Yen gains as Ueda stands firm and focus shifts to Powell

USD/JPY: Will Powell reinforce Ueda impact?

USD/JPY is the biggest mover in the G10 FX space this morning with the comments from BoJ Governor Ueda in the Diet helping to lift the yen. As we have stated here before, the sharp drop in USD/JPY in July into August is changing the behaviour of market participants and the price action is increasingly looking like there being greater appetite to sell USD/JPY on rallies rather than before which was to buy on dips. The yen buying today is understandable given Governor Ueda showed very little sign of a shift in the views and plans of the BoJ following the financial market turmoil earlier this month. As we stated here yesterday, Governor Ueda was very firm in arguing the steps taken at the July policy meeting were justified. He also did not shy away from repeating the guidance from the July meeting that the policy rate can gradually move higher toward the neutral rate if the BoJ forecasts continue to be realised.

We shouldn’t be surprised with that. Given the significance of the steps taken in July to have communicated anything that suggested back-tracking would be far more damaging to credibility and create unnecessary uncertainty. He also wasn’t dismissive of what happened and repeated that the BoJ would be flexible in its approach to policy implementation going forward. He mentioned being flexible in regard to JGB plans and that even after policy was adjusted, the stance remains exceptionally loose. We had thought yesterday that he may have emphasised caution ahead a little more than he has and that has helped lift the yen. Governor Ueda also pointed the finger at US growth expectations for the turmoil rather than the BoJ decision itself. With those concerns now easing, conditions have improved. Governor Ueda added that there was no difference in his views and Deputy Governor Uchida’s and it is clear that the BoJ would avoid tightening policy in circumstances of volatile financial market conditions. So a firm but careful message that rate hikes remain on the table.

The yen was also helped by the release of modestly stronger nationwide CPI. The headline rate was 0.1ppt higher than expected, remaining unchanged at 2.8%. The underlying measures were as expected – the core-core rate fell from 2.2% to 1.9%. With wage growth strengthening the macro backdrop remains consistent with a gradual move toward that neutral rate that Governor Ueda repeated today was “far” above the current policy rate level.

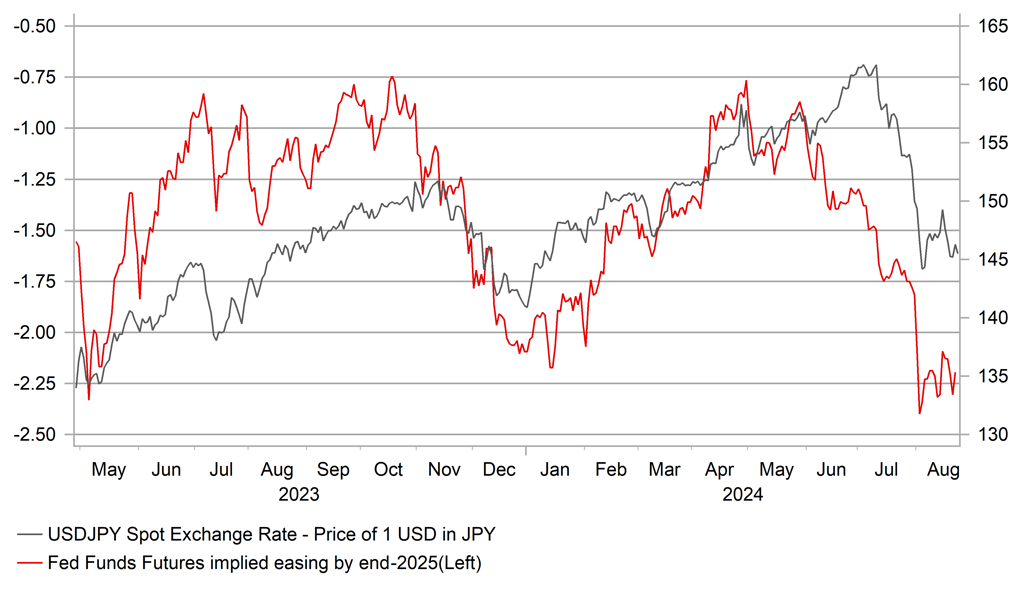

The focus now shifts to this afternoon and the speech by Fed Chair Powell at Jackson Hole. We have had a steady stream of Fed speakers this week who have nearly all expressed the same view – that conditions are in place to commence monetary easing in September. That message will be repeated this afternoon in all likelihood and hence it is hard to see any big surprises from this speech. There’s a risk perhaps that he may come across more cautious in order to send a message that 25bp cuts are appropriate and that the Fed has not fallen behind the curve. We wouldn’t expect this to illicit much of a US dollar rebound but it could curtail further selling and see some modest recovery for the dollar.

