No let up for yen selling ahead of BoJ meeting

JPY: Pressure to back up talk with action continues to build

The yen has continued to weaken during the Asian trading session ahead of tomorrow’s BoJ policy meeting. It has resulted in USD/JPY rising further above the 155.00-level. The yen has now weakened by almost 6% against the US dollar from last month’s lows. The price action highlights that verbal intervention by Japanese officials is becoming less effective at slowing down the pace of yen weakness. After Japanese officials chose not to intervene to defend the 152.00 and 155.00 levels, it has raised doubts over their willingness to intervene directly in the foreign exchange market to support the yen at the current juncture when US yields and the US dollar are continuing to adjust higher. The yen continued to weaken further overnight even as Finance Minister Suzuki reiterated that they continue to watch forex moves closely and that they will take appropriate action but can not say much on FX at this point. Earlier this week he even added that the “environment is in place for intervention if needed” while emphasizing that last week’s FX agreement between Japan, South Korea and the US in which all three countries acknowledged concerns over recent yen and won weakness was a milestone. With those warnings failing to prevent the yen from weakening further, it appears like market participants are pressuring Japanese officials to back up those words with policy action. Even a more hawkish policy rhetoric from the BoJ at tomorrow’s policy meeting (click here) may prove insufficient on its own to derail the current strong yen weakening trend.

The global macro backdrop is making it more difficult for Japanese officials to prevent the yen from weakening further. There have been further encouraging signs this week that global growth is picking up at the start of this year in the business confidence surveys from Europe that is contributing to the ongoing adjustment higher in yields outside of Japan. The release today of the preliminary estimate of the US GDP in Q1 is expected to confirm that the US economy continued to grow strongly at the start of this year. While growth is expected to moderate to around 2.5% in Q1 following robust growth of just over 3.0% in the 2H of last year, the scale of the slowdown has been more modest than initially expected. The improving growth outlook and more sticky inflation is encouraging market participants to continue scaling back expectations for rate cuts from other major central banks outside of Japan. The US and euro-zone rate markets are now pricing in only around 40bps and 65bps of rate cuts from the Fed and ECB respectively by the end of this year. In the current market environment, market participants will doubt whether even direct intervention will prove effective at supporting the yen beyond the initial boost.

INTERVENTION IN 2022 WAS SUPPORTED BY PULLBACK IN US YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Improving cyclical momentum in euro-zone to provide support for euro

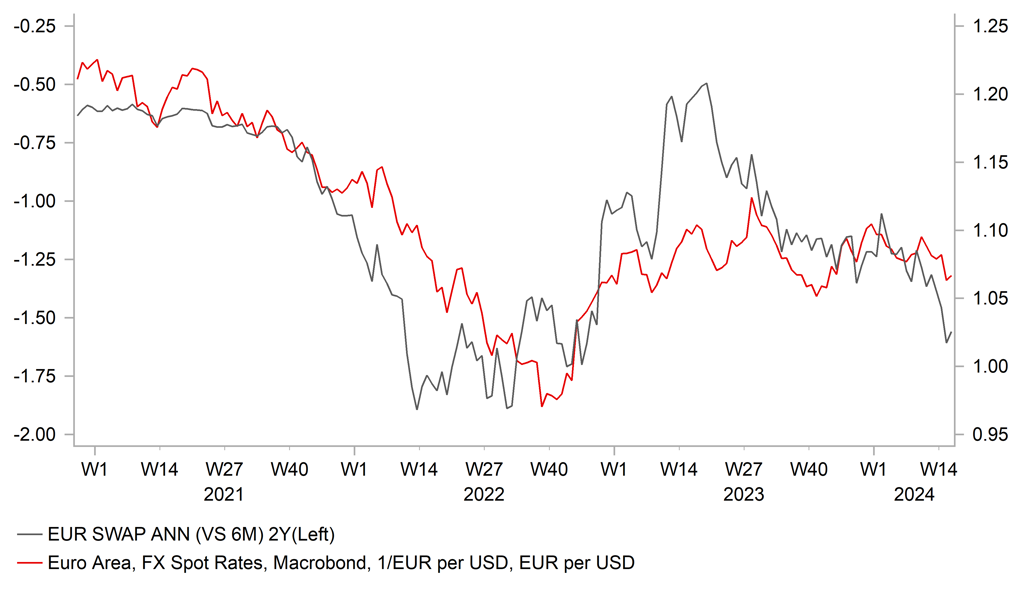

The euro has been holding up relatively better against the US dollar than the yen. After failing to break below the 1.0600-level last week, EUR/USD has climbed back towards the middle of the 1.0500-1.1000 trading range that has been in place for most of the time since late in 2022. Not even building expectations for widening policy divergence between the ECB and the Fed in the coming months has been sufficient to trigger a sharper adjustment lower for the pair. The two-year swaps spread between the euro-zone and the US has widened by around 30-40bps in favour of the US so far this year but it hasn’t fully fed through to a much stronger US dollar. Looking at the chart below, the move in short-term yield spreads would on its own suggest that EUR/USD should at least be testing the bottom of the 1.0500-1.1000 trading range.

ECB officials have indicated that they remain on course to begin cutting rates in June unless there is a significant surprise in the coming months. The fallout from the recent flare up in geopolitical risks in the Middle East is not yet judged as sufficient to alter the ECB’s rate cut plans. A more significant adjustment higher in energy prices would be required to deter the ECB from cutting rates as soon as in June. ECB officials have indicated that they comfortable to lower rates ahead for the Fed but are likely to be wary of cutting rates too aggressively given it could pose upside risks to the inflation outlook by weakening the EUR more significantly especially if the Fed leaves rates on hold until later this year.

Lower rates in the euro-zone should help to ease headwinds to growth in the euro-zone. There are already tentative signs that euro-zone economy is beginning to pick-up at the start of this year as the headwind to growth from higher inflation fades. Business confidence in France and Germany in their service sectors has risen to its highest levels in almost a year. If the improving surveys are backed up by hard evidence of a pick-up in growth in Q2 that could help to provide more support for the EUR heading into the 2H of this year. In these circumstances, it will become more challenging for EUR/USD to keep moving lower as it moves closer to the lows from last autumn between 1.0400 and 1.0500. Unlike last year, the reversal of the negative energy price shock in Europe should help to prevent the pair from moving even closer to parity.

YIELDS SPREAD MOVES HAVE INCREASED DOWNSIDE RISKS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

ECB Economic Bulletin |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Apr |

-2 |

2 |

! |

|

US |

13:30 |

GDP (QoQ) |

Q1 |

2.5% |

3.4% |

!!! |

|

US |

13:30 |

Goods Trade Balance |

Mar |

-91.10B |

-91.84B |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

214K |

212K |

!!! |

|

US |

15:00 |

Pending Home Sales Index |

Mar |

-- |

75.6 |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

7,406B |

!! |

Source: Bloomberg