Lower US yields limits US dollar gains for now

USD: Limited impact on dollar with tariff plans on track

The focus on US trade policy is set to intensify in the coming days with President Trump stating yesterday that the plans to implement the 25% tariffs on Canada and Mexico were “moving along very rapidly”. Both MXN and CAD have seen limited reaction at this stage in part due to a government official later stating that the tariffs were still to be determined. With the tariffs scheduled for next Tuesday and steel and aluminium tariffs scheduled for later in March, then tariffs on semi-conductor chips and pharmaceuticals from possibly 2nd April and finally reciprocal tariffs from 12th April there remain huge risks of increased financial market volatility. We are certainly sceptical of drawing parallels with 2017, Trump’s first year in office when the US dollar depreciated notably. A large part of that was down to the fact that Trump didn’t deliver any trade tariffs at all while global GDP growth was relatively robust – the euro-zone for example recorded GDP growth of 2.6% which was the strongest since before the GFC. On this occasion Trump has already delivered a 10% tariff on China imports with a heavy schedule of further planned increases over the coming weeks and months.

A more plausible explanation in our view is the point of the economic cycle today compared to Trump’s first term in office that may well result in a different FX reaction on this occasion. US real GDP growth accelerated from 1.8% in 2016 to 2.5% in 2017 to 3.0% in 2018 before moderating to 2.5% in 2019. The Fed had the policy rate close to a record low when Trump won the election in 2016 (0.50%) before a sustained period of monetary tightening.

But now we are much more likely at the top of the economic cycle with growth of 2.9% and 2.8% in the last two years and the fed funds rate coming partially down from the most restrictive stance since the GFC. Our view of a weaker US dollar in the second half of the year reflects our assumption of slower economic growth allowing the Fed to resume monetary easing. The US consumer is very unlikely to continue driving the US economy with post-covid stimulus running dry for more consumers resulting in a greater exposure to tighter monetary policy. US consumer credit card delinquency rates are over 11% now, the highest since coming out of the GFC in 2011-12.

So weak economic data of late is resulting in lower front-end yields with the 2-year UST bond yield at a new year-to-date low and is 25bps lower from the intra-day high on 12th February. With more voices from the ECB arguing in favour of pausing its cutting cycle sooner rather than later, the prospects look good for a further favourable move in spreads for EUR/USD. Nonetheless, with a potential wave of tariffs to come appetite for buying EUR is still likely to be curtailed. The yen in these circumstances increasingly looks like the G10 currency that could perform best.

10-YEAR REAL YIELD SPREAD ALSO MOVING IN FAVOUR OF EUR/USD

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Election optimism fades taking euro lower

EUR/USD hit an intra-day high of 1.0528 yesterday in response to the German election result, which was just shy of the January intra-day high of 1.0533 but EUR momentum then reversed as optimism faded. We stated here yesterday that there are certainly positives to take from the victory for the CDU-CSU and Friedrich Merz. We would still argue that this victory certainly increases the prospect of a better policy-driven growth outlook later this year if Merz can follow through with his election manifesto that contains some pro-growth policies for Germany’s industrial sector. The CDU is aiming to lower corporate tax rates to improve corporate competitiveness and to simplify regulations to enhance a more business-friendly environment. The CDU also aims to reduce energy costs and create a better environment for start-ups via the creation of a “Start-up Protection Zone”. But the main focus for the financial markets is on the ability of the new government to alter or suspend the constitutional debt brake.

With BSW failing to achieve the 5% threshold it is now highly likely that the CDU-CSU can lead a smaller, simpler two-party coalition with the SPD. Friedrich Merz confirmed this yesterday stating that given the seat composition of the Bundestag that he was in a position to seek a “red-black coalition”, adding that “this is precisely what we intend to do”. He confirmed that negotiations with the SPD were already in motion and that he would meet with outgoing Chancellor Olaf Scholz in the coming days.

