EUR gains as AfD merely meets expectations

EUR: CDU/CSU to lead coalition government

The fact that the German election result did not throw up a surprise outperformance for the far-right AfD party has been met with relief in the financial markets and the euro is the best performing G10 currency this morning following the confirmation of victory for the CDU-CSU, which won 28.5% of the vote. There had been speculation of AfD outperforming its polling and winning well over 20% of the vote so the 20.8% share won by AfD was more in line with recent polling rather than an outperformance. The SPD suffered losses and managed to gain 16.4% of the vote, its worst result since World War II while the Greens vote share also declined, winning 11.6% and the Left won 8.8%. At the time of writing both BSW and the FDP are below the 5% threshold meaning they will not have representation in parliament. However, it is very close for BSW with the current vote share at 4.97%. With no seats for both these parties Politico estimates a majority in parliament can be achieved with the CDU-CSU forming a coalition with the SPD. The combined seats for both parties is estimated at 328 seats in the 630-seat parliament. If BSW does hit the threshold it is then a very fine margin on whether a two-party coalition is possible and it could then mean a third party would be required for a working governing coalition. Exit polls according to broadcaster ZDF revealed that immigration and security (44%) was the top concern amongst voters while the state of the economy (35%) was the next biggest concern.

The euro has advanced in part on the hope of a relatively quick negotiation period to form a government. If BSW falls short of the 5% threshold that is certainly plausible but will be more complicated if BSW is in parliament. The euro has also gained on the hope of policies being introduced that allow for suspension of the debt brake or to revise the rules to boost spending in areas like defence. A suspension is more feasible in an emergency but whether the Ukraine war and need for defense spending is an emergency is questionable. A change to the debt brake set-up would require a two-thirds majority in that looks much more difficult given this election result.

Still, we have argued that this election could be the catalyst for some positive momentum in terms of economic policies that help to lift growth expectations later this year for better growth in 2026 and onwards. Friedrich Merz is committed to a more pro-business policy agenda and if we have a relatively short coalition negotiation period followed by policies to boost growth it can certainly be an important factor in our forecast profile being realised later in the year with our year-end EUR/USD forecast of 1.0800 more plausible.

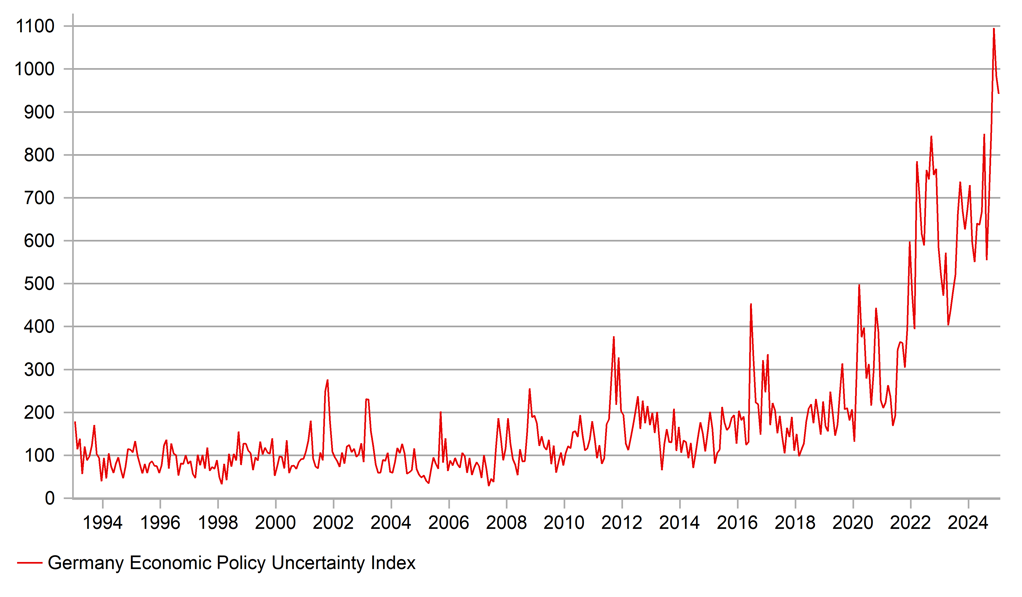

GERMANY’S ECONOMIC POLICY UNCERTAINTY IS EXTREMELY ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

USD: Trump policy uncertainty having a dampening impact on US growth?

The US dollar index recorded its third consecutive week of losses last week extending its decline since the high set in the middle of January to just over 3%, and in the process it has reversed just over half of the gains recorded following the US election victory for Donald Trump at the end of last year. The reversal of US dollar strength reflects in part building investor optimism that President Trump’s trade plans may not prove as disruptive as feared for the global economy. Market participants are currently viewing Trump’s trade plans as if the glass is half-full. That mentality was again evident at the end of last week when President Trump was asked about a potential trade deal with China and stated that it is “possible”. It helped to temporarily lower USD/CNY back below 7.2500 and lift EUR/USD back above 1.0500.

