A softer USD apart from against JPY ahead of BoJ meeting

USD/JPY: The yen has underperformed this week ahead of BoJ hike

The US dollar has continued to trade at weaker levels during the Asian trading session following the sell-off at the start of Trump’s second term as President. It has resulted in the dollar index falling back towards the 108.00-level as it moves further below the year to date high of 110.18 set on 13th January. The weaker US dollar reflects some initial relief amongst market participants that Trump has so far held off from taking immediate action to hike tariffs. However, the threat of higher tariffs continues to remain firmly in place. He has already threatened to impose higher tariffs on Canada, Mexico and China from 1st February, and ordered reviews into their trade practices which are scheduled to be completed by 1st April that could provide the justification to implement higher tariffs. Furthermore, he has threatened to hike tariffs against the EU as well stating that “we have a USD350 billion trade deficit with the EU. They treat us very, very badly, so they’re going to be in for tariffs”. Overall recent developments indicate that initial US dollar weakness at the start of Trump’s second term could prove to be short-lived. Price action this week again highlights that long US dollar positioning was a very crowded trade in anticipation of further strength at the start of Trump’s second term. In his latest post on Truth Social President Trump has threatened to put high levels taxes, tariffs and sanctions on anything being sold by Russia to the United Sates, and various other participating countries as he seeks to place more pressure on President Putin to “settle now and stop this ridiculous war”.

The US dollar has weakened this week against all other G10 currencies apart from against the yen. USD/JPY tested support at the 155.00-level at the start of this week but failed to break below, and has since hit a high of 156.75 overnight. The price action highlights that market participants had already moved to price in another rate hike from the BoJ at tomorrow’s policy meeting. The Japanese rate market is now almost fully priced a 25bps rate hike tomorrow after there was no disruptive market reaction to the start of Trump’s second term. It should give the BoJ the confidence to hike rates for the third time in the current tightening cycle in response to encouraging evidence that stronger wage growth in Japan is likely to be sustained in the upcoming fiscal year. For the yen to strengthen further after tomorrow’s policy meeting, the BoJ would have to deliver more hawkish policy guidance signalling another rate hike could be delivered before later this year. More likely we think the BoJ will stick to current cautious guidance favouring a gradual pace of hikes.

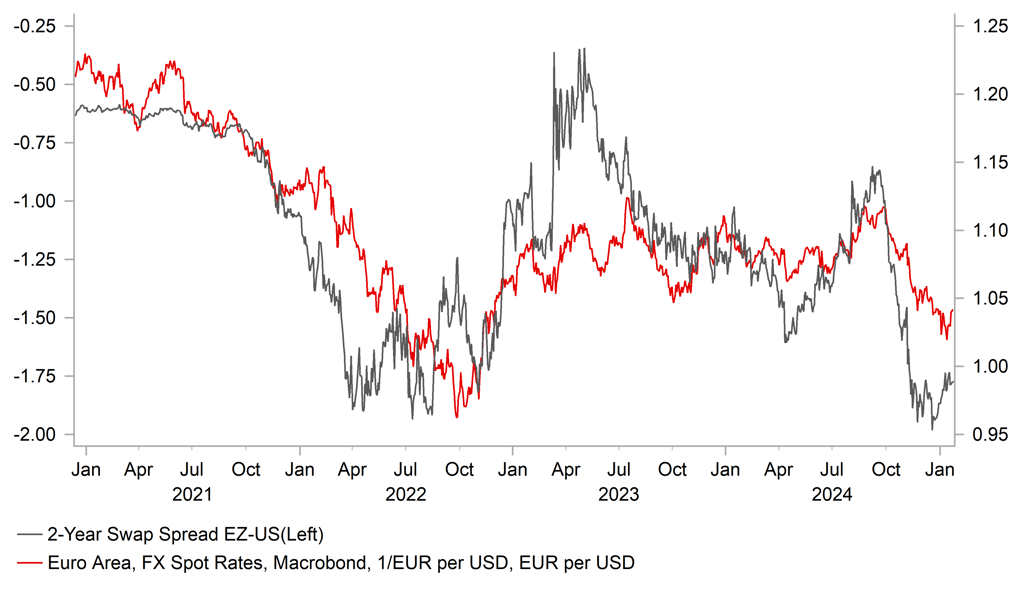

SHORT-TERM YIELDS SPREADS ENCOURAGING LOWER EUR/USD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB signals further rate cuts on the way

The euro has strengthened in recent weeks against both the US dollar and the pound. It has resulted in EUR/USD climbing back up the 1.0400-level and EUR/GBP up to 0.8450. It has been driven more by the reversal of US dollar and pound gains rather by positive euro fundamental drivers. Market participants are less concerned over the immediate risk of higher tariffs being put in place by the US against the EU, while the unease over rising Gilt yields temporarily undermined the attractiveness of the yield pick-up in the UK that encouraged EUR/GBP to trend lower throughout last year.

Comments from ECB officials in recent days have indicated that on the whole they continue to favour further rate cuts at the start of this year. A view shared by the euro-zone rate market that is currently pricing in between 75-100bps of further rate cuts by the middle of this year. It stands in contrast to market expectations for more cautious rate cuts for the Fed. The US rate market is only fully pricing in one further 25bps rate cut from the Fed by the summer. With US employment growth picking up in recent months and the Fed wanting more time to see how Trump’s policy plans are likely to impact the outlook for the US economy, the Fed has already adopted a more cautious approach to delivering further rate cuts. Widening policy divergence between the ECB and Fed should keep downward pressure on EUR/USD at the start of this year, and is another reason why we believe further upside for the pair should prove limited.

ECB President Lagarde stated yesterday that she was “confident that inflation will be at target in 2025” and that the “disinflationary process is continuing. When it came to assessing the risk to growth and inflation she added that judges that risks are to the downside for growth this year in the euro-zone, and she is not overly concerned over any inflation exported from the US. The outlook continues to favour further gradual rate cuts in her view. A view that was backed up by Bank of France Governor Villeroy de Galhau who stated yesterday that it is plausible for rates to be around 2% in the summer. Governing Council member Knot added as well that current market expectations for 25bps cuts in January and March are reasonable. He is comfortable with the policy rate moving to more neutral levels but is not yet convinced that “we need to go into stimulative mode”. The comments fit with our own forecasts for the ECB’s policy rate (click here) which show it falling to 2.00% by the summer and then saying at the level during the 2H of this year.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Jan |

-35 |

-40 |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

221K |

217K |

!!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Nov |

0.2% |

0.6% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Jan |

-14.0 |

-14.5 |

! |

|

US |

16:00 |

U.S. President Trump Speaks |

-- |

-- |

-- |

!!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,834B |

!! |

|

JP |

23:30 |

National CPI (YoY) |

Dec |

-- |

2.9% |

! |

Source: Bloomberg