USD/JPY reverses sharp drop from early in summer

USD/JPY: Red Sweep is most bullish outcome for USD/JPY

The US dollar has continued to strengthen during the Asian trading session with gains most evident against the yen which has been the worst performing G10 currency. It has resulted in USD/JPY hitting an intra-day high overnight of 152.38 after breaking back above resistance from its 200-day moving average at around 151.40. The pair has now almost fully reversed the plunge lower in August when yen-funded carry trades were unwound. The yen has been hurt this week by the renewed upward momentum for yields outside of Japan. The 10-year US Treasury yield has continued move higher overnight rising to an intra-day high of 4.24% and currently stands around 24bps higher than last week’s low. The sell-off in the US bond market has spilled over into other major bond markets as well. The yields on the 10-year Bund and Gilts have both risen by around 15bps and 13bps respectively from the recent lows. The upward pressure on global bond yields is mainly driven by the rising probability of Donald Trump winning the US election who has pledged to put in place more inflationary policies such as higher trade tariffs, looser fiscal policy and tighter immigration. The worst outcome for the US bond market and most bullish outcome for the US dollar at least initially would be a win for Donald Trump accompanied by a “Red Sweep” where the Republicans take control of Congress so he can fully implement the fiscal policy proposals. According to PolyMarket, the probability of a Red Sweep has risen closer to 50% compared to just below 30% in early October. Alongside the recent rebound for the price of oil from a low of USD69/barrel for Brent in early September, the rising probability of a Red Sweep is helping to lift market-based measures of inflation expectations. The 10-year US inflation breakeven rate has risen by around 30bps from the early September low. USD/JPY is poised to move back to the mid-to-high 150.00’s if a Red Sweep is realised after the US election.

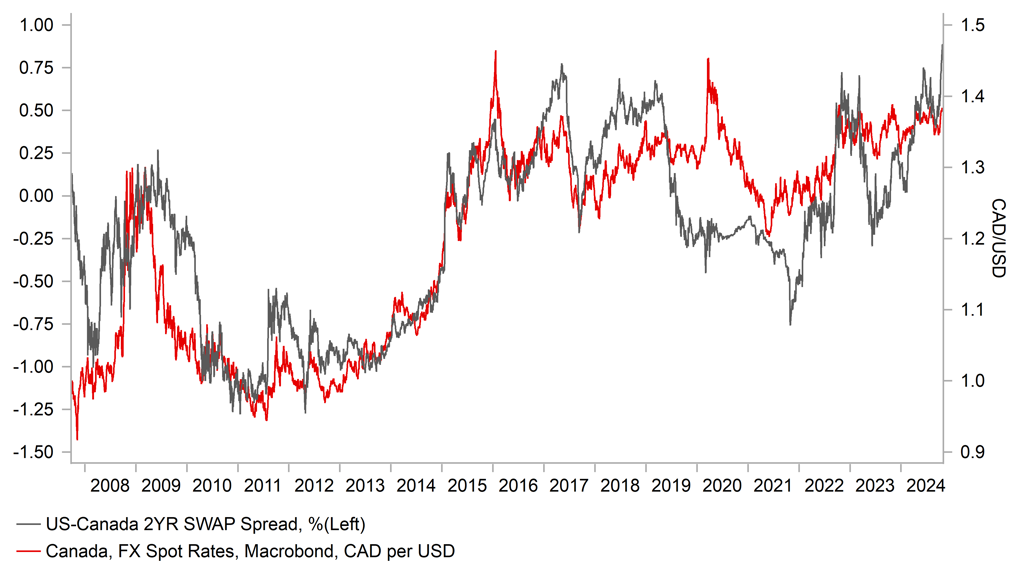

YIELD SPREADS ARE LIFTING USD/CAD

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC set to speed up pace of rate cuts just as Fed slows down

The Canadian dollar has continued to weaken against the US dollar ahead of today’s BoC policy meeting. It has resulted in USD/CAD trading back above the 1.3800-level for the first time since late July/early August during the period of heightened financial market volatility early in the summer. The pair is now trading back closer to highs recorded in recent years recorded between 1.38000 and 1.4000. Despite recent weakness against the US dollar, the Canadian dollar has been second best performing G10 currency this month as the US dollar has rebounded. It highlights that the performance of the Canadian and US dollar remain closely linked.

The Canadian dollar has derived some support from the recent rebound for the price of oil driven by the heightened geopolitical tensions in the Middle East. It has helped to provide an offset to the negative impact from yield spreads moving against the Canadian dollar. Short-term yield spreads between the US and Canada have widened sharply in favour of a stronger US dollar since early in September and hit fresh highs At current levels the spread is signalling that USD/CAD could attempt to climb above the 1.4000-level. The sharp widening in short-term yield spreads between the US and Canada has been driven by expectations for policy divergence in the near-term between the Fed and BoC. While the Fed is expected the slowdown the pace of rate cuts at remaining policy meetings this year, the BoC is expected to speed up the pace of rate cuts starting at today’s policy meeting.

The Canadian rate market has moved to fully price in a larger 50bps rate cut from the BoC at today’s policy meeting. According to the latest Bloomberg survey, Canadian economists are less convinced with 14 out of 23 economists forecasting a 50bps rate cut today. In light of recent guidance from the BoC, softer inflation and looser labour market conditions, we expect the BoC to deliver a larger 50bp cut. For the Canadian dollar to weaken significantly after today’s meeting the BoC would also have to indicate that they remain open to another larger cut as soon as the next meeting in December. The main catalyst for a break above the 1.4000-level for USD/CAD before year end would be a Trump and Red Sweep US election outcome.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

14:00 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

CA |

14:45 |

BoC Interest Rate Decision |

-- |

3.75% |

4.25% |

!!! |

|

US |

15:00 |

Existing Home Sales |

Sep |

3.88M |

3.86M |

!!! |

|

EC |

15:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

CA |

15:30 |

BOC Press Conference |

-- |

-- |

-- |

!! |

|

US |

19:00 |

Beige Book |

-- |

-- |

-- |

!! |

|

UK |

21:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

Source: Bloomberg