USD stages tentative rebound but built on shaky foundations

USD: Optimism over US tariff reversal helps the US dollar to rebound

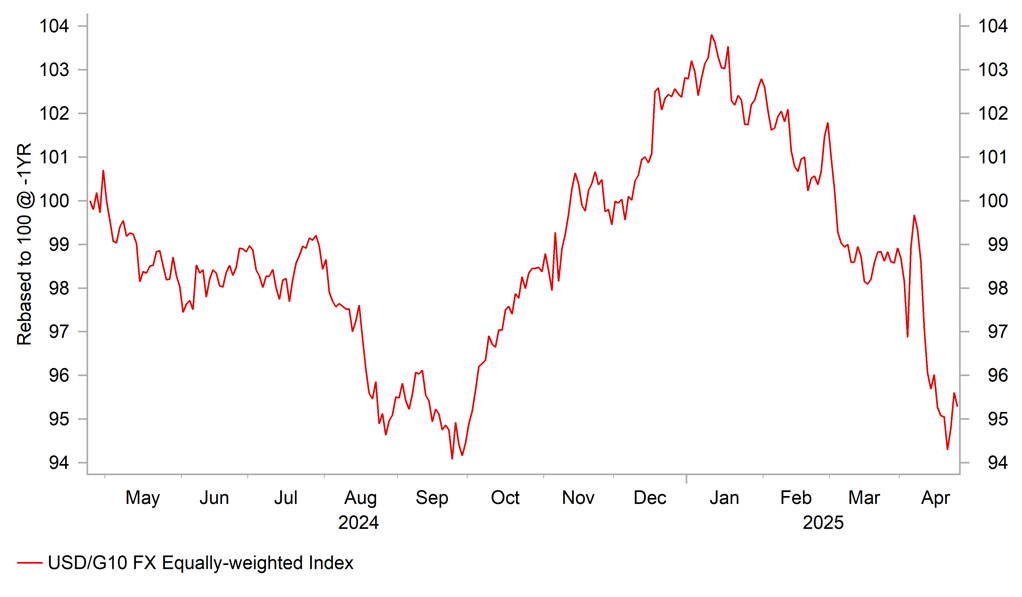

The US dollar has continued to trade at modestly stronger levels after staging a rebound over the last couple of trading days. It has resulted in the dollar index moving back up towards the 100.00-level as it moves further above the year to date low of 97.921 recorded on Monday. The US dollar rebound has been encouraged by recent developments suggesting that the Trump administration is in the process of reversing some of the more disruptive parts of their trade policies. At the same time comments from President Trump have helped to dampen fears over threats to the Fed’s independence when setting monetary policy after he stated that he does not plan to fire Fed Chair Powell. The developments have helped to restore some much needed confidence in US policymaking. On the trade front, there is building optimism that the US will act quickly to reverse tariff hikes on China that recently have reached an “unsustainable” rate of 145%. According to a WSJ report yesterday, the China tariffs were likely to come down to between roughly 50% and 65%. The administration is also considering a tiered approach similar to the one proposed by the House committee on China last year which suggested setting lower 35% levies for items the US deems not to be a threat to national security, and higher tariffs of at least 100% for items deemed as strategic to America’s interest. It follows comments from President Trump that tariffs “will come down substantially but it won’t be zero”. However, Treasury Secretary Bessent denied that that Trump administration had offered to unilaterally cut import tariffs on goods from China. He expressed optimism though that “there is an opportunity for a big deal here”. He stated that if China wants to rebalance by boosting consumption, then “let’s do it together” but he wants to see results and timelines. He noted that recent data shows China’s economy is tilting even further away from consumption towards manufacturing. A White House official later clarified as well that “President Trump has been clear: China needs to make a deal with the United states of America”. Overall, recent comments from the Trump administration have indicated that tariffs on China are likely to be reversed but they are still likely to remain at highly disruptive levels for trade between the two countries.

The Trump administration is also moving to put in place carve outs to help dampen disruption from trade tariffs for the US economy. Recently imports of smartphones and other electronic products were excluded from tariffs. Bloomberg has reported as well overnight that US officials are now considering whether to reduce certain tariffs targeting the auto industry. The report suggests that the US could spare automobiles and parts already subject to tariffs from facing additional duties from levies on steel and aluminium. Another option being studied would be to fully exempt auto parts that comply with the USMCA trade pact. Those components don’t currently face tariffs but the Trump administration had planned to tax the non-US share of those parts from Canada and Mexico. The Financial Times had also reported that the Trump administration might exempt auto parts from China from the 20% tariff applied over the fentanyl border dispute. While further steps to water down/reverse tariffs would be positive developments, we are not convinced that recent developments are sufficient yet to support a more sustained rebound for the US dollar at the current juncture.

USD FALLS BACK TO LOWS FROM LAST SEPTEMBER

Source: Bloomberg, Macrobond & MUFG GMR

USD: PMI surveys signal global slowdown underway

The negative impact of heightened policy uncertainty and fears over disruption from trade tariffs were evident in the latest PMI surveys released yesterday from the Europe and the US. The composite PMI readings for April dropped by 0.8 points to 50.1 in the euro-zone, by 3.3 points to 48.2 in the UK, and by 2.3 points to 51.2 in the US. The broad-based deterioration in business confidence will reinforce expectations for a slowdown in global growth in Q2. It fits with the IMF’s updated global economic projections that were released earlier this week. The IMF’s reference forecasts for global growth were revised lower by a cumulative 0.8 percentage points for this year and next to 2.8% and 3.0% respectively. Despite the forecasted slowdown, the IMF still noted that global growth remains well above recession levels. The biggest downgrades for growth were for the Mexico, Canada, the US and China. The IMF expects US growth to slow to 1.8% (-0.9ppts lower) in 2025 and 1.7% (-0.4ppts lower) in 2026. It will create a more challenging backdrop for the Fed when setting monetary policy. The US rate market is currently pricing in around 83bps of Fed rate cuts by the end of this year with the next 25bps rate cut expected in June or July. However, with inflation set to rise further above the Fed’s 2.0% target this year, it will likely require an even sharper slowdown for the US economy and loosening of labour market conditions for the Fed to meet those expectations. The weaker US dollar reflects in part the bigger expected negative impact on growth in the US compared to for other major economies. The IMF’s forecasts for growth in the euro-zone were revised lower but more modestly by -0.2 percentage points for both 2025 and 2026. The US dollar could derive more support going forward if the US economy does not slow as much as feared making it harder for the Fed to cut rates as much as currently priced in.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Current Assessment |

Apr |

85.5 |

85.7 |

!! |

|

US |

11:00 |

IMF Meetings |

-- |

-- |

-- |

! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

GE |

13:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Mar |

2.1% |

0.9% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

222K |

215K |

!!! |

|

EC |

14:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Existing Home Sales |

Mar |

4.14M |

4.26M |

!!! |

|

US |

22:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg