Yen continues to trade at weaker levels after BoJ policy update

CNY: Speculation intensifies over further policy easing in China

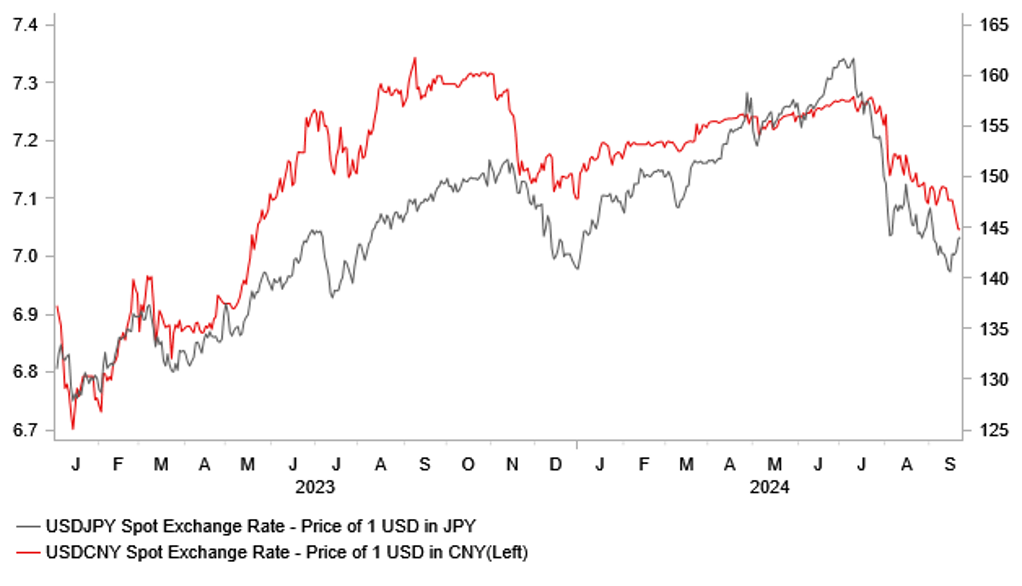

The major foreign exchange rates have remained relatively stable at the start of this week. The yen is still trading on a softer footing after the BoJ’s policy meeting at the end of last week in response to the less hawkish policy signal delivered by Governor Ueda who talked down the possibility of raising rates again as soon as at the next policy meeting in October. He placed more emphasis on recent financial market instability and the disinflationary impact from the stronger yen which both favour the BoJ taking more time to tighten policy further in the near-term. At the same time, Governor Ueda also added that it would be important for the Fed to achieve a soft landing for the US economy to continue their rate hike cycle. The BoJ’s caution over further near-term rate hikes has helped to lift USD/JPY from around the 142.00-level up closer to 144.50. At the current juncture, we are still sticking to our forecast for the BoJ to deliver the next hike in December, and view the recent yen sell-off as temporary.

In contrast to the BoJ, the PBoC has lowered the 14-day reverse repo rate by 10bps to 1.85% over the weekend. It follows the 10bps cut to the 7-day reverse repo rate (China’s key policy rate) on 22nd July. According to Bloomberg, the 14-day reverse repo operations tend to be used sparsely and only to stabilize interbank liquidity during long holidays like Lunar New Year ad National Day. The PBoC conducted a CNY74.5 billion reverse repo operation today at the new lower rate of 1.85%. It was the eighth 14-day reverse repo operation this year with the first seven all held before the Lunar New Year holiday in February. The rate adjustment is viewed more as catch up by market participants and not necessarily that the PBoC is embarking on a fresh round of easing although further easing is expected before the end of this year in light of slowing growth momentum and the rising risk of deflation in China. Growth forecasts for China have been downgraded after the release of soft activity data over the summer which makes it harder for the government to meet their growth target for this year of around 5%.

The Fed’s decision to deliver a larger 50bps rate cut to start their own easing cycle has created more room for the PBoC to keep lowering rates without intensifying downward pressure on the renminbi. The renminbi has weakened only modestly overnight following the PBoC’s decision to cut the 14-day reverse repo rate. USD/CNY continues to trade close to recent lows at just above the 7.0500-level and remains well below the high from late July at around 7.2775. Market speculation over the possibility of fresh policy stimulus from domestic policymakers to support growth has been encouraged by the announcement that PBoC Governor Pan Gongsheng will hold a press conference tomorrow on financial support for economic development alongside two other officials. The PBoC Governor used a similar briefing in January to announce a cut to the required reserve ratio (RRR) two weeks ahead of the time.

