JPY strengthens as focus turns to next week’s BoJ policy meeting

JPY: Growing calls from Japanese politicians for BoJ to tighten policy

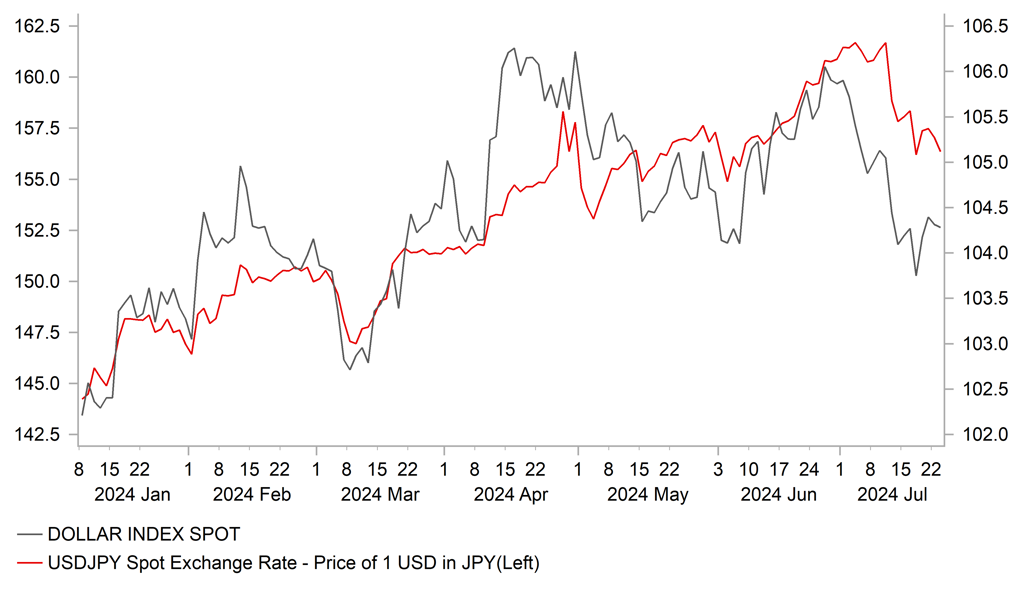

The yen has strengthened during the Asian trading session resulting in USD/JPY falling to an intra-day low of 156.20 down from the high of 157.10. The yen derived support from further comments from Japanese politicians overnight that are placing more pressure on the BoJ to tighten monetary policy at next week’s meeting on 31st July. LDP Secretary General Toshimitsu Motegi stated overnight that “the BoJ needs to clearly communicate that it will firmly proceed with the normalization of monetary policy”. It closely follows calls last week from Digital Transformation Minister Kono Taro who called on the BoJ to raise interest rates to provide more support for the yen to help bring down energy and food costs. While LDP Secretary General Toshimitsu Motegi did not explicitly call on the BoJ to raise rates at next week’s policy meeting, his comments do indicate growing unease amongst Japanese politicians over the slow pace of policy normalization.

A Bloomberg released yesterday did indicate though that the BoJ could disappoint expectations again by leaving rates on hold next week. According to the report, people familiar with the matter told Bloomberg that recent weakness in consumer spending is complicating their decision over whether to raise rates next week. Some officials reportedly take the view that skipping a rate hike in July is an option to provide more time to examine incoming data to confirm if consumer spending will pick up as expected. Some of them also hold the position that the BoJ should avoid giving the impression of begin overly hawkish.

On the other hand, some officials are reportedly open to raising rates next week given that inflation remains broadly in line with forecasts. They assess that the BoJ’s current policy rate is very low and see a risk of missing the opportunity to hike rates again given a lot of uncertainties going forward. According to the report, officials are likely to wait until the last minute to finalize their decision. We share the views of those in the second school of thoughts and are sticking to our forecast for a 15bps hike next week. We expect yen weakness and the timing of the upcoming LDP leadership election should favour delivering an earlier hike next week rather than waiting until later this year. According to local media reports, there are proposals to start the campaign period for the LDP leadership elections on 6th or 13th September and to set the voting day for 20th or 27th September. The timing of which could have an impact the BoJ’s policy decision on 20th September. If the BoJ does not raise rates next week as we expect, the yen is likely to quickly back to recent lows putting pressure back on Japan to intervene again. Please see our latest FX Weekly report for more details (click here).

