Trump’s tariff plans to be less supportive for USD than expected?

USD: Scaling back Trump’s tariff plans ahead of “Liberation Day” on 2nd April

The US dollar has weakened modestly start the start of this week resulting in the dollar index falling back below the 104.00-level. The main trigger has been Bloomberg report stating that President Trump’s plans for a “Liberation Day” tariff announcement on 2nd April is poised to be more targeted according to aides and allies. While the announcement would remain a very significant expansion of US tariffs, it is not shaping up to be as broad-based as initially threatened or feared. The report adds that the “reciprocal tariff” plans will exclude countries that don’t have tariffs on the US, and with whom the US has a trade surplus. Furthermore, it has been reported that other existing tariffs like on steel and aluminium may not necessarily be cumulative helping to ease the potential hit to those sectors. It follows comments last week from US Treasury Secretary Bessent who that those tariffs may not add on to the country-by-country rates applied under “reciprocal tariff” plans. The list of countries that are cited in the report as likely targets for Trump new tariffs include the EU, Mexico, Japan, South Korea, Canada, India and China. Scott Bessent has emphasized that roughly 15% of countries are the worst offenders. President Trump had also previously indicated that he plans to announce sector specific tariffs on autos, semi-conductors and pharmaceuticals in early April, but the Bloomberg report is also suggesting now that they aren’t set to be launched on the same day as the “reciprocal tariffs” on 2nd April. According to officials, an auto tariff is still being considered and President Trump has not ruled it out at another time. The “Liberation Day” announcements might even include some roll back of tariffs on Canada and Mexico although that is described as “uncertain”.

We expect the report of more targeted US tariff plans to provide relief for financial markets at the start of this week. Keven Hassett who is the National Economic Council director stated that “I think markets need to change their expectations, because it’s not everybody that cheats us on trade, it’s just a few countries and those countries are going to be seeing some tariffs”. The report should help to further dampen upside risks for the US dollar from President Trump’s upcoming tariff announcements. It comes on top of recent evidence showing that the US economy is slowing in response to heightened policy uncertainty at the start of Trump’s second term, and plans for looser fiscal policy in China and Germany have already helped to dampen US dollar strength. The Fed signalled as well last week that it is prepared to look through higher inflation from tariffs expecting the pick-up to prove transitory. The dovish reaction function was another unfavourable development for the US dollar. Please see our latest FX Weekly report for more details (click here).

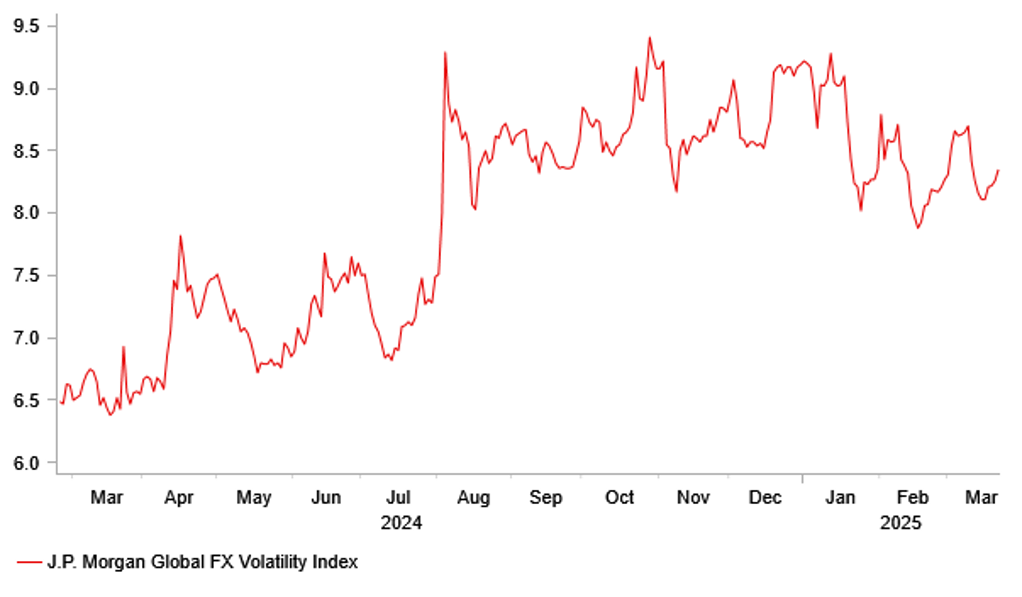

FX VOLATILITY HAS EASED AT THE START OF THIS YEAR

Source: Bloomberg, Macrobond & MUFG GMR

TRY: Limited spill-overs from political developments in Turkey

The other main development over the weekend was the formal arrest of Istanbul Mayor Ekrem Imamoglu who has been jailed on corruption charges on Sunday. The case has the potential to keep Imamoglu, who denies the charges, behind bars for years and prevent hm running from running against President Erdogan in the next election. It follows his detention last Wednesday and the decision to revoke his university diploma. His arrest came on the same day that he was scheduled to be declared the presidential candidate for the main opposition Republican People’s Party, CHP.

The latest political developments have triggered a pick-up in domestic financial market volatility in Turkey. The BIST 100 equity index has fallen sharply by around 15% and USD/TRY initially jumped above the 41.000-level last week before dropping back towards the 38.000-level. It represents a step up in the pace of lira depreciation. Prior to the last week’s detention of Imamoglu, the lira had declined by an annualized rate of around -16% against the US dollar year to date which was roughly the same rate of depreciation as in 2024.

Over the weekend, the Central Bank of Turkey held a meeting with executives from banks to discuss potential market volatility and future steps according to people familiar with the matter. The Banks Association later confirmed that the monetary authorities and lenders had held a “technical meeting”. At the same time, Treasury and Finance Minister Simsek held a meeting with regulators on measures to be taken against market turmoil. Turkey’s market regulator has since announced steps on Sunday including a ban on short-selling, more relaxed conditions for share buybacks and a reduction of the minimum equity capital protection requirement for margin trading.

The Central Bank of Turkey had already taken policy action at the end of last week on Thursday when it raised the overnight lending rate by 2 percentage points to 46.00% allowing policymakers to raise the average cost of funding they provide to commercial lenders and providing support for the lira. They also decided to suspend lending at its lower rate of one-week repo at 42.5% for an unspecified period. The CBRT noted that the action was necessary to support their tight monetary stance.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

FR |

08:15 |

French Manufacturing PMI |

Mar |

46.2 |

45.8 |

!! |

|

FR |

08:15 |

French Services PMI |

Mar |

46.3 |

45.3 |

!! |

|

GE |

08:30 |

German Manufacturing PMI |

Mar |

47.1 |

46.5 |

!! |

|

GE |

08:30 |

German Services PMI |

Mar |

52.3 |

51.1 |

!! |

|

EC |

09:00 |

Manufacturing PMI |

Mar |

48.3 |

47.6 |

!! |

|

EC |

09:00 |

Services PMI |

Mar |

51.2 |

50.6 |

!! |

|

UK |

09:30 |

Manufacturing PMI |

Mar |

47.3 |

46.9 |

!!! |

|

UK |

09:30 |

Services PMI |

Mar |

51.2 |

51.0 |

!!! |

|

US |

13:45 |

S&P Global Composite PMI |

Mar |

-- |

51.6 |

!! |

|

US |

17:45 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

UK |

18:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

JP |

23:50 |

Monetary Policy Meeting Minutes |

-- |

-- |

-- |

!! |

Source: Bloomberg