These developments certainly point to the prospects of the coalition negotiation period being less complicated and hence could be completed by the timeline suggested by Merz – by Easter. It also can be argued that this CDU-SPD coalition which functioned well under Angela Merkel has certainly greater scope to deliver policy changes than under the gridlock of the SPD-led three-party coalition that was rife with division. That could mean there is scope for agreeing policies that could garner support from the Greens and/or the Left. Both the SPD and the Greens campaigned on relaxing fiscal rules that may open up a parliamentary deal. While the CDU, SPD, Greens and the Left have different priorities for fiscal easing, there is certainly scope for a deal that could allow for greater fiscal easing ahead. Merz is also now considering taking action in the current parliament with a EUR 200bn fund for defence spending being considered. Time is limited though with the new parliament scheduled to sit on 24th March. A speedy agreement that saw a considerable jump in defence spending would certainly help relations with the US.

So while we can understand the retracement of the initial move higher in EUR/USD given there are numerous uncertainties, there remains reason to believe that over the medium term there remain grounds to believe that this change in government at least opens up the prospect of better impetus from economic policies that could lead to some improvement in optimism over the growth outlook that could prove EUR supportive.

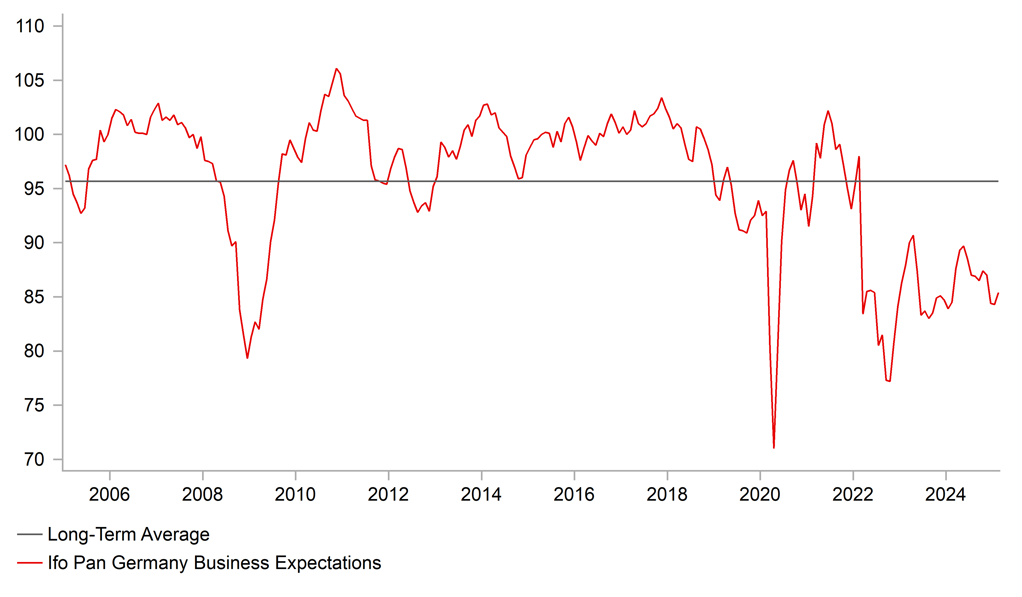

GERMAN IFO BUSINESS OPTIMISM IMPROVED BUT REMAINS DEPRESSED

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:15 |

Fed's Logan Speaks |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

ECB's Nagel Speaks |

-- |

-- |

-- |

!! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Feb |

-21 |

-24 |

! |

|

EC |

13:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Jan |

-- |

0.3% |

! |

|

UK |

14:00 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!!!! |

|

US |

14:00 |

House Price Index (YoY) |

Dec |

-- |

4.2% |

! |

|

US |

14:00 |

House Price Index (MoM) |

Dec |

0.2% |

0.3% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Dec |

-- |

0.4% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 n.s.a. (YoY) |

Dec |

4.3% |

4.3% |

!! |

|

US |

15:00 |

CB Consumer Confidence |

Feb |

103.3 |

104.1 |

!!! |

|

US |

15:00 |

Richmond Manufacturing Index |

Feb |

-2 |

-4 |

! |

|

US |

16:45 |

Fed Vice Chair for Supervision Barr Speaks |

-- |

-- |

-- |

!! |

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

4.330% |

!! |

|

US |

18:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg