USD respite but evidence of easing trade frictions are tentative

USD: Scope for dollar rebound appears limited

After the scale of the US dollar sell-off this month, a period of reversal was always likely to unfold and the catalyst for some moderate rebound this week is on what you would expect – speculation that both the US and China will take steps to lower the current huge tariff rates. As Scott Bessent reportedly stated this week, the current tariffs by the US and China mean an effective embargo on trade and hence is unsustainable, so any speculation of steps to lower the tariff rates certainly makes sense. However, apart from media reports from “people familiar with the matter” and without official confirmation this optimism could fade quickly. The dollar may also have been helped by reports from South Korea that trade negotiations are developing quickly and that “an agreement of understanding” could be reached next week according to Scott Bessent. He added that progress was being made faster than he expected. Numerous trade deals with some key trading partners is the other route to diluting the negative impact of tariffs. The comments elsewhere on trade deals have been less explicit but a quick deal with South Korea would lift expectations once again that Trump is merely using these reciprocal tariffs to extract quick deals in order to avoid any significant harm to the US economy. China equities and risk generally is stronger along with the US dollar and next week will bring possible information on fiscal stimulus support from China. The 24-member Politburo will gather next week and today it stated that it would fully prepare and announce plans to counter the external shock ahead. New monetary policy tools and additional financing to support firms impacted by the trade conflict were also promised. China was also clear that no dialogue had taken place with the US in regard to trade tariffs.

The dollar has outperformed versus the yen today helped by the confirmation in US-Japan talks yesterday between Finance Minister Kato and US Treasury Secretary Bessent in Washington that FX was not a topic of discussion. In the midst of this broad dollar rally, the inflation data from Japan has received limited reaction in the FX market. The Tokyo CPI reading were much stronger than expected (headline 3.5% vs 3.3% expected and up from 2.9% previously) with school fee cuts falling out of YoY calculations and higher food and energy prices. The jump was the largest in two years. Governor Ueda is also in Washington and repeated plans to raise rates further if the BoJ’s forecasts are met.

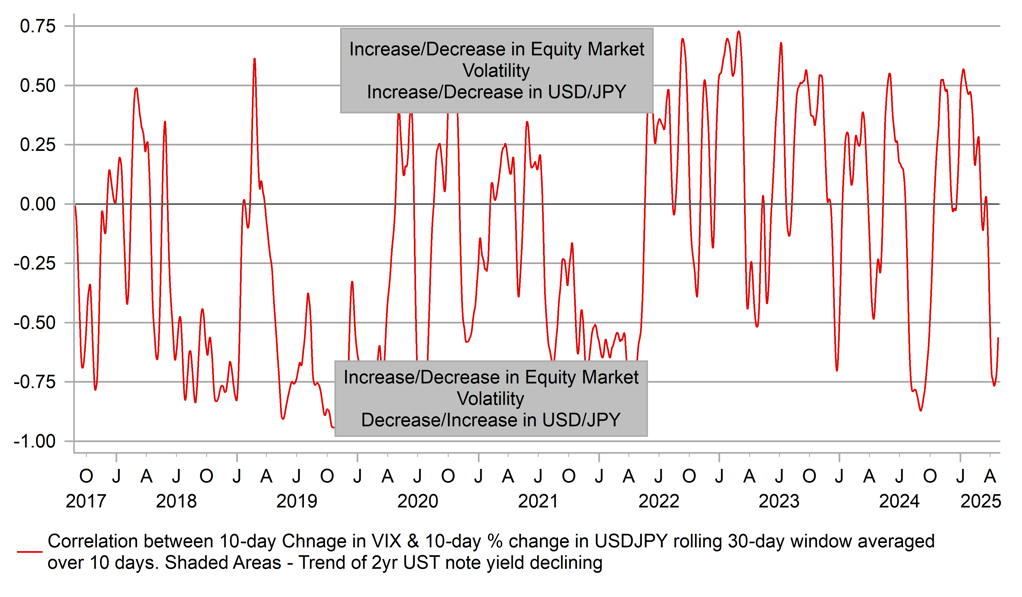

Even if reports are correct that there will be some easing of tariff rates, a hit to US growth is still coming that will ensure volatility levels remain higher, equity markets are pressured to the downside and the global backdrop remains unfavourable for any sustained move higher in USD/JPY. Sellers will likely return to the USD/JPY market if this bounce extends much further.

VIX / USD/JPY CORRELATION SET TO REMAIN NEGATIVE

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE taking the same approach as the ECB

ECB Governing Council member Olli Rehn spoke yesterday and stated that the ECB should not rule out a larger 50bp rate cut if the conditions supported a bigger move and confirmed that if inflation forecasts indicate lower inflation that the ECB would cut again in June. ECB Chief Economist Philip Lane also spoke and mentioned “disinflationary forces” that are hitting the euro-zone economy through the decline in energy prices and the appreciation of the euro. The comments were certainly consistent with current OIS pricing that a 25bp cut is a done deal. Disinflation and the demand shock are the focus underlining rate cut prospects.

