GBP & USD supported by delayed BoE & Fed rate cuts

USD: FOMC minutes strike more hawkish tone

The US dollar has staged a modest rebound so far this week resulting in the dollar index rising back up towards the 105.00-level after failing to break below support from the 200-day moving average at around 104.40 at the end of last week. Similar price action has been evident in the US rate market where yields have bounced off last week’s lows. In the absence of the major US economic data releases this week, there have been no clear fundamental drivers for the pick up in US yields until the release last night of the latest FOMC minutes. The minutes revealed that the views expressed by FOMC participants when deliberating how to set monetary policy had become more hawkish. Most notably the minutes revealed that “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such action became appropriate”. Furthermore, “many participants noted that they were more uncertain about the degree of restrictiveness delivered by the current policy rate”. For these participants they saw uncertainty coming from the “possibility that high interest rates may be having smaller effects than in the past, and that the longer-run equilibrium interest rates may be higher than previously thought, or that the level of potential output may be lower than estimated”. The minutes suggests that FOMC participants were beginning to consider whether keeping rates at the current level would be sufficient to bring inflation back to target. It provides further pushback against market expectations for the Fed to begin lowering rates this year.

However, the US economic data flow has softened since the last FOMC meeting on 1st May providing some much needed for Fed officials. Payroll growth has slowed, retail sales were softer and the latest CPI report was in line with expectations. It has been the worst run of negative US economic data surprises recently since the summer of 2022. Overall, we still believe it remains unlikely that the Fed will hike rates further as stated recently by key Fed officials including Fed Chair Powell. Fed officials have signalled clearly this week that they would need to see several months of softer inflation data before they would be willing to begin cutting rates unless there is a sharp slowdown in employment growth. While it id does not completely rule out the possibility of a rate cut as soon as in July, it appears more likely that the Fed will wait at least until September to begin cutting rates. The delayed start to the Fed’s rate cut cycle remains a supportive development for the US dollar but at the current juncture it is not sufficient on its own to encourage an even stronger US dollar. The pick-up in growth outside of the US at the start of this year is helping to provide an offset to yield spreads moving in favour of the US dollar.

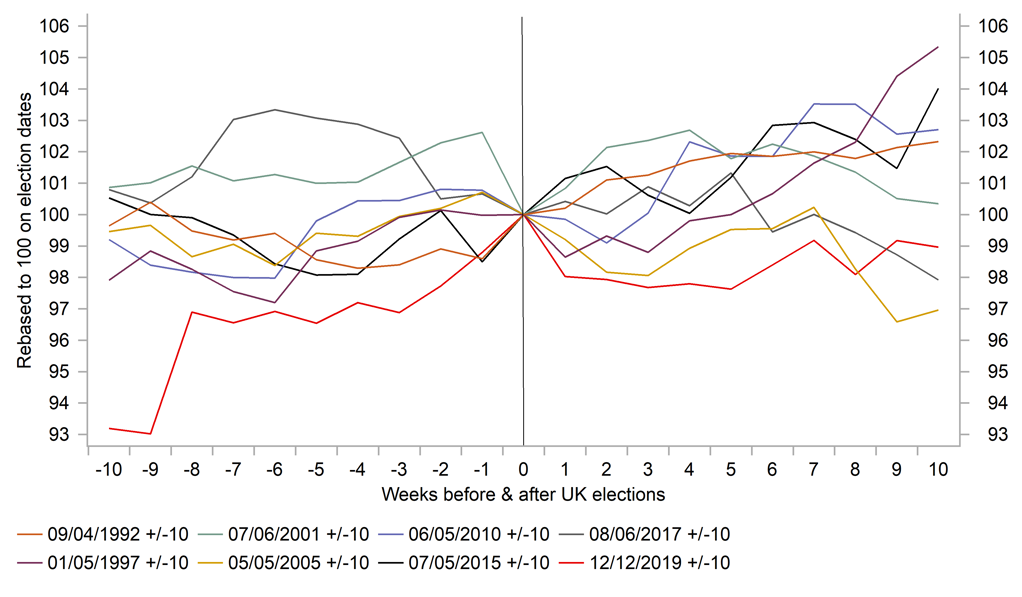

TWI GBP PERFORMANCE AROUND UK ELECTIONS

Source: Macrobond, Bloomberg & MUFG Research

GBP: Will UK election risk take shine off the pound’s outperformance?