FED EASING EXPECTATIONS CONTINUES TO WEIGH ON USD/JPY

Source: Macrobond & Bloomberg

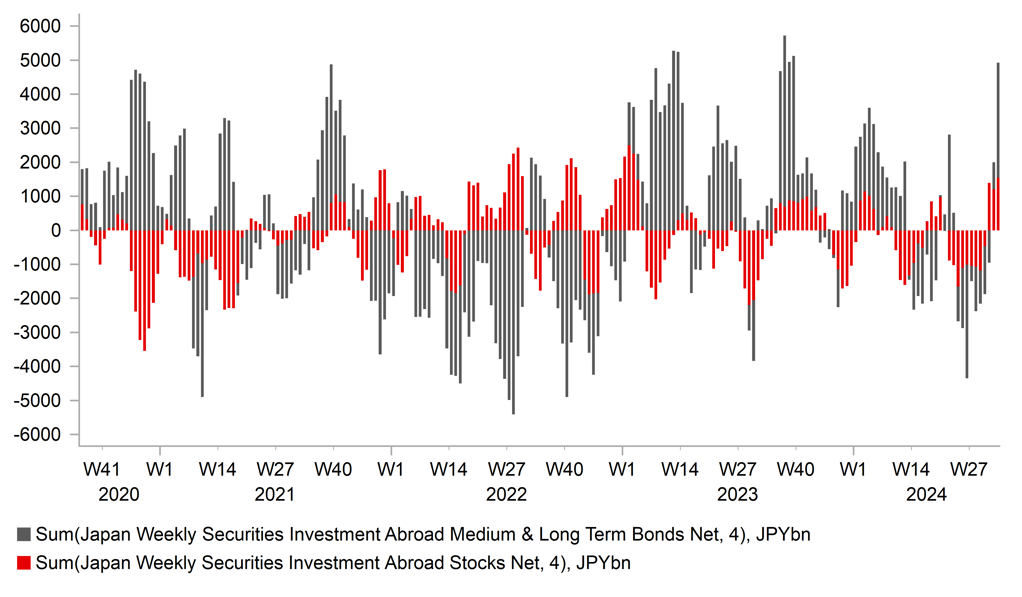

JPY: Japanese investors’ demand for foreign securities surges

The weekly cross-border flow data, released yesterday by the MoF, were certainly eye-catching. The data covered the week to last Friday and the combination of the considerably lower levels of USD/JPY and the revival of risk appetite prompted a considerable upturn in demand for foreign bonds. The chart above highlights the sharp upturn in purchases with Japanese investors buying JPY 1,854bn worth of foreign bonds last week – over a 4-week period buying reached JPY 3,377bn, the largest 4-week total since early October last year.

That four-week period captures a move in 10-year UST bond yields falling from over 4.25% all the way down to the brief low below 3.70% before settling in the 3.80%-4.00% range. It also captures the plunge in USD/JPY from over 155.00 and certainly from an FX perspective, the plunge is making foreign bond prices look more attractive and hence investors with greater risk appetite could have taken advantage of the FX drop to increase unhedged purchases. There are certainly plenty of examples of sudden declines in USD/JPY drawing in stronger demand for foreign securities.

The other interesting takeaway from the weekly data was the evidence of a lack of follow-through in buying of Japanese equities by foreign investors who were net sellers totalling JPY 48bn last week. The previous week to 9th of August foreign investors were buyers after the plunge in prices on the Monday of that week. Foreign investors had been net sellers the two weeks prior to that which was reflected in the 4-week selling total of JPY 783bn. The lack of follow-through does suggest caution amongst foreign investors given the Topix remains close to 10% off its peak, in contrast to the 1.5% shortfall from the high for the S&P 500.

Foreign investors could well still be over-hedged on Japanese equity positions and that is one source of further yen buying we may see going forward if the Japanese equity markets continue to lag behind. The Topix Index has closed the week out with a 0.50% gain today despite the strengthening of the yen in response to Governor Ueda’s comments.

PURCHASES AND SALES OF FOREIGN SECURITIES BY JAPANESE INVESTORS ON A 4-WEEK ROLLING SUM BASIS

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:00 |

Fed's Bostic speaks on CNBC |

!!! |

|||

|

US |

13:30 |

Building Permits (MoM) |

Jul |

-- |

3.9% |

! |

|

US |

13:30 |

Building Permits |

Jul |

1.396M |

1.454M |

!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Jun |

-0.2% |

-1.3% |

!! |

|

CA |

13:30 |

Corporate Profits (QoQ) |

-- |

-- |

0.6% |

! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Jul |

-- |

-2.1% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Jun |

-0.3% |

-0.8% |

! |

|

US |

15:00 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!!!! |

|

US |

15:00 |

New Home Sales |

Jul |

624K |

617K |

!! |

|

US |

15:00 |

New Home Sales (MoM) |

Jul |

-- |

-0.6% |

!! |

|

UK |

16:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

US |

17:30 |

Fed's Goolsbee speaks on CNBC |

!!! |

|||

|

US |

18:45 |

Fed's Goolsbee speaks on FOX News |

! |

|||

|

US |

19:15 |

Fed's Goolsbee speaks on Bloomberg TV |

! |

Source: Bloomberg