Lagarde optimism hints at further cautious cuts

EUR: More cuts from ECB with inflation close to target

Our view for the forecast profile for EUR/USD remains that the euro will drop to around the parity level in the first quarter of next year before then stabilising and recovering moderately in the second half of the year. This is partly based on the macro divergence theme being maintained in the early part of the year before then beginning to fade. That divergence is quite well priced and hence the scope to the downside is not huge.

ECB President Lagarde expressed her latest views in an FT podcast released today and there was certainly evidence of optimism from Lagarde on the achievement of the 2.0% inflation target. Lagarde stated that “we are getting very close” to the point when “we have sustainably brought inflation to our medium-tern 2%”. However, reflecting the extent of what is priced in the curve now, there was limited impact in FX and indeed the Euribor / ESTR futures strip sold off modestly and the 2-year bond yield in Germany drifted slightly higher. There was an element of caution to Lagarde’s comments in making her inflation comment “with a little reservation” due to the still high level of services inflation. At close to double the target level, services inflation remains the element that warrants caution and hence wage growth and corporate profits needed to be monitored closely. Our EUR/USD relative macro view for next year is more about the Fed pausing and admittedly even that is now much better priced following the FOMC meeting last week that signalled a hawkish shift from the committee. The 2-year EZ-US swap rate continues to trade at the lows recorded at the worst point in the divergence pricing in 2022 following Russia’s invasion of Ukraine when there were pronounced fears over deep recession in Europe due to natural gas shortages. Those fears never materialised and eventually EUR/USD rebounded.

On this occasion much of the fear of divergence in growth next year stems from expectations of trade tariffs hitting Europe. We will have to wait until Trump is in the White House to see how aggressive he is but tariffs hitting the euro-zone seems very likely. Nonetheless, there remains a positive support backdrop for the euro-zone as well – some of the highest nominal wage growth rates in decades at a time when inflation is back close to target points to supportive real wage growth that will help support consumption and the services sector. While trade is important, the euro-zone as a whole is classed as a large closed economy, just like the US. The market consensus remains that growth in the euro-zone will pick up modestly in 2025. So we see the scope for a large sustained sell-off in EUR/USD from here as quite limited.

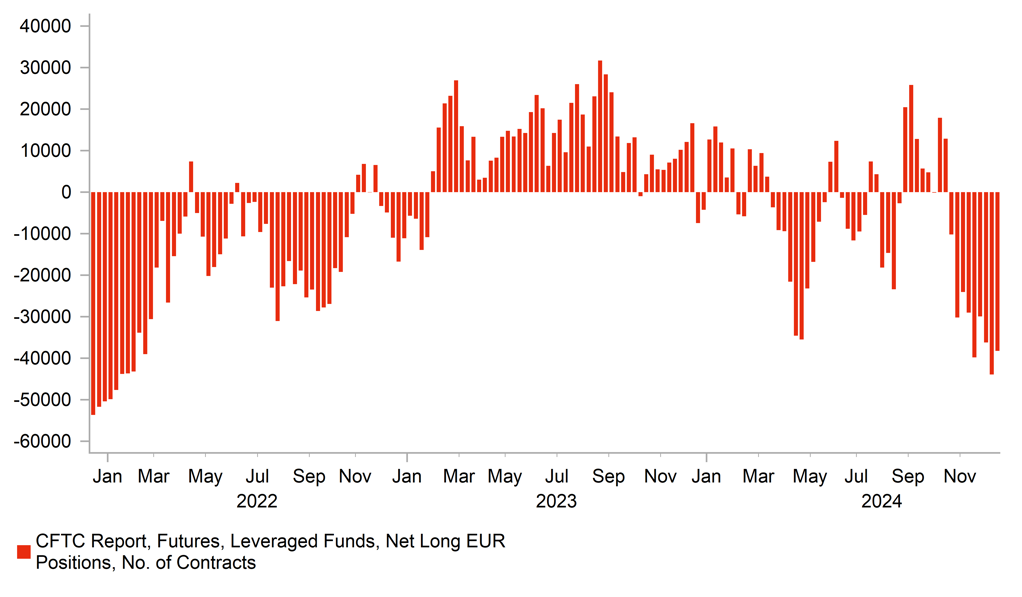

EUR LEVERAGED FUNDS’ SHORTS REMAIN SUBTANTIAL ALTHOUGH LAST WEEK SAW SOME MODEST PARING BACK

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Japan sees Europe risks as specs sell yen

There was limited big changes to FX positioning reported by CFTC on Friday with Leveraged Funds’ short positions in EUR remaining substantial – positioning was lightened modestly but nonetheless, remained close to the total short position reported last week of close to 44k. That short position was the largest since January 2022 in the run-up to the start of Russia’s invasion of Ukraine. Based on our measure of how stretched positioning is, our z-score indicates EUR remains the second most stretched positioning of all the currencies reported with just NZD more stretched. NZD shorts are currently the largest since December 2019 highlighting the fact that yield remains a dominant influence for demand and the lack of yield after aggressive RBNZ action is fuelling selling.

