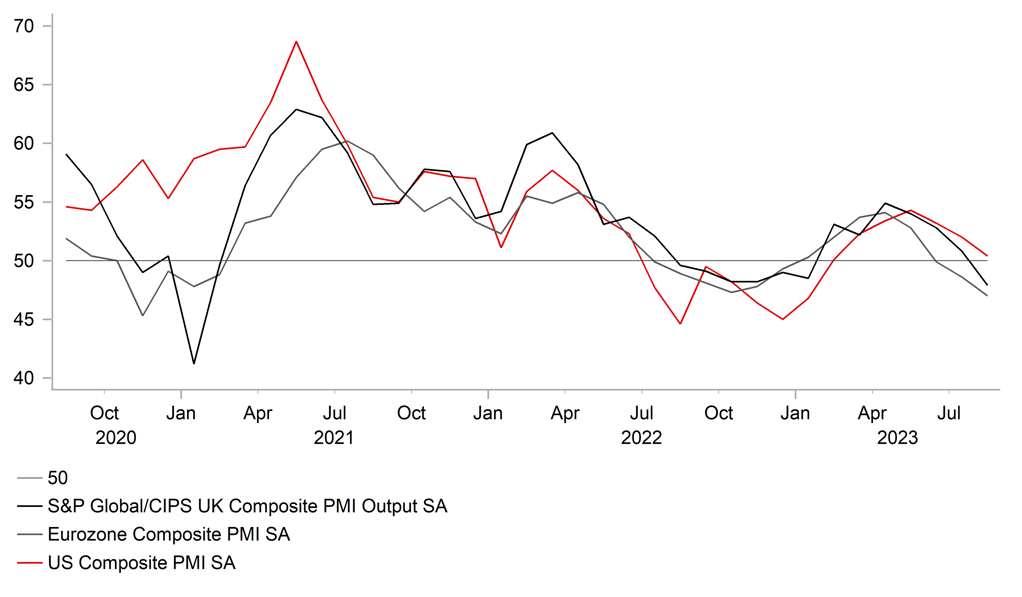

Weak PMI surveys cast doubts on need for further hikes

USD: Weaker PMI surveys trigger pick-up in FX volatility

The surveys have understandably heightened investor concerns that the economic slowdown in broadening out and signals an increased likelihood that the euro-zone economy will contract again in Q3 after expanding modestly by 0.3% in Q2. At the very least it challenges the consensus forecast for economic growth to pick-up in the second half of this year as the cost of living crisis eases. The surveys suggest that the ECB’s monetary tightening is having a stronger impact on slowing the economy, and should make the ECB more cautious over hiking rates further in the near-term. It supports our forecast for the ECB to pause their hiking cycle at the September policy meeting. The ECB will have noted as well that negotiated wage growth in the euro-zone remained stronger at 4.34% in Q2 for the second consecutive quarter. The next important data release for the ECB ahead of their next policy meeting will be the euro-zone CPI report for August that is scheduled to be released on 31st August. Unless there is significant upside surprise for core inflation in August, we would expect market participants to remain less confident that the ECB will hike again in September. The euro-zone rate market is currently pricing in around 14bps of hikes for September implying that one more hike still judged as more likely than not right now. A decision by the ECB to pause their hiking cycle next month therefore still poses some downside risk for euro-zone yields and the euro in the month ahead.

The hit to business confidence in August was also evident in the UK. The composite PMI from the UK dropped sharply below the 50.0-level to 47.9 in August which was the weakest level since January 2021. Similarly, it should make the BoE more cautious over the need to keep hiking rates by suggesting that monetary tightening is beginning to have more of a negative impact on activity. After the release of another upside wage growth surprise earlier this month, the UK rate market had moved to price in a higher probability of the BoE delivering another larger 50bps hike in September and had moved to price in around 75bp of further hikes. After yesterday’s weak PMI surveys, the UK rate market is now pricing in around 21bps of hikes in September and a total of around 61bps of further hikes by early next year. The pound initially sold off sharply as BoE rate hike expectations were scaled back resulting in cable dropping briefly to a low of 1.615 ad EUR/GBP rising up to 0.8566 but losses were not sustained.

The initial US dollar rally was not sustained after it was also revealed that business confidence declined in the US as well which cast some doubt on recent investor optimism over the resilience of US activity data so far this year. The US composite PMI declined by 1.6 point to 50.4 in August. While it remains higher than in the euro-zone and UK, it is more consistent with weaker growth. The preliminary benchmark revisions for the US payrolls report also revealed that employment growth was revised lower by -306k in the year to March 2023 implying modestly weaker employment growth although it is unlikely to materially alter the Fed’s assessment of labour market conditions when setting policy. We still expect the Fed to leave rates on hold at the September FOMC meeting encouraged by slowing inflation even as the US economy has shown more resilience recently. The US dollar should continue to derive more support tin near-term from more evidence of economic weakness outside of the US in China and Europe, and from the recent yield spread movements in favour of the US.

WEAKER PMI SURVEYS RE-HEIGHTEN GROWTH CONCERNS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:30 |

Chicago Fed National Activity |

Jul |

-- |

-0.32 |

! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Jul |

-4.0% |

4.7% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

240K |

239K |

!!! |

Source: Bloomberg