USD continues to correct lower after BoJ policy update

USD: Sell-off reinforced after Trump softens China tariff threats

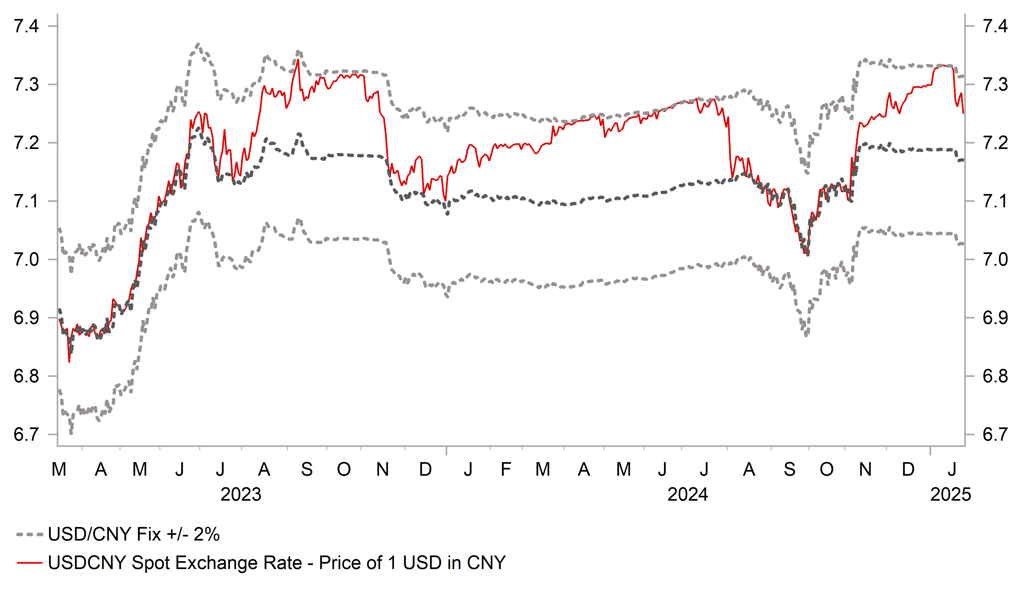

The US dollar has continued to weaken during the Asian trading session leaving the dollar index on course for its second consecutive weekly decline after it failed to break above the 110.00-level earlier this month. The main driver of the reversal of US dollar strength this week has been the scaling back of investor fears over disruption to global trade from Trump’s tariff plans. Tariff fears have eased further overnight after President Trump told Fox News that he prefers not to have to impose higher tariffs on China. He stated specifically that “we have one very big power over China, and that’s tariffs, and they don’t want them. And I’d rather not have to use it. But it’s a tremendous power of over China”. It follows a threat earlier this week to implement a 10% tariff hike on China as soon as 1st February for allowing fentanyl to “pour” into the US. The mixed messages on tariffs from Trump are creating more volatility in the FX market. USD/CNY has fallen sharply overnight back towards the 7.2500-level as it moves further below the top of the daily trading band at 7.3140 where it was trading in the week ahead of the start of Trump’s second term as president. The biggest beneficiaries this week from the scaling back of investor fears over trade disruption from tariff hikes have been hard hit emerging market currencies such as the Hungarian forint and Brazilian real. However, we are not convinced that the short-term relief will last, and still expect President Trump to implement higher tariffs.

At the same time, the correction lower for the US dollar has been encouraged by a drop in US yields. Short-term yields dropped modestly yesterday after President Trump stated yesterday in a speech at Davos that “I will demand that interest rates drop immediately” threatening the Fed’s independence. Those comments appear to have been softened since with Bloomberg reporting now that President Trump says he will speak with Fed Chair Powell about lowering rates at the “right time”. The report goes on to add that while Trump says he’s guided by the Federal Reserve on interest rates, he will “let it be known” if he disagrees. Overall, the comments do not change our view that Trump is unlikely to have a significant impact on the setting of Fed policy. He will be able to choose a new Fed Chair when Powell’s term ends but that is not until May 2026. It is already well known similar to during his first term that President Trump prefers lower rates and a weaker US dollar to support the US economy but his policy platform of tariffs, tighter immigration and tax cuts if implemented will help to keep US yields and the US dollar higher for longer.

CNY REBOUNDS AS TARIFF FEARS EASE FOR NOW

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ rate hike has been less disruptive than last summer

The weaker US dollar and decline in short-term US yields has contributed to USD/JPY falling back to support at the 155.00-level overnight. In contrast, the yen has remined more stable against other G10 currencies indicating that the impact from the BoJ’s latest policy update has been limited. The BoJ will be pleased by the market reaction after receiving criticism following the last rate hike delivered at the end of July given it was followed by a sharp strengthening of the yen and plunge in the Japanese equity market in early August. The BoJ have learnt lessons from that unfavourable market reaction and signalled clearly that they were planning to hike rates today to help limit financial market disruption.

The BoJ’s decision to raise rates today by a further 25bps to 0.50% was already fully priced in by the Japanese rate market. In the accompanying press conference, Governor Ueda stated that Japan’s economy and inflation had evolved in line with their outlook which was the biggest reason for another rate hike today. He sees the inflation trend settling at their 2.0 target at “around FY2026”. It was backed up by upward revisions to the BoJ’s inflation forecasts. The majority of policy board members now expect core inflation (less fresh food and energy) to remain just above 2.0% over the forecast period to FY2026. In contrast, the growth outlook for Japan was largely unchanged. Confidence in the inflation outlook was backed up by comments from Governor Ueda stating that he expects solid results from the upcoming spring wage talks. With financial markets remaining calm during Trump’s first days in office, there was no need for the BoJ to hold back from tightening policy further today.

The updated policy guidance reiterated that they will keep raising rates if the economic outlook is realized. Governor Ueda emphasized that real rates after adjusting for inflation remain negative even after today’s rate hike, and that the policy rate remains far from neutral. However, he refrained from providing stronger guidance over the potential timing of further rate hikes. He only signalled that the pace of future rate hikes will depend on how the economy and inflation evolves and they have no preconception on the pace of rate hikes. They will also decide the policy path by checking the impact of rate hikes that have already been implemented. Overall, the updated guidance has not significantly altered market expectations that the BoJ is likely to wait until at least July to hike rates further or wait even longer until the autumn. The guidance is not sufficiently hawkish to trigger sharper and more broad-based yen gains.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French S&P Global Composite PMI |

-- |

47.7 |

47.5 |

! |

|

GE |

08:30 |

German Composite PMI |

-- |

48.2 |

48.0 |

! |

|

EC |

09:00 |

S&P Global Composite PMI |

-- |

49.7 |

49.6 |

!! |

|

UK |

09:30 |

Composite PMI |

Jan |

50.0 |

50.4 |

!!! |

|

EC |

10:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Dec |

0.2% |

0.1% |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

-- |

-- |

55.4 |

!! |

|

US |

15:00 |

Existing Home Sales |

Dec |

4.19M |

4.15M |

!!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jan |

73.2 |

74.0 |

!! |

Source: Bloomberg