EUR upside scope has limits given the macro outlook

EUR: Growth challenges to persist

The US Thanksgiving holiday means the FX market moves were relatively modest yesterday and with the UST bond market closed there was a lack of direction. The UK Gilt market is where we saw the biggest move with the fallout from the Autumn Statement extending into yesterday and helped by the PMI data which advanced more than expected – the Composite Index crept above the 50-level (50.1) for the first time since July. The UK 10-year breakeven rate jumped 3bps explaining some of the Gilt 10yr yield move as the National Insurance Contribution cut was larger than expected and the benefits payments inflation adjustment was also the larger of the two options thought to have been considered (6.7% vs 4.6%) while the government maintained its pensions triple-lock commitment with an increased pension payment of over 8.0% and the national living wage was increased by over 10%. Over the near-term investors fear it may change the dial on another BoE rate hike.

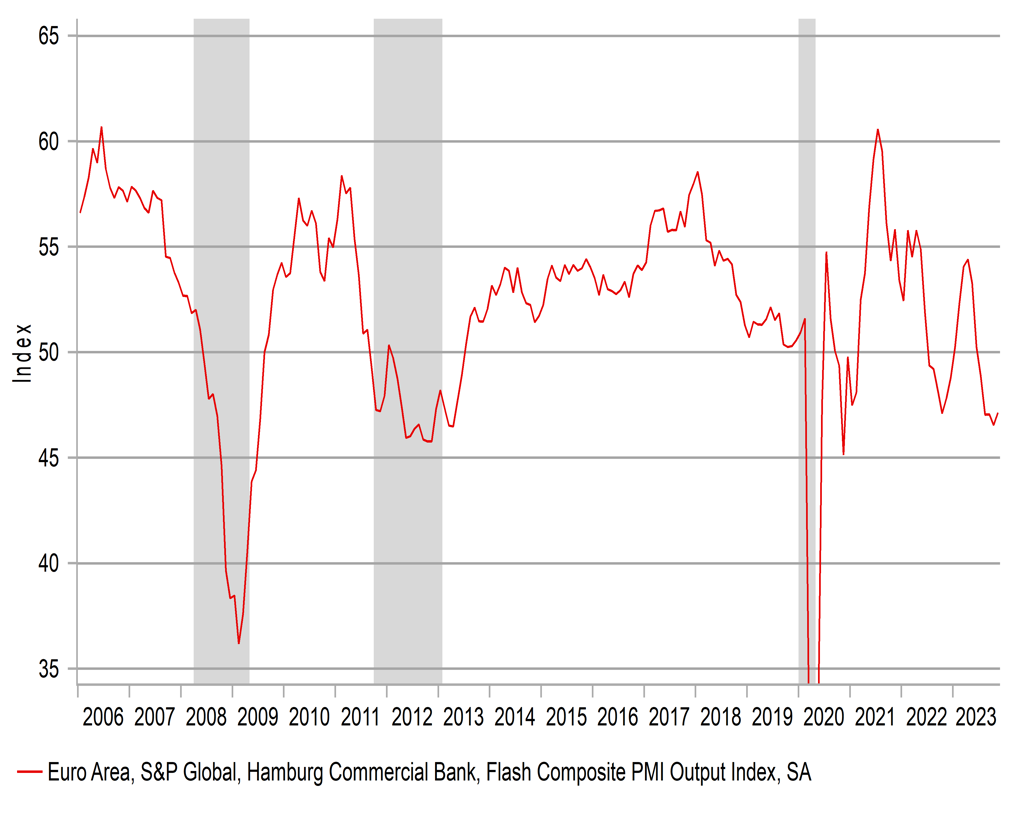

The jump in German government bond yields yesterday was much more muted and for good reason. The PMI data in Germany and in the euro-zone did improve but the improvements were pretty modest underlining the still weak with the euro-zone readings for manufacturing and services well below UK levels and still in contraction territory.

The news from Germany that it plans to suspend its constitutional debt brake for a fourth consecutive year to us underlines the lack of fiscal space Germany will have going forward and reinforces the downside risks to growth. Suspending the debt brake was forced upon the government by the Constitutional Court decision on bringing back on balance sheet certain expenditures that were not included. Certain expenditure projects related to say for example greening the German economy may now be shelved which would have a negative impact on growth going forward.

