Divided MPC prompts GBP rebound

GBP: Not so fast

We opened this week with a piece covering the dovish shift from the BoE following comments from BoE Governor Bailey and Deputy Governor Ramsden in Washington that certainly to us looked like a clear shift to a more dovish stance that increased the prospect of rate cuts commencing sooner than priced into the market – by June. While we would argue that prospect remains plausible it is also clear that the MPC remains divided and that reaching the required majority to cut rates will be difficult over the coming months. In that sense, a June rate cut is a close call and lots will have to go favourably from an inflation perspective to get a cut by then.

The comments yesterday from MPC member Jonathan Haskel were not surprising. As a known hawk he expressed considerable concerns over inflation remaining too high mainly due to the “extremely tight” jobs market. We also had comments from BoE Chief Economist Huw Pill and were more revealing given his position and more centrist position based on past comments. Pill repeated the comment that a rate cut was “some way off” and was keen to play down the implications of headline CPI falling to target over the coming months. He added that the MPC was not focused on jobs data (that shows falling employment) due to reliability issues and are more focused on wage and services inflation which remain high.

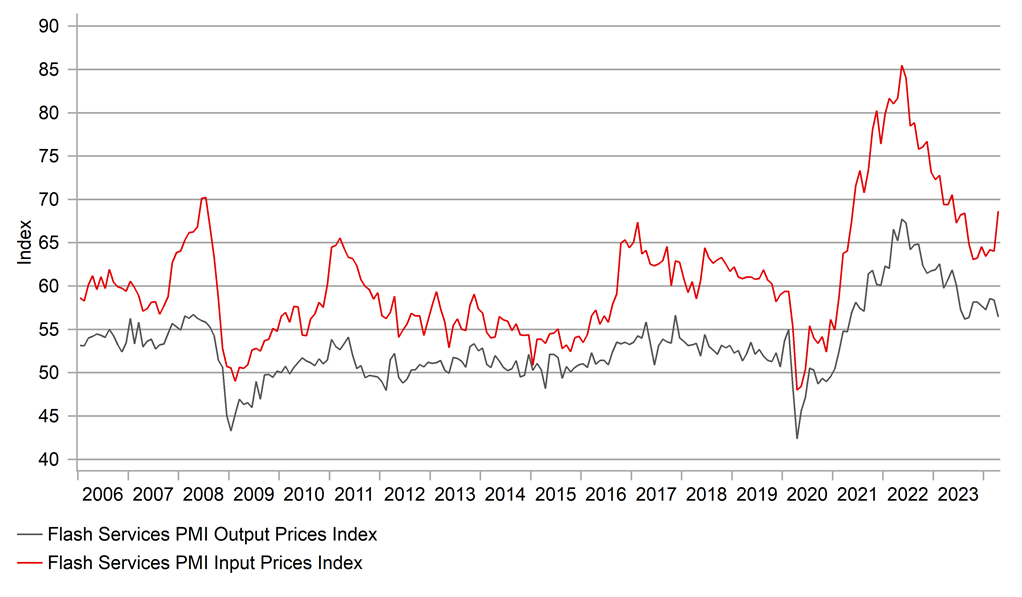

The comments certainly highlight continued concerns over inflation and the advance PMI data yesterday from the UK did highlight potential inflation risks further ahead. After a sustained decline in service input prices reported in the PMI data, the April advance Input Price Index jumped to 68.7, the highest level since May last year. If sustained that would point to output price increases. It’s just one data-point but will only add reason for the hawks arguing caution in cutting rates. The combined manufacturing and services employment PMI index yesterday increased from 49.95 to 51.12 which certainly contrasts with the ONS employment data, backing up the BoE’s scepticism of the official employment statistics.

The PMI data in the UK and the euro-zone were certainly a contrast to the weaker than expected data in the US and after a sustained period of largely better data from the US, the data favouring Europe has helped GBP/USD rebound sharply. The 0.8% jump in GBP/USD yesterday was in fact the biggest one-day gain since 14th December. With a BoE rate cut in June still a possibility we would be surprised to see much follow through from this GBP buying although the pick-up in growth in Europe is likely a factor that will curtail US dollar buying at stronger levels. Even moderately better growth in Europe will likely limit dollar appreciation going forward.

FLASH UK PMI HIGHLIGHTS A PICK-UP IN SERVICES INPUT PRICES

Source: Macrobond & Bloomberg

USD: Trump complains about strong dollar with Tokyo intervention looming

The widespread consensus in the financial markets is that a Trump election victory in November would be a positive for the US dollar. Indeed, options pricing indicates a skew in that direction underlining the expectations that further fiscal stimulus and the prospect of a further increase in tariffs would be key policies of an incoming Trump administration that would lead to US dollar strength.

However, doubts could grow about that if Trump was to pursue a more explicit weak currency policy and in that regard it’s notable that Trump yesterday criticised the current level of the dollar calling it “a disaster for our manufacturers and others” as companies would be “forced to either lose lots of business, or build plants or whatever” in other “smart countries”. Of course there is an element (very large?) of playing politics here and Trump’s objective is to criticise Biden’s policies and to blame Biden for the level of the dollar and if Trump were President perhaps he would be using it as an example of US strength.