WEAKER USD IS HELPING TO BRING DOWN USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

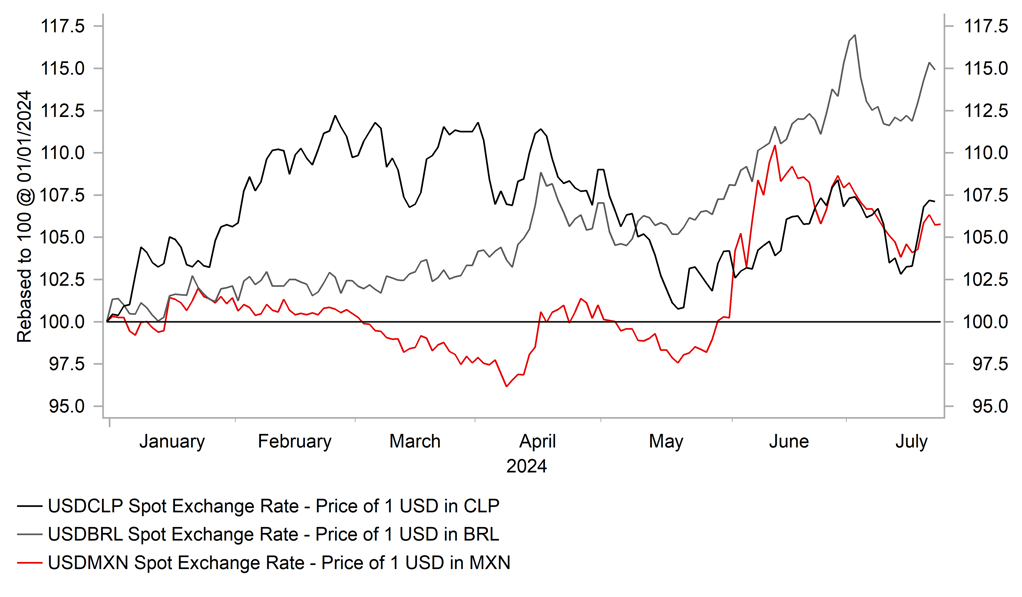

EM FX: External drivers remain challenging for EM FX performance

Emerging market currencies have weakened over the past week against the USD and moved back closer to the year to date lows. The Latam currencies of the CLP (-3.4% vs. USD), BRL (-2.4%), COP (-1.2%) and MXN (-1.1%) have been the worst performing currencies since last Monday. In contrast, the Central and Eastern European currencies of the RUB (+0.5% vs. USD), HUF (+0.4%), and CZK (+0.4%) have been the best performing currencies. It marks a reversal in fortunes for Latam currencies after they strengthened sharply in the first half of this month. The renewed sell-off for the BRL reflects in part renewed concern over the health of Brazil’s public finances. Finance Minister Fernando Haddad announced at the end of last week that they will freeze BRL15 billion in spending from this year’s budget to comply with the fiscal target to keep the primary budget deficit within the tolerance range of 0.25% of GDP. However, market participants remain disappointed that the spending freeze was not even bigger to bring the primary deficit into balance. The government announced yesterday that the primary budget deficit will now total 0.25% of GDP at the end of this year. President Lula also stated yesterday that he has not yet decided on who will become the next central bank governor.

The unwind of high yielding Latam FX carry trades over the past week has also been triggered by more risk-off trading conditions. MSCI’s ACWI global equity index declined for three consecutive days at the end of last week which was the most sustained sell-off since late May. Tech stocks were hit hard last week in response to heightened fears over the introduction of further US trade restrictions. Bloomberg reported that the Biden administration is mulling plans to impose more sanctions on Chinese tech firms and to heighten semiconductor trade restrictions between the US and China. The risk of trade tensions escalating further between the US and China have increased recently supported by increased likelihood of former President Trump winning the November election. The decision by President Biden to not seek re-election to expected to immediately change market expectations that Trump remains the clear favourite to win. As we have highlighted previously Latam and Asian currencies are more vulnerable downside risks if Trump becomes President again.

Asian and Latam currencies have been undermined as well over the past week by negative developments in China. The release of the latest GDP report revealed that the pace of growth slowed in Q2 to an annual rate of 4.7%. It has increased pressure on domestic policymakers to provide more stimulus to meet their target for growth this year of around 5.0%. In response the PBoC lowered the 7-day reverse repo rate today by 10bps to 1.70% for the first time since last August. The combination of lower rates, slowing growth and the threat of higher tariffs is a negative combination for CNY. Please see our latest EM EMEA Weekly for more details (click here).

LATAM FX HAS BEEN UNDERPERFORMING

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

CH |

11:00 |

FDI |

Jun |

-- |

-28.20% |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Jun |

-- |

0.2% |

!! |

|

US |

15:00 |

Existing Home Sales |

Jun |

3.99M |

4.11M |

!!! |

|

US |

15:00 |

Richmond Manufacturing Index |

Jul |

-7 |

-10 |

!! |

|

EC |

15:00 |

Consumer Confidence |

Jul |

-13.0 |

-14.0 |

!! |

Source: Bloomberg