In contrast, market participants have largely looked through President Trump’s plans/threats last week to: i) hike tariffs by 25% on steel and aluminium from 12th March and to ii) hike tariffs by 25% on automobiles, semiconductors and pharmaceuticals from 2nd April. That comes on top of previous plans/threats to: i) hike tariffs by 25% on most imports from Canada and Mexico from 4th March and to ii) put in place reciprocal tariffs (click here) on all trading partners from 1st April. One thing is clear is that trade policy uncertainty is set to remain unusually elevated and act as a drag on global trade and growth in the near-term. The next couple of months is set up to be pivotal for US dollar performance. The US dollar should bounce back strongly in Q2 if Trump follows through and implements some of these more disruptive tariffs. It would likely trigger a pick-up in FX market volatility as well that has eased back at the start of this year. In contrast, if all of Trump’s tariff threats are watered down significantly and/or trade deals emerge including one with China then the door would open for a deeper correction lower for the US dollar. Please see our latest FX Weekly report for more details (click here).

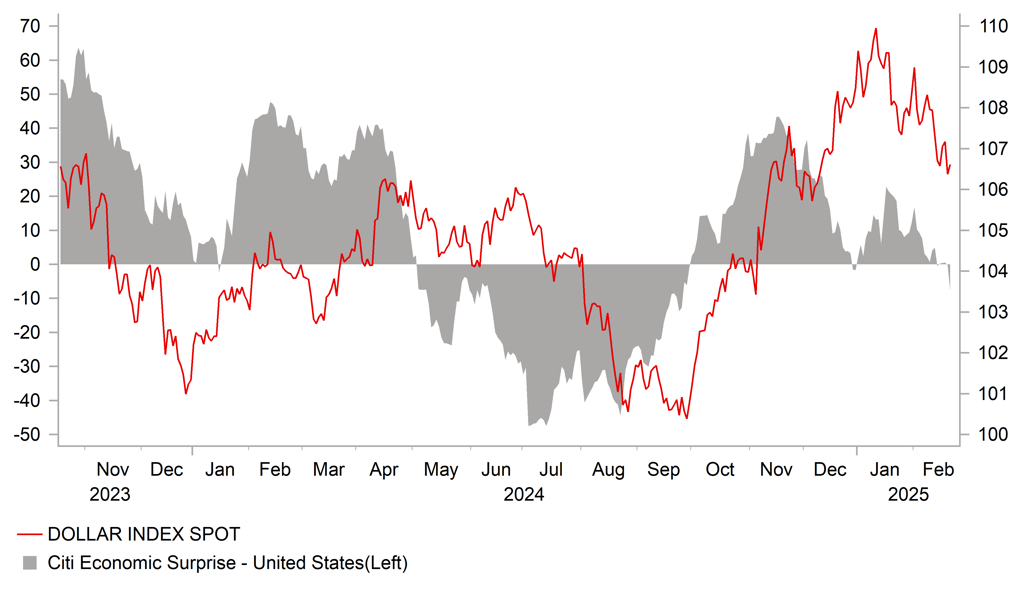

At the same time, the US dollar has been undermined over the past week by the release of a run of softer US economic data. It has resulted in the US economic surprise index moving into negative territory for the first time since September. The recent run of softer US economic surprises over the past week has included: i) the NHB housing market index for February, ii) housing starts for January, iii) leading index for January, iv) services PMI for February and v) University of Michigan sentiment survey for February. It has has put an dampener on investor optimism that the election victory for Donald Trump would lead to pick-up in US growth. The Atlanta Fed’s Nowcast tracker for GDP growth in Q1 has dropped back to 2.3% and is currently suggesting that the slowdown in growth at the end of last year has continued at the start of this year, although it is still above the Fed’s estimate of the longer run growth rate of between 1.7% and 2.0%.

The sharp drop in the services PMI at the end of last week to the lowest level since January 2023, and the drop in UoM sentiment survey to the lowest level since November 2023 even suggest that heightened policy uncertainty at the start of Trump’s second term may initially be having a detrimental impact on the US economy. Details of the UoM survey revealed that households are worried by the inflationary impact from Trump’s policies such as higher tariffs. The longer-term measure of inflation expectations for 5-10 years rose to its highest level in February since April 1995. Furthermore the index measuring the expected change in households’ financial situations in a year dropped sharply to its lowest level since July 2022. While it would be an exaggeration to say that the US economy is slowing sharply, the softer US data flow provides another reason to put a dampener on US dollar strength in the near-term

NEGATIVE US ECONOMIC SUPRISES PROVIDE HEADWIND FOR USD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Ifo Business Climate Index |

Feb |

85.9 |

85.1 |

!! |

|

EC |

10:00 |

CPI (YoY) |

Jan |

2.5% |

2.5% |

!!! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

-- |

-- |

-34 |

!! |

|

UK |

13:15 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:30 |

Dallas Fed Mfg Business Index |

Feb |

-- |

14.1 |

!! |

|

UK |

18:00 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg