BoJ policy update results in a more volatile JPY

JPY: BoJ policy update supports our outlook for rate hike in April

The yen has strengthened after today’s BoJ policy meeting resulting in USD/JPY falling back towards the 147.00-level after hitting an intra-day high overnight of 148.55. The main driver for the yen’s gains have been comments from Governor Ueda in the accompanying press conference in which he indicated that the BoJ is moving closer to raising rates. However, he still refrained from giving a stronger indication over the exact timing of an exit from negative rates. Governor Ueda expressed more confidence in the likelihood of achieving their 2.0% inflation target. He stated that the probability of achieving their inflation target was “rising gradually”. He has been encouraged by comments from big companies in Japan regarding the wage hikes for the upcoming fiscal year. He added as well that the number of companies that have decided to hike wages at this year’s spring wage negotiations is higher than this time last year. There is still though uncertainty about how widespread wage hikes will be, although not as high as last year. We continue to believe that once the BoJ has more confidence that stronger wage growth will be sustained in the upcoming fiscal year that will be that will be the last piece of the puzzle before the BoJ begins to raise rates. As a result, the BoJ reiterated again that they will be closely watching the outcome of the spring wage negotiations as they want to see a virtuous cycle of wages and prices is in place.

Recent developments has meant that the BoJ’s “confidence has grown in the achievement of the price target”. That was backed up as well by the BoJ’s updated economic projections which showed the core-core inflation measure remaining at 1.9% in fiscal years 2024 and 2025 which is just below the BoJ’s target. Despite the comments indicating more confidence in achieving their inflation target, Governor Ueda refrained from giving a stronger indication over the timing of the first rate hike by stating that we “can’t quantify how much closer we are to exiting negative rates”. He did add though that he certainly foresees further rate hikes when exiting negative rates policy indicating that it is unlikely to be a one off hike. He finished off by emphasizing that the BoJ will end negative rate policy when they judge that the achievement of their 2.0% inflation target is in insight.

With regards to the potential timing of the first hike, he noted that the BoJ will have more data available at the April policy meeting compared to in March. Overall, the comments from today’s policy meeting support our view that the BoJ will exit negative rates at the April policy meeting rather than waiting until June. It was backed up by Governor Ueda indicating “we can make some judgements on wages at smaller companies by looking at other economic data, and from hearings with companies”. While we expect the BoJ’s exit from negative rates to encourage a stronger yen (click here) alongside rate cuts from other major central banks such as the Fed, recent price action has highlighted that it is still likely premature to expect the yen to strengthen on a more sustained basis at the current juncture.

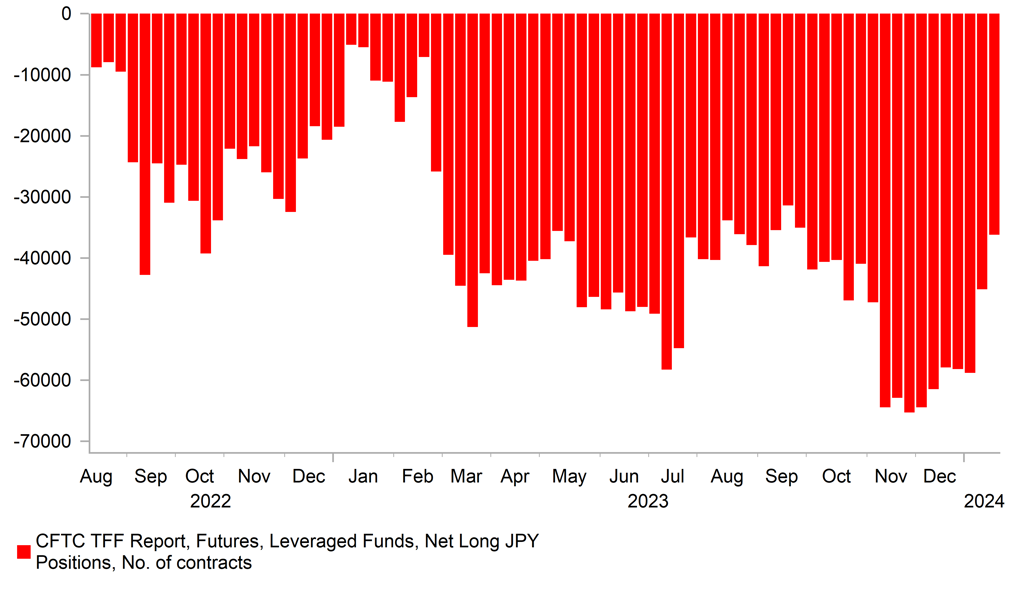

JPY SHORTS HAVE BEEN SCALED BACK AT START OF 2024

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: US yield pick-up & China pessimism are creating challenging backdrop

Emerging market currencies have continued to weaken at the start of the new calendar year. The worst performing EM currencies last week were the ZAR, THB, HUF, and KRW, While the CLP was the only emerging market currency that has strengthened marginally against the USD. The USD has continued to rebound across the board supported by the resilience of the US economy. The release of the stronger than expected US retail sales report for December revealed that the US economy likely slowed more modestly than expected in Q4. It has cast some doubt on how quickly the Fed will begin to cut rates in response to slowing US inflation. The US rate market is now pricing in less than a 50:50 probability of the first Fed rate cut being delivered as soon as at the March FOMC meeting. The main US economic data release in the week ahead will be the latest PCE deflator report for December. The report is expected to reveal that US inflation pressures eased at the end of last year. The core PCE deflator which is the Fed’s preferred measure of underlying inflation pressures is expected to have slowed to annualized rate of just under 2.0% in the 2H of last year. If confirmed it should give the Fed more confidence that inflation will return to target, and further encourage discussions over lowering the policy rate to less restrictive levels.

In contrast to the building optimism over a softer landing for the US economy that has lifted the US equity market to a new record high at the end of last week, market participants remain concerned over the health of China’s economy. Negative investor sentiment towards Chinese assets is clearly evident by the underperformance of their domestic equity market at the start of this year. The Shanghai composite equity index has fallen sharply by over 7% and has hit the lowest levels since May 2020 during the initial recovery from the first negative COVID shock. China’s equity market has been trending lower since May of last year which for the most part has coincided with a stronger USD. After failing to break below the 7.1000-level in December , USD/CNY has risen back up to the 7.2000-level and could potentially retest the highs from last autumn at just above the 7.3000-level. The top of the +/-2% daily trading band for USD/CNY is currently located at just above the 7.2500-level. However, we expect domestic policymakers to provide more support for the CNY if required in order to help stabilize USD/CNY close to last year’s highs. Ongoing concerns over the cyclical performance of China economy which lost upward momentum at the end of last year despite support from policy stimulus remains a headwind for Asia FX performance. Please see our latest EM EMEA Weekly report for more details (click here).

CHINA GROWTH CONCERNS REMAIN HEADWIND FOR ASIA FX

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Dec |

0.0% |

-0.2% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Jan |

-14.3 |

-15.0 |

! |

|

NZ |

21:45 |

CPI (YoY) |

Q4 |

4.7% |

5.6% |

!! |

Source: Bloomberg