USD rebound fails to advance ahead of Thanksgiving holiday

USD: Oil price volatility & European political risk in focus

The US dollar has weakened overnight resulting in the dollar index dropping back to support from the 200-day moving average that comes in at just above 103.60 after it failed to extend its advance yesterday. The dollar index hit an intra-day high yesterday of 104.21 but it has since given back most of those gains that were recorded following the release of the stronger than expected US initial claims report. The report revealed that initial claims fell back more than expected in the week to 18th November by 24k to 209k. It was the lowest reading since the middle of last month which has helped to ease concerns over the health of the US labour market that have picked up recently following the release of the much weaker than expected nonfarm payrolls report for October. The initial claims data is consistent with other leading indicators which are not showing a jump in job layoffs. Nevertheless the recent payrolls report still revealed further evidence of softening labour demand which is moving more into balance with labour supply. A development Fed officials wanted to see in the coming months to give them more confidence that they have tightened policy sufficiently. It is one reason market participants remain confident that the Fed has finished hiking rates One other source of volatility in the foreign exchange market yesterday was the sharp moves in the price of oil. The price of Brent briefly dropped sharply back below USD80/barrel to an intra-day low of USD78.41/barrel but has since climbed back up to USD81/barrel. The main trigger for the sharp sell-off yesterday was the announcement that OPEC+ members have delayed their meeting scheduled for this weekend. According to reports, the meeting has been delayed by four days to 30th November until a dispute is resolved over output quotas for African members. Despite the last minute disputes, Saudi Arabia is still expected to extend a 1 million barrel production cut into 2024 while other members broadly commit to existing quotas through next year (click here). Pressure would increase on OPEC+ to deepen production cuts next year if the price of oil was to drop back towards the bottom of this year’s trading range between USD70/75/barrel. On balance, we view a lower oil price as a factor that helps to ease upward pressure for the US dollar apart from against oil-related currencies such as CAD and NOK with G10 FX.

In Europe, the main focus at the start of today’s trading session is the surprise victory for far-right lawmaker Geert Wilders in the Dutch elections. Wilder’s anti-EU party (PVV) won 37 seats according to the preliminary count which is more than double than number of seats in the previous parliament, and 12 more seats than the next largest party. The next three largest parties are the Left Alliance who are set to win 25 seats, the VVD on 24 seats, and the NSC 20 seats. Geert Wilders will now have to persuade other parties to from a coalition government which will require a total of 76 seats in the 150 seat parliament. Before the election, the three other big parties ruled out taking part in a Wilders-led government but market participants will be watching closely now to see if that changes because of the scale of his victory. So far there has been limited reaction from the euro to political developments in the Netherlands. If Wilders was able to form a coalition government it would mark a significant shift to the right. He wants to toughen immigration rules and hold a referendum to leave the EU.

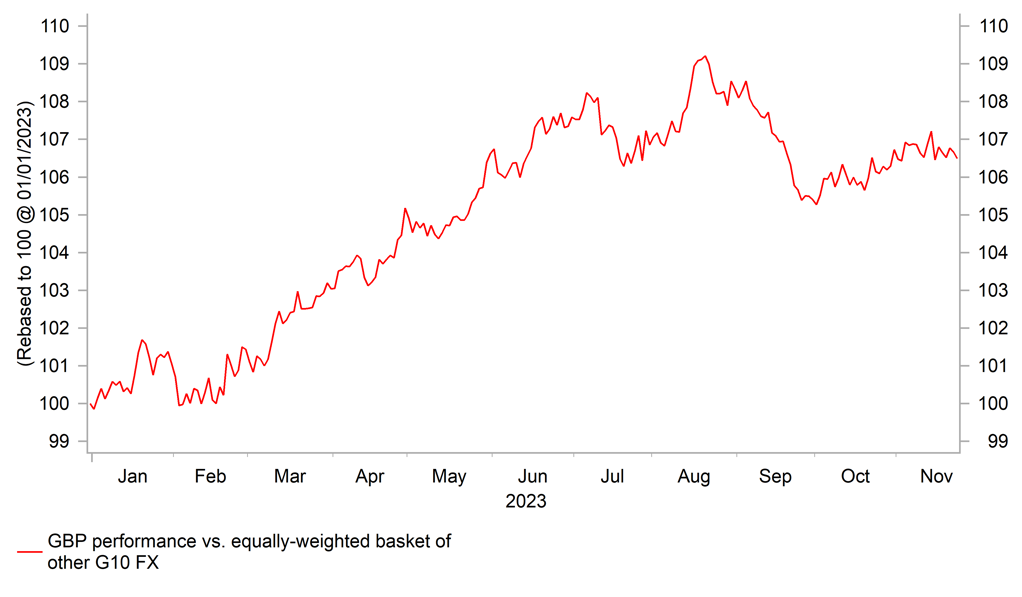

GBP HAS BEEN CONSOLIDATING THIS MONTH

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK government fiscal give-aways not sufficient to alter pound outlook

The main focus yesterday for UK financial markets was the release of the government’s autumn fiscal statement. It had more impact on the UK rate market than the pound. While there was limited impact on the pound, the fiscal give-aways have encouraged the UK rate market to scale back BoE rate cuts expectations for next year adding to the pushback from BoE officials this week against premature rate cut expectations. The UK rate market expects the BoE to wait a little longer than the ECB and Fed before cutting rates at the August MPC meeting next year, and has scaled back total cuts priced in by the end of next year to around 60bps. It compares to larger rate cuts priced in for the Fed and ECB by the end of next year of around 88bps and 85bps respectively. The higher risk of persistent inflation in the UK is making market participants relatively more cautious over pricing in a policy reversal from the BoE.

The government’s decision to utilize fiscal space generated by higher inflation and current spending cuts to announce tax cuts ahead of next year’s election supports market expectations over more persistent inflation risks in the UK. The two main fiscal give-aways were the 2ppt cut in the basic rate of National Insurance that totals GBP10 billion/year and making permanent full capital expensing for businesses that is expected to add up to GBP10 billion/year from 2026/27 onwards as it was already accounted for until then. A favourable development that should help to encourage stronger business investment in the UK. Despite the fiscal stimulus measures announced yesterday, the OBR’s updated forecasts revealed that growth is expected to remain weak this fiscal year and next at 0.6% and 0.9% respectively. It highlights that the new policy announcements are unlikely to significantly alter the outlook for the UK economy in the year ahead although further fiscal easing appears likely in next year’s budget as well. As a result we are sticking to our forecasts for a weaker pound.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Nov |

43.4 |

43.1 |

!! |

|

EC |

09:00 |

Services PMI |

Nov |

48.1 |

47.8 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

-- |

45.0 |

44.8 |

!!! |

|

UK |

09:30 |

Services PMI |

-- |

49.5 |

49.5 |

!!! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

EC |

19:30 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

7,815B |

!! |

|

NZ |

21:45 |

Retail Sales (QoQ) |

Q3 |

-0.8% |

-1.0% |

!! |

|

JP |

23:30 |

National CPI (YoY) |

Oct |

-- |

3.0% |

! |

Source: Bloomberg