But there are other reports that suggest Trump’s political advisers are looking at alternatives to simply increasing tariffs further on other countries. Politico quotes some of Trump’s economic advisers as seriously studying ways to encourage other key countries to strengthen their own currencies or to face tariffs instead.

The ‘elephant in the room’ so to speak in focusing on FX policies is of course the Fed and if complaints about the dollar’s strength are to grow it will inevitably lead to increased criticism by Trump of Fed Chair Powell and makes it even more likely that Trump would replace Powell with someone more aligned to policies that would lead to dollar depreciation. Increased politicisation of the US dollar with the dollar at these more elevated levels will certainly act to reduce speculative dollar buying at stronger and stronger levels.

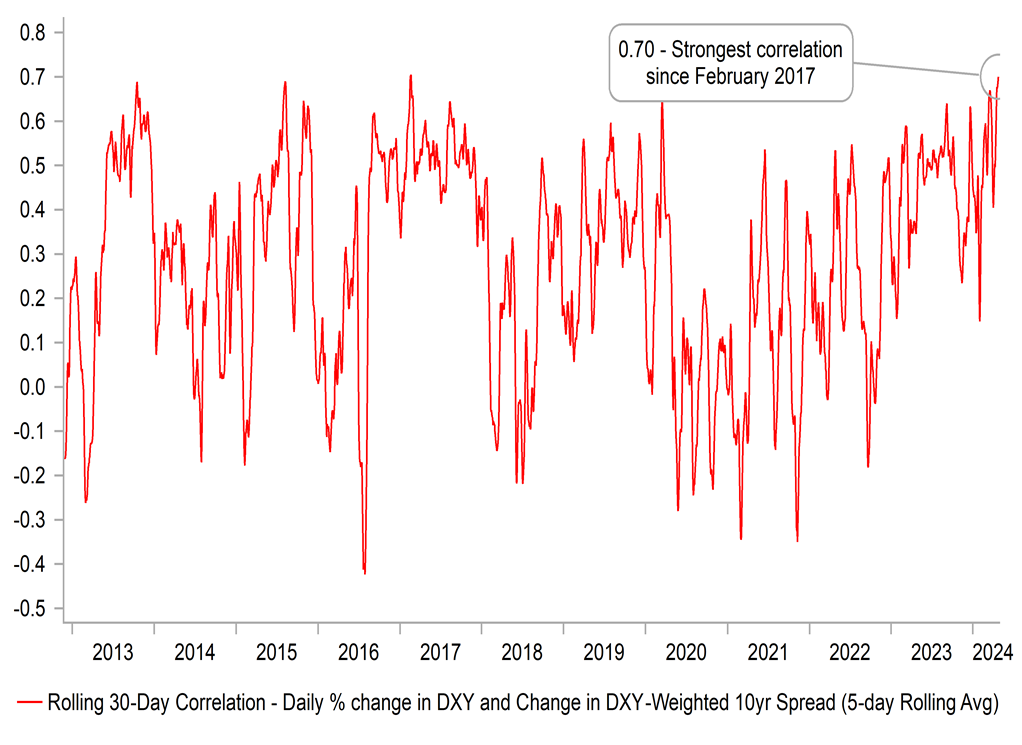

This is especially so given the imminent threat of intervention in Japan. While speculative short yen positions look to be large, the spot moves indicate increased caution on selling yen at these levels. The BoJ meeting on Friday adds to the uncertainty over near-term direction and the possible timing of intervention. In September 2022, the Japanese authorities intervened on the day of a BoJ meeting when a dovish outcome fuelled yen selling while in October 2022 the authorities intervened a week ahead of a key BoJ meeting. Action still looks imminent to us and after the joint statement by the US, Japan and S Korea including the US “acknowledging the concerns” over “sharp depreciation” of the yen and won the Japan authorities are now nearly compelled to act on a further break higher in USD/JPY.

USD / 10YR YIELD CORRELATION HIGHLIGHTS CURRENT DRIVER OF USD STRENGTH

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Consumer Confidence |

Apr |

96.9 |

96.5 |

! |

|

SZ |

09:00 |

ZEW Expectations |

Apr |

-- |

11.5 |

! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Apr |

88.9 |

87.8 |

!!! |

|

GE |

09:00 |

German Business Expectations |

Apr |

88.9 |

87.5 |

!! |

|

GE |

09:00 |

German Current Assessment |

Apr |

88.7 |

88.1 |

!! |

|

GE |

10:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Apr |

-- |

-18 |

!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Apr |

-16 |

-18 |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

3.3% |

! |

|

US |

13:30 |

Core Durable Goods Orders (MoM) |

Mar |

0.3% |

0.3% |

!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Mar |

2.5% |

1.3% |

!! |

|

US |

13:30 |

Goods Orders Non Defense Ex Air (MoM) |

Mar |

0.2% |

0.7% |

! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Feb |

0.0% |

0.5% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Feb |

0.1% |

-0.3% |

!! |

|

EC |

14:15 |

ECB McCaul Speaks |

-- |

-- |

-- |

!! |

|

EC |

15:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

4.235% |

!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

Source: Bloomberg