FASTER FED RATE CUTS HAVE WEIGHED ON USD/JPY & USD/CNY

Source: Bloomberg, Macrobond & MUFG GMR

European FX: Mixed market impact from regional central bank policy paths

The European currencies of the GBP and EUR continue to outperform amongst G10 currencies this year. The GBP has been the top performer and is set up to extend its advance after the BoE’s latest policy update (click here). It has already resulted in cable breaking above the 1.3300-level and EUR/GBP falling below the July low at 0.8383. The BoE’s decision to leave rates on hold and lack of strong dovish signal that they are considering speeding up rate cuts anytime soon stands in marked contrast to the Fed’s decision to deliver a larger 50bps cut to kick off their own easing cycle while the ECB delivered a second smaller 25bps cut. The slower pace of BoE rate cuts has reinforced the GBP’s appeal as a high yielding G10 carry currency at a time when global investor risk sentiment is improving as well. The Fed’s larger 50bps rate cut has boosted investor optimism in a softer landing for the global economy that has helped to lift the MSCI’s ACWI global equity index to a new record high.

The other European currencies of the NOK and SEK have also benefitted from the recent improvement in global investor risk sentiment. It has resulted in EUR/SEK moving back towards the bottom of the year to date range between 11.100 and 11.800, and EUR/NOK has fallen to support from the 200-day moving average at around 11.600. In recent months the NOK has underperformed relative to the SEK driven in part by the lower price of oil with Brent moving closer to USD70/barrel. The IEA cut their oil demand forecast for his year reflecting softer demand from China which is now seen rising 180k bpd in 2024 compared to 410k in July. It has meant that the price of oil has fallen this month even as geopolitical tensions in the Middle East have escalated. Unlike the GBP, the NOK has failed to benefit as much from the Norges Bank’s decision to keep rates higher in Norway. At their latest policy meeting, the Norges continued to signal that they are planning to wait until early next year to begin cutting rates.

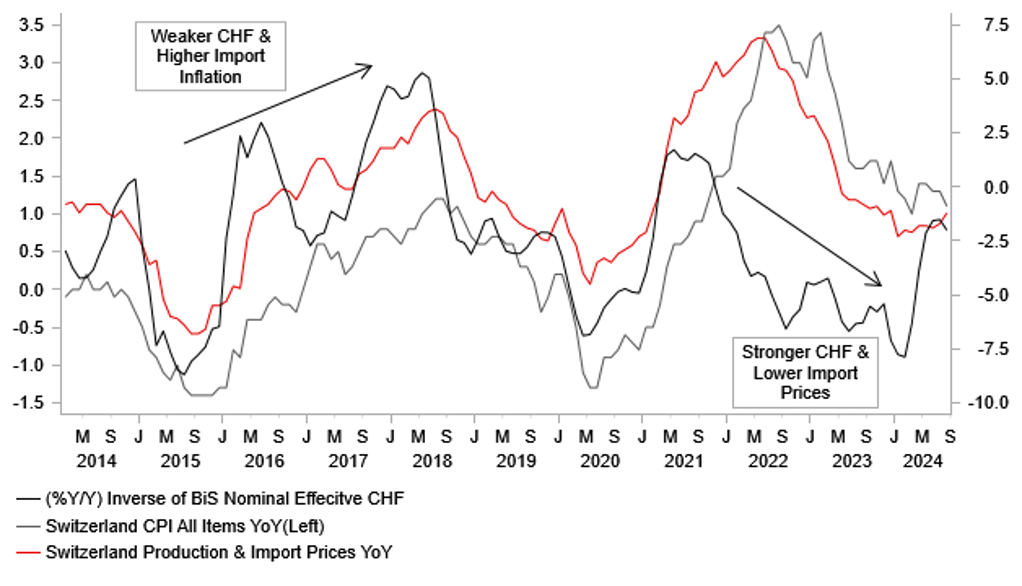

The next European central banks to provide policy updates in the week ahead will be the Riksbank (Wed) and SNB (Thurs). Both central banks are expected to continue lowering interest rates after starting to cut rates ahead of other G10 central banks back in March and May respectively. The SNB’s and Riksbank’s rate cutting cycles have not prevented the CHF and SEK from strengthening. The CHF strengthened sharply into early August resulting EUR/CHF hitting a low of 0.9211 on 5th August amidst market turbulence over the summer. It has since given back some of those gains as global investor risk sentiment has improved. The stronger CHF and another downside inflation surprise in Switzerland (headline & core both at 1.1%Y/Y in August) will keep pressure on the SNB to follow the ECB and cut rates again in the week ahead. The SNB would have to deliver a larger 50bps cut if they want to at least temporarily weaken the CHF. Please see our latest FX Weekly report for more details (click here).

STRONG CHF REMAINS A CHALLENGE FOR SNB

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

Manufacturing PMI |

Sep |

45.7 |

45.8 |

!! |

|

EC |

09:00 |

Services PMI |

Sep |

52.3 |

52.9 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Sep |

52.3 |

52.5 |

!!! |

|

UK |

09:30 |

Services PMI |

Sep |

53.5 |

53.7 |

!!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Sep |

-23 |

-22 |

!! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

US |

13:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Chicago Fed National Activity |

Aug |

-- |

-0.34 |

! |

|

US |

14:45 |

Manufacturing PMI |

Sep |

48.6 |

47.9 |

!!! |

|

US |

14:45 |

Services PMI |

Sep |

55.3 |

55.7 |

!!! |

|

US |

15:15 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

! |

|

US |

18:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg