Trump tries to rein back US dollar slump of historic proportions

USD: A day of relative calm but risks unlikely to fade

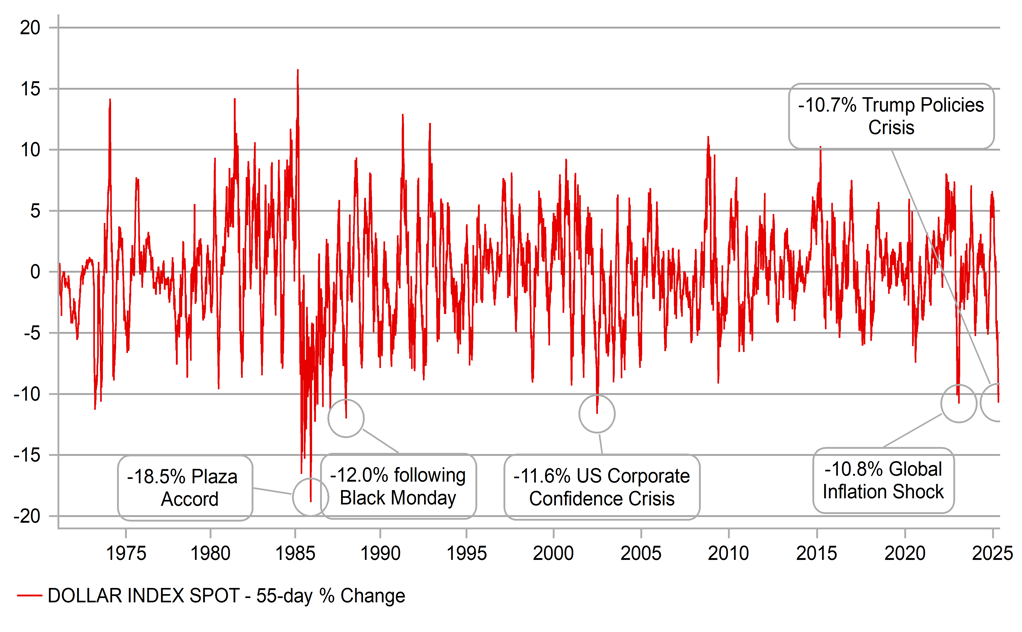

There were some more favourable comments out of Washington yesterday after the sharp dollar selling on Monday fuelled by President Trump’s comments about Fed Chair Powell that only served to reinforce the risks for the US dollar going forward. However, President Trump looks to be backtracking somewhat, perhaps seeing the potential damage being done and his advisors may be suggesting bringing some balance to his communications. His admission that he has no intention of firing Fed Chair Powell has helped to arrest the slide in the dollar for now. At issue now for the dollar and general sentiment for US assets is that the benchmark on what Trump could do going forward has been set against the huge reciprocal tariff rates announced on 2nd April that nobody had predicted in worst case scenarios. Hence, a dollar depreciation accord and/or firing Chair Powell are no longer unrealistic. The scale of the US dollar decline is now historic. Sharp selling first emerged in early February in response to the postponement of tariffs on Canada and Mexico and the introduction of the first 10% tariff on China. Covering the period since then, 3rd Feb) to Monday (55 trading days), the US dollar (DXY) fell 10.7%. Since the Plaza Accord period in 1985, the dollar has only declined by more over the same period during the global inflation shock to January 2023; the US corporate confidence crisis in 2002; and the period following Black Monday in 1987. So this is a US dollar drop of historic proportions and the loss of confidence is of a magnitude that could take considerable time and effort to restore. It is understandable for investors to believe that the administration does not have the will to reverse course and make efforts to restore confidence.

In addition to Trump’s comment that he has no intention of firing Chair Powell, there are two other obvious scenarios in which the dollar could see some further recovery. The first would be evidence of some quick and significant trade deals with some key trading partners. So deals announced with say Japan, the UK and India would go some way to lifting expectations of a large number of countries falling outside of reciprocal tariff rates in a relatively short period of time. Bilateral trade deals tend to be complicated and involve in-depth negotiations so it is hard to believe that scenario will unfold quickly. Secondly, a public statement by President Trump and/or other senior officials that the administration does not and will not endorse a weak US dollar policy could also help, at least in the near-term although of course actions ultimately speak louder than words.

Another emerging developed centres around some back-tracking from the US specific to China. Bloomberg yesterday reported comments made by US Treasury Secretary Scott Bessent yesterday in a closed-door event where he reportedly stated that the US-China tariff stand-off is “unsustainable” given the tariff levels means there is an effective trade embargo in place between the top two economies in the world. He therefore expects the situation to de-escalate and for negotiations to take place. Trump also helped on this topic yesterday stating that he would be “very nice” with China and that tariffs could come down “very substantially”.

Predicting what President Trump will do is difficult of course but Scott Bessent is correct that the situation does appear unsustainable. The scale of the US dollar move does point to some scope if these reports of de-escalation intensify that we could see this US dollar rebound extend further. Still, investors are likely to remain cautious and in many ways, damage is already done that likely means any US dollar recovery will be brief and relatively modest.