It seems that will be the approach of the BoE as well. Up until now there had not been as much clear communication on the BoE’s approach but earlier this week MPC member Megan Greene in a Bloomberg TV interview emphasised her view that tariffs were more of a deflationary shock for the UK economy. Governor Bailey speaking on Wednesday at an event in Washington stated that the UK had to take “very seriously” the hit to global growth from trade wars and then yesterday in a CNBC interview Bailey confirmed that the BoE is more focused on the growth shock although there are inflation risks in both directions. The apparent lack of appetite of the UK government to retaliate certainly limits the near-term inflation risks.

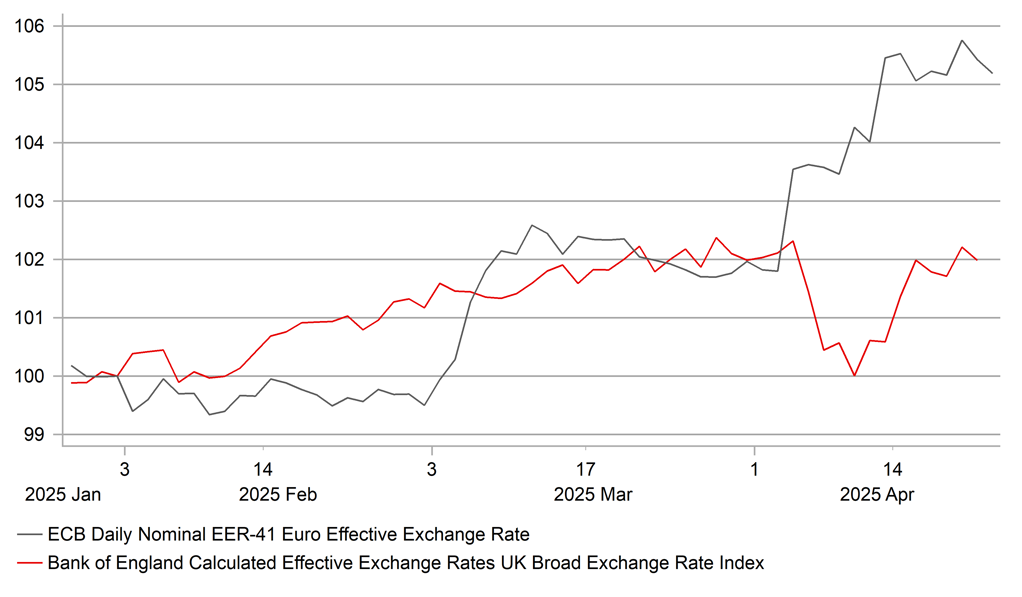

But there was also a sense from Bailey’s and Greene’s comments that inflation risks will play more in the mind of the BoE than the ECB. Given the labour market and the recent strength of the economy, along with a minimum wage increase, inflation risks remain much higher in the UK. The protection from global inflation risks via FX is also not as clear as it is for the euro-zone. The chart above highlights the recent divergence in TWI performances for EUR and GBP with EUR supported by safe-haven demand that GBP is unlikely to see. While a 25bp cut at the next MPC meeting on 8th May is highly likely and fully priced, further cuts beyond could quickly be questioned if supply-side issue create inflationary pressures in the UK. Much stickier wage growth could force the BoE into a more cautious approach to rate cuts given fiscal uncertainties and Gilt market concerns.

EUR EER HAS SEEN CLEAR OUTPERFORMANCE VERSUS GBP EER SINCE TARIFF ACTION BEGAN AT THE START OF FEBRUARY

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

Core Retail Sales (MoM) |

Feb |

-0.6% |

0.2% |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Mar |

0.0% |

0.2% |

! |

|

CA |

13:30 |

Retail Sales (MoM) |

Feb |

-0.4% |

-0.6% |

!! |

|

CA |

13:30 |

Retail Sales (MoM) |

Feb |

-- |

-0.6% |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Apr |

6.7% |

5.0% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Apr |

4.4% |

4.1% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Apr |

47.2 |

52.6 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Apr |

50.8 |

57.0 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Apr |

56.5 |

63.8 |

! |

|

UK |

15:15 |

BoE's Greene speaks |

||||

|

CA |

16:00 |

Budget Balance (YoY) |

Feb |

-- |

-26.85B |

! |

|

CA |

16:00 |

Budget Balance |

Feb |

-- |

-5.13B |

! |

Source: Bloomberg