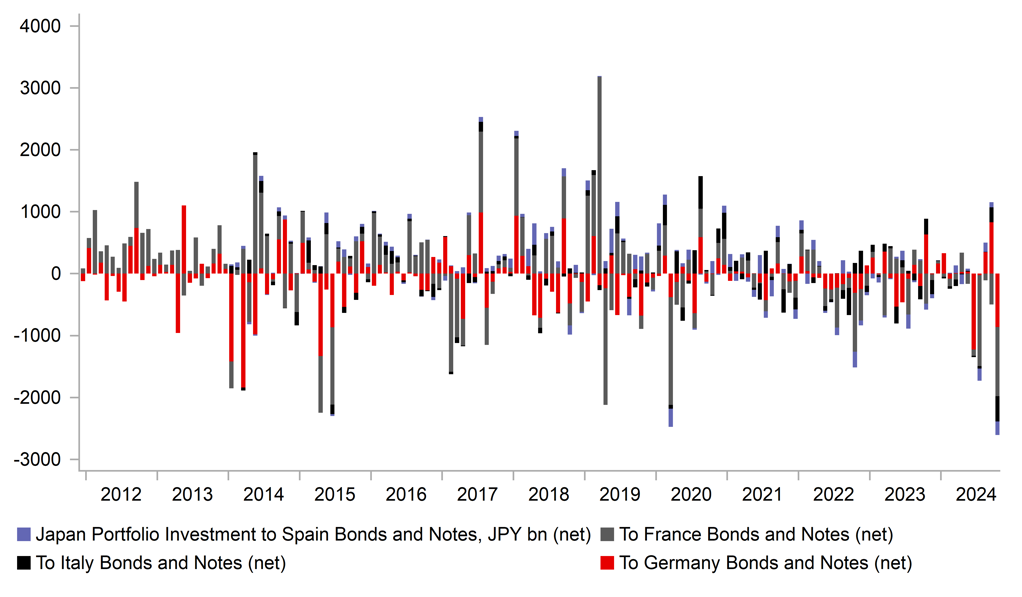

The euro selling and stretched short positioning could also have a political angle to it. We have a German election in February and the political landscape in France is also likely weighing on performance. The balance of payments statistics for October, which was before the escalation of political uncertainty in Germany (which took place on 7th Nov when Scholz dismissed his finance minister), still revealed substantial selling combined across the key euro-zone countries – Germany, France, Italy and Spain. Bond selling by Japanese investors totalled JPY 2,700bn, the largest month of sales for those four countries combined since the series began in 1995.

Our concerns for the year ahead are mostly focused in France, not Germany. Francois Bayrou stated that he would announce his government before the Christmas holiday period but media reports yesterday in France reported a delay suggesting Bayrou is struggling to even get going. The objective for President Macron going forward is to try and fragment the alliance on the left in parliament – this is surely his best way of countering National Rally and Marine Le Pen. Our EUR/USD forecasts imply Macron could get some success with this strategy and certainly we do not assume early presidential elections in France. But political risks could certainly be a downside factor for EUR if speculation of early presidential elections were to rise.

RECORD SELLING OF CORE-EZ BONDS BY JAPANESE INVESTORS IN OCT

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Trade Balance Non-EU |

Nov |

-- |

5.71B |

! |

|

US |

13:30 |

Chicago Fed National Activity |

Nov |

-- |

-0.40 |

! |

|

CA |

13:30 |

GDP (MoM) |

Oct |

0.1% |

0.1% |

!! |

|

CA |

13:30 |

IPPI (MoM) |

Nov |

0.3% |

1.2% |

! |

|

CA |

13:30 |

IPPI (YoY) |

Nov |

-- |

1.1% |

! |

|

CA |

13:30 |

RMPI (MoM) |

Nov |

0.4% |

3.8% |

!! |

|

CA |

13:30 |

RMPI (YoY) |

Nov |

-- |

-2.8% |

! |

|

US |

14:00 |

Dallas Fed PCE |

Nov |

-- |

2.30% |

! |

|

US |

15:00 |

CB Consumer Confidence |

Dec |

112.9 |

111.7 |

!!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

Source: Bloomberg