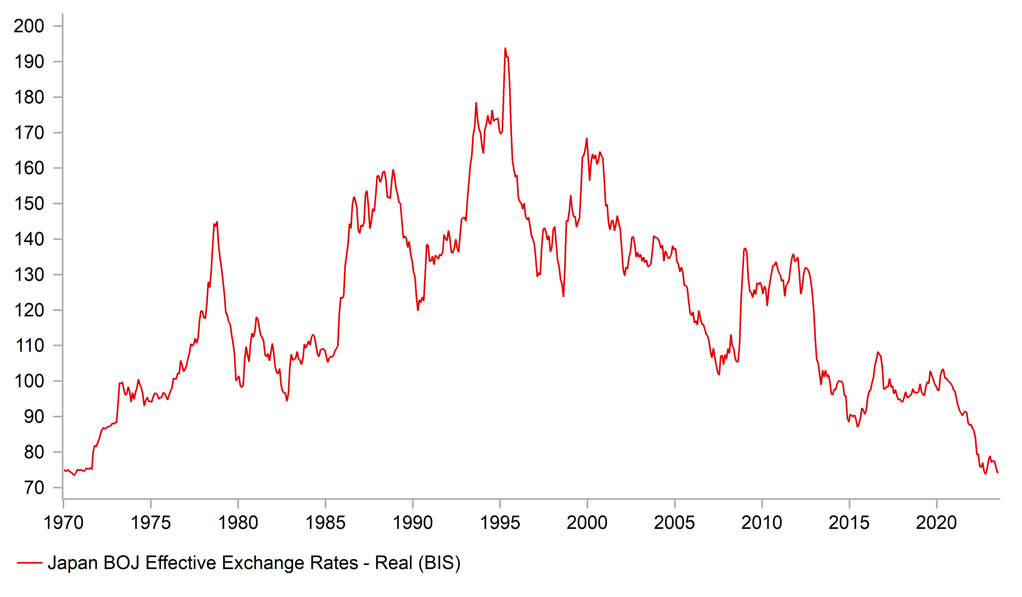

Lack of push back from BoJ leaves JPY vulnerable to further weakness

JPY: BoJ Governor Ueda does not signal earlier rate hike plans

The yen has weakened further overnight following the BoJ’s latest policy meeting. It has resulted in USD/JPY moving further above the 148.00.00-level. The BoJ left their policy settings unchanged as expected, and then market attention quickly turned to Governor Ueda’s press conference for an update on policy guidance. There has been a pick-up in speculation recently over the possibility of the BoJ bringing forward rate hike plans. However, the comments from Governor Ueda today appear to have been carefully crafted not to further encourage those expectations. He stated that he can’t comment on the market reaction to his interview with the Yomiuri newspaper while emphasizing that patient continuation of easing is needed. He did say the BoJ will mull adjusting policy if the price goal is in sight although he can’t say when that will happen. He believes the distance to ending negative rates has not changed much. He also stated that he can’t say when wage results will be clear. The lack of clarity over the timing of any further adjustment in policy seems to be a step back from his comments to the Yomiuri newspaper last week when he indicated that the BoJ could have enough information about wages to judge if they will continue to rise by year end and talked about the possibility of raising rates.

It leaves the yen vulnerable to further weakness in the near-term. However, the move higher in USD/JPY will continue to be dampened by the heightened risk of intervention from Japan to support the yen. Both Finance Minister Suzuki and Prime Minister Kishida talked about intervening if required ahead of today’s BoJ policy meeting. Prime Minister Kishida stated that Japan would maintain high vigilance and take necessary action against excessive currency moves without excluding any option. Similar comments were made by Finance Minister Suzuki overnight who stated that they won’t rule out any options against excess FX moves and will watch FX moves with a high sense of urgency. He added that both the US and Japan agree that excessive FX moves aren’t desirable. We continue to judge that the comments are consistent with the highest level of intervention risk.

JPY WEAKNESS TO REMAIN IN FOCUS AFTER BOJ UPDATE

Source: Bloomberg, Macrobond & MUFG Research calculations

G10 FX: Diverging paths for central banks but FX impact not clear cut

Yesterday was a busy day for G10 central bank updates that triggered a pick-up in foreign market volatility. The BoE and SNB both delivered dovish policy surprises by unexpectedly leaving rates on hold at 5.25% and 1.75% respectively. It has resulted in the pound and Swiss franc weakening into the end of this week. EUR/GBP has risen up towards the top of the 0.8500 to 0.8700 range that has been in place since September, and EUR/CHF rose up to an intra-day high yesterday of 0.9677 after the pair had been trading in narrow range between 0.9500 and 0.9600 over the summer. While the BoE and the SNB did not rule out further rate hikes if required, their rate hike cycle may have just peaked out. As we highlighted in yesterday’s FX Focus (click here) the updated guidance from the BoE signalled that they moving their focus towards keeping rates at higher levels for longer to bring down inflation rather than continuing to hike rates further into restrictive territory. The SNB’s new conditional inflation forecast which is based on the assumption of the SNB’s policy rate remaining at 1.75% over the forecast horizon was revised somewhat below the June forecast mainly due to the economic slowdown in Switzerland and slightly lower inflationary pressure from abroad. After the revision, the updated inflation projections are just within the range of price stability at the end of the forecast horizon (1.9% for 2025) which reduces the need for further hikes. Even after yesterday’s sell-off the Swiss franc (+2.2% vs. USD) and pound (+1.6%) remain the best two performing G10 currencies this year

In contrast, the two Scandinavian central banks of the Norges Bank and Riksbank delivered hawkish policy updates yesterday but they have offered limited support for their domestic currencies. Ongoing weakness for the Norwegian krone (-8.9% vs. USD) and Swedish krona (-6.7%) which are two of the worst performing G10 currencies this year is keeping pressure on the Norges Bank and Riksbank to keep hiking rates. The Norges Bank raised their policy rate by a further 25bps to 4.25% and signalled clearly that “there will likely be one additional policy hike, most likely in December”. If pressures in the economy persist or the krone turns out to be weaker than projected, inflation could remain high for longer than currently envisioned, and in that case the Norges Bank stated that it is prepared to raise the policy rate to a further extent than currently envisaged.

Similarly, the Riksbank raised their policy rate by a further 25bps to 4.00%, and the updated rate path signalled a higher probability that it could deliver one further hike. The Riksbank went further in attempting to provide more support for the krona by also announcing plans to begin partly hedging FX reserves that will require selling USD8 billion and EUR2 billion in exchange for the krona over the next four to six months from 25th September. While the daily flows are unlikely to be large enough to the trigger a sustained rebound for the krona, they will offer more support. However, the Riksbank was keen to emphasize that it is not a form of intervention to support the krona. Furthermore, the Riksbank has attempted to encourage market expectations that it view the krona as “unjustifiably weak” and released an article outlining why they believe the krona is likely to strengthen in the medium-term and citing internal studies showing that it is 10-15% undervalued. It is a view we share in expecting the krona to strengthen in the year ahead but developments yesterday have not altered our strategic view that the krona can weaken further in the near-term. We maintain a long USD/SEK trade recommendation (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Sep |

44.0 |

43.5 |

!! |

|

EC |

09:00 |

Services PMI |

Sep |

47.7 |

47.9 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

43.0 |

43.0 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

49.2 |

49.5 |

!!! |

|

EC |

12:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Jul |

0.4% |

0.1% |

!! |

|

US |

13:50 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

! |

|

US |

14:45 |

Services PMI |

Sep |

50.6 |

50.5 |

!!! |

Source: Bloomberg