The pound has continued to trade at stronger levels after the release yesterday of the latest UK CPI report for April provided a trigger for fresh upward momentum. It has lifted cable back above the 1.2700-level and EUR/GBP has fallen back to support at the 0.8500-level which has held for almost a year. It leaves the pound as the best performing G10 currency so far this year alongside the US dollar. After yesterday’s UK CPI report revealed that services inflation surprised significantly to the upside coming in at 5.9% in April compared to the BoE’s forecast of 5.5%, the UK rate market has moved to push back the timing of the BoE’s first expected rate cut until later this year. It moves the outlook for BoE policy more in line with the Fed rather than ECB. A bearish development for EUR/GBP from a yield spread perspective with the ECB set to begin cutting rates sooner next month unless there is an external shock. The ECB will be watching closely the release today of the negotiated wage data from the euro-zone for Q1 for evidence of a further moderation in wage growth at the start of this year. The UK rate market is now pricing in around 10bps of cuts by the August MPC meeting and 18bps by September, and for the year as whole only 34bps. After just one bad inflation report, we believe that the UK rate market has gone too far in pricing out BoE rate cut expectations for this year.

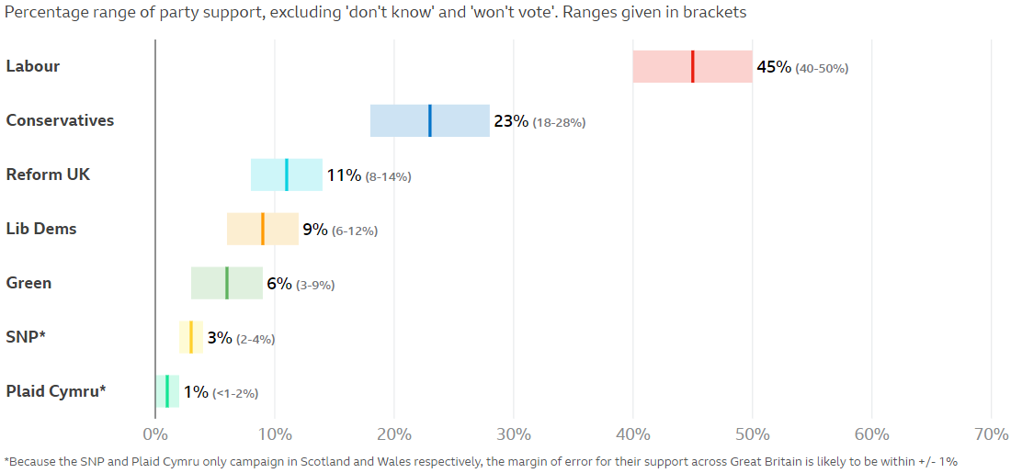

The other main development in the UK yesterday was the unexpected announcement from Prime Minister Sunak when he called a general election on 4th July. The earlier timing of the election is a surprise as the Conservatives have seen their support in public opinion polls deteriorate further in recent months and the threat of another leadership challenge for Prime Minister Sunak did not materialize after the disappointing local election results earlier this month. While the general election will raise political uncertainty in the UK in the coming months which could be viewed as modestly bearish for the pound, the election impact should be limited. The Conservative party have been trailing well behind in the opinion polls for a long time now and those polls were backed up by the recent local election results so that market participants should already be anticipating that the Labour party are likely to form the next government. The Conservative party will be mainly trying to limit their losses unless there is a significant surprise.

Last week Labour leader Starmer outlined six first steps he plans to tackle in government including: i) sticking to tough spending rules in order to deliver economic stability, ii) setting up Great Britain Energy (a publicly owned clean power energy company), iii) cutting NHS waiting lists by providing 40k more appointments each week funded by tackling tax avoidance and non-dom loopholes, iv) launching a border security command to stop gangs arranging small boat crossings, v) providing more neighbourhood officers to reduce antisocial behaviour and introduce new penalties for offenders, and vi) recruiting 6.5k teachers funded by ending tax breaks for private schools. For financial markets the commitment to stick to tough spending rules in order to economic stability should help to limit the pound reaction to a likely Labour win.

LABOUR PARTY HAVE A STRONG LEAD IN OPINION POLLS

Source: BBC poll tracker

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

May |

46.2 |

45.7 |

!! |

|

EC |

09:00 |

Services PMI |

May |

53.6 |

53.3 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

49.5 |

49.1 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

54.7 |

55.0 |

!!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

12:30 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

220K |

222K |

!!! |

|

US |

14:45 |

Manufacturing PMI |

May |

50.0 |

50.0 |

!!! |

|

US |

14:45 |

Services PMI |

May |

51.2 |

51.3 |

!!! |

|

US |

15:00 |

New Home Sales |

Apr |

677K |

693K |

!!! |

|

US |

20:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg