% following the release yesterday of the latest Canadian CPI report for April. The report revealed that core inflation surprised to the downside for the fourth consecutive month this year. The average of the core CPI measures (trim & median) slowed further to an annual rate of 2.8% in April from 3.1% in March. After applying a seasonal adjustment, the 6-month annualized rate has slowed even more to 2.4%. With inflation moving closer to the BoC’s inflation target and Canada’s economy growing below potential, there is now room for the BoC to make their policy rate less restrictive. We continue to expect the first BoC rate cut at the June policy meeting. Market expectations for widening policy divergence between the BoC and Fed should keep USD/CAD trading in the high 1.3000’s in the coming months. We also look for further AUD and NZD outperformance against the Canadian dollar.

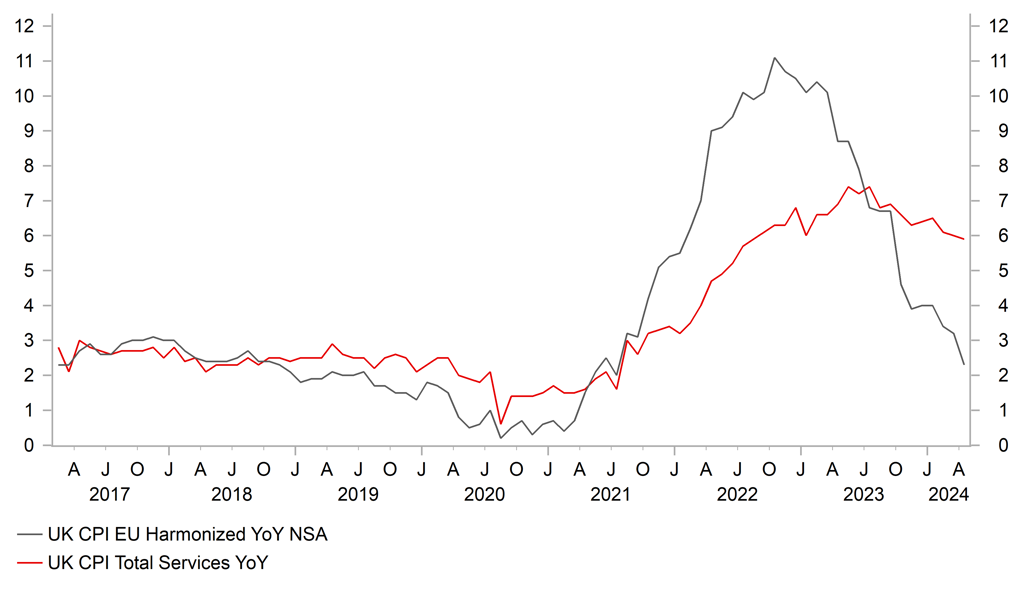

UK SERVICES INFLATION REMAINS ELEVATED

Source: Macrobond, Bloomberg & MUFG Research

GBP: Big upside surprise for services inflation to encourage BoE caution

The pound has strengthened this morning following the release of the latest UK CPI report for April. It has resulted in cable rising above 1.2750 and EUR/GBP falling back towards the 0.8500-level. The pound’s recent upward momentum has been reinforced by the paring back of BoE rate cut expectations. The UK rate is now pricing in just less than a 50:50 probability of the first BoE rate cut being delivered at the August MPC meeting and for this calendar year as a whole is now only pricing in around 38bps of cuts. The hawkish repricing of BoE rate cut expectations has been triggered by the latest UK CPI report revealing that underlying inflation pressures remined more persistent than expected. While headline inflation slowed sharply by 0.9ppt to 2.3% driven primarily by the expected decline in energy prices (-12% for household energy prices), the slowdown in underlying inflation measures was much more modest. Core inflation slowed by 0.3ppt to 3.9% and services inflation by just 0.1ppt to 5.9%. The BoE had been expecting services inflation to fall to 5.5%. Many services prices rise in April as they go through an annual reset.

In light of these unfavourable developments, MPC members will remain concerned over the risk of inflation proving more persistent in the UK. The stronger April CPI report should rule out the BoE beginning to cut rates as soon as at their next MPC meeting in June and also casts doubt on recent comments from BoE officials indicating that a rate cut could be delivered over the summer at say the August MPC meeting. A more delayed start to the BoE rate cut cycle alongside the still high yields on offer in the UK will encourage a stronger pound in the near-term.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:05 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

UK |

13:45 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

US |

15:00 |

Existing Home Sales |

Apr |

4.21M |

4.19M |

!!! |

|

US |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

-- |

!!! |

|

NZ |

21:10 |

RBNZ Gov Orr Speaks |

-- |

-- |

-- |

!! |

|

NZ |

23:45 |

Retail Sales (QoQ) |

Q1 |

-0.3% |

-1.9% |

!! |

Source: Bloomberg