A signal of the changing balance of macro risks was underlined by the release of the ECB minutes which look to us to indicate a stronger prospect of rate cuts possibly coming sooner than expected. The comments in the minutes on inflation were positive with the minutes noting that the “‘Persistent & Common Component of Inflation’ was now close to 2%”. The minutes also continued to acknowledge that “most of the impact” from the monetary tightening had yet to materialise. Still, there was also a desire to stress the continued need to keep rates “at sufficiently restrictive levels for as long necessary” which could imply risks of the ECB being slow to respond to worsening economic conditions that could materialise sooner.

We have been keen to stress that while the window for dollar appreciation back to the highs set in October and/or beyond may now have closed, the growth outlook in the euro-zone does not point to much upside scope for EUR/USD either.

EURO-ZONE COMPOSITE REMAINS AT RECESSIONARY LEVELS

Source: Macrobond

JPY: Inflation remains firm and yields rise

The modest FX moves from yesterday have continued into today as the US Treasury bond market reopens after Thanksgiving with yields higher. This is more catch-up from yesterday and hence broader markets have seen only modest moves. JGB yields are also higher today partly in response to the nationwide inflation data for October. The data was modestly weaker with each of the nationwide measures coming in 0.1ppt lower than expected. Overall inflation and core both still accelerated but the core-core annual rate slowed from 4.2% to 4.0% in October (expected 4.1%). Inflation continues to be driven stronger by food (8.6% YoY); furniture and household equipment (6.9%); clothing and footwear (3.0%); medical care (2.3%); transport and communication (3.2%); and recreation and culture (6.4%). Within that last category lies hotel charges which surged and underlines the lift to inflation from strong gains in tourism as the sector revives after covid.

The resilience of core-core inflation certainly points to something different happening in Japan. The 4.0% rate is only 0.3ppt blow the cyclical high and when you consider the move in underlying inflation through the global inflation shock from the pre-shock low, Japan is broadly similar to the US and the euro-zone. Japan’s core-core annual rate increased from -1.1% to 4.3% - a 5.4ppt increase. In the US, core CPI increased 5.3ppts and in the euro-zone the increase was 5.5ppts. The latest fiscal stimulus package announced in Japan (JPY 17trn) will help support internal demand (although like in the past, much of the giveaways will probably be saved) after recent GDP data showed household spending shrinking. This is why the BoJ remains focused on wage gains as being key for sustaining inflation. With two-thirds of households believing the latest fiscal stimulus was inappropriate, the spending impact may be muted.

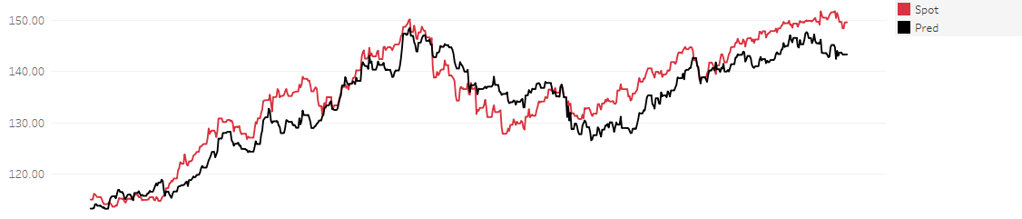

But if the BoJ can see enough evidence in wage negotiations pointing to another year of stronger wage growth it is likely to encourage them to remove NIRP, possibly at the January meeting. The final meeting of this year on 19th December will be important in that regard. Today’s inflation data keeps the prospect of a change alive. There remains evidence of impressive resilience in USD/JPY with appetite for running short JPY still strong. Our own short-term regression model indicates notable divergence with the spot rate and implies USD/JPY should be trading closer to 143.00.

MUFG SHORT-TERM REGRESSION MODEL DIVERGENCE WITH SPOT – FAIR-VALUE IS AROUND 143.00

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Nov |

87.5 |

86.9 |

!! |

|

EC |

09:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

CA |

11:30 |

Corporate Profits (QoQ) |

-- |

-- |

-2.0% |

! |

|

EC |

12:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Sep |

-0.2% |

0.1% |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

-- |

-- |

0.4% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Sep |

0.0% |

-0.1% |

!! |

|

US |

14:45 |

Manufacturing PMI |

Nov |

49.8 |

50.0 |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Nov |

-- |

50.7 |

!! |

|

US |

14:45 |

Services PMI |

Nov |

50.3 |

50.6 |

!!! |

|

CA |

16:00 |

Budget Balance |

Sep |

-- |

-3.05B |

! |

|

CA |

16:00 |

Budget Balance (YoY) |

Sep |

-- |

-4.29B |

! |

Source: Bloomberg