ONE OF THE LARGEST US DOLLAR DECLINES SINCE PLAZA ACCORD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Macron considering parliamentary elections this year

There were media reports yesterday that President Macron of France is considering holding fresh parliamentary elections as early as later this year. Following the elections last year in July, there can be no new elections for twelve months which has acted as a disincentive for opposition parties to bring down the current minority government. But that will change from July onwards when elections will be possible. President Macron may believe the political landscape has changed to his benefit which could help in winning a majority and bringing back greater stability in parliament. The return of President Trump means political leadership in Europe will be key in protecting Europe’s interests and President Macron has been the most prominent politician leading the way in Europe. Marine Le Pen’s guilty verdict on embezzlement charges may also have damaged the support of RN. The support for her probable replacement (if she loses her appeal against the decision), Jordan Bardella, has declined in the polls.

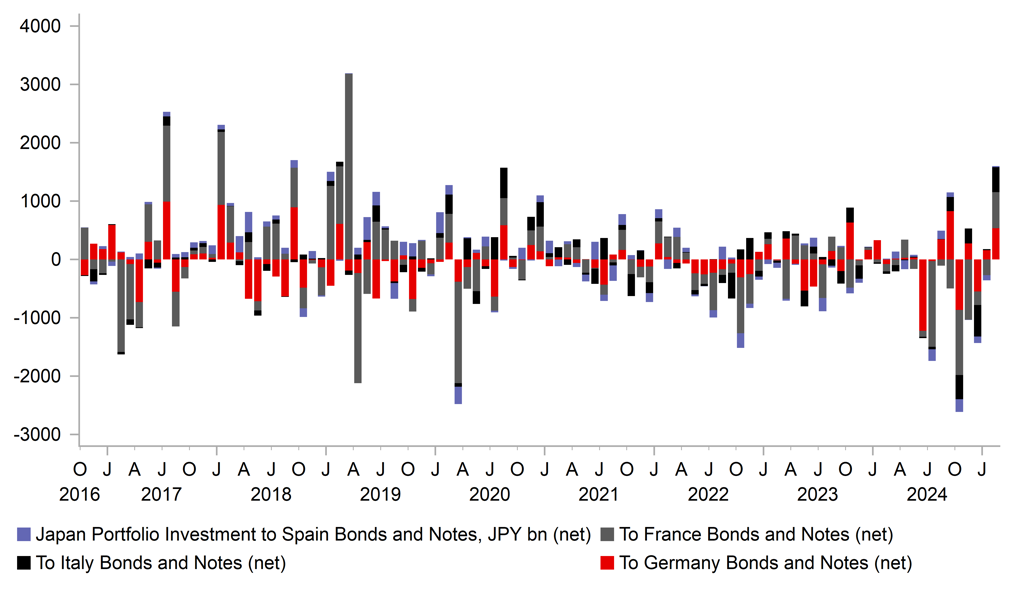

However, just like last year’s elections, a decision to rerun would be very risky. There has been a period of relative stability since Francois Bayrou became prime minister and if that stability continues, holding elections would likely be met with disapproval in the financial markets. What has been noticeable of late is the potential for Europe to benefit from the loss of confidence in US assets. The OAT-Bund spread has been relatively stable with Bunds outperforming US Treasury bonds and there has been a pick-up in demand for euro-zone debt. That is evident in Japan MoF data with the balance of payments data for February revealing combined purchases of bonds from Germany, France, Italy and Spain reached the largest (JPY 1,604bn) since March 2019. The buying of French bonds (JPY 618bn) was the largest since June 2019.

JAPAN BUYING OF CORE EZ BONDS SURGED IN FEBRUARY

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French Manufacturing PMI |

Apr |

47.9 |

48.5 |

!! |

|

FR |

08:15 |

French Services PMI |

Apr |

47.7 |

47.9 |

!! |

|

GE |

08:30 |

German Manufacturing PMI |

Apr |

47.5 |

48.3 |

!!! |

|

GE |

08:30 |

German Services PMI |

Apr |

50.3 |

50.9 |

!!! |

|

EC |

09:00 |

Manufacturing PMI |

Apr |

47.4 |

48.6 |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Apr |

50.3 |

50.9 |

!! |

|

EC |

09:00 |

Services PMI |

Apr |

50.4 |

51.0 |

!! |

|

UK |

09:30 |

Composite PMI |

Apr |

50.4 |

51.5 |

!!! |

|

UK |

09:30 |

Manufacturing PMI |

Apr |

44.0 |

44.9 |

!!! |

|

UK |

09:30 |

Services PMI |

Apr |

51.5 |

52.5 |

!!! |

|

UK |

11:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!!! |

|

US |

13:30 |

Building Permits |

Mar |

1.482M |

1.459M |

!! |

|

US |

14:00 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

US |

14:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!!! |

|

US |

14:45 |

Manufacturing PMI |

Apr |

49.0 |

50.2 |

!!! |

|

US |

14:45 |

Services PMI |

Apr |

52.8 |

54.4 |

!!! |

|

US |

15:00 |

New Home Sales |

Mar |

684K |

676K |

!!! |

|

UK |

17:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

UK |

19:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

|

EC |

20:15 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg