Optimism over fresh policy stimulus in China in focus

CNY: Politburo meeting triggers initial optimism over further policy stimulus

The major foreign exchange rates have remained stable overnight ahead of the latest central bank updates this week from the Fed (Wed), ECB (Thurs) and BoJ (Fri). One of the biggest movers in the foreign exchange market overnight has been the Chinese renminbi that has strengthened by around 0.5% against the US dollar resulting in USD/CNY fall back towards the 7.1500-level. It follows the Politburo meeting held yesterday at which domestic policymakers in China promised “counter-cyclical” policy to provide more support for economic growth after the recovery lost upward momentum in Q2. More specifically, the outcome from Politburo meeting suggests that there will be: i) more demand-side property easing including a further relaxation of home purchase restrictions in Tier-1 cities, ii) a boost to infrastructure investment, iii) continued monetary easing having indicated room for rates to be lowered further, and iv) further consumption incentives that will focus on boosting spending on auto, electronics and home appliances. The meeting also suggested that a series of measures will be carried out to help resolve risks from local government debt. Furthermore, the government has pledged to improve the business environment for private enterprises and the platform economy, to boost capital markets and lift investors’ confidence. While the outcome from the Politburo meeting has been greeted by an initial bout of optimism from market participants, we will be watching closely to assess if fresh stimulus measures are sufficiently forceful to support a pick-up in cyclical momentum for China’s economy in the second half of this year. Our forecast for USD/CNY (click here) to drop back below the 7.0000-level by the end of this year rests on the assumption that the economic recovery in China will strengthen as well as the US dollar will weaken further more broadly as the Fed ends their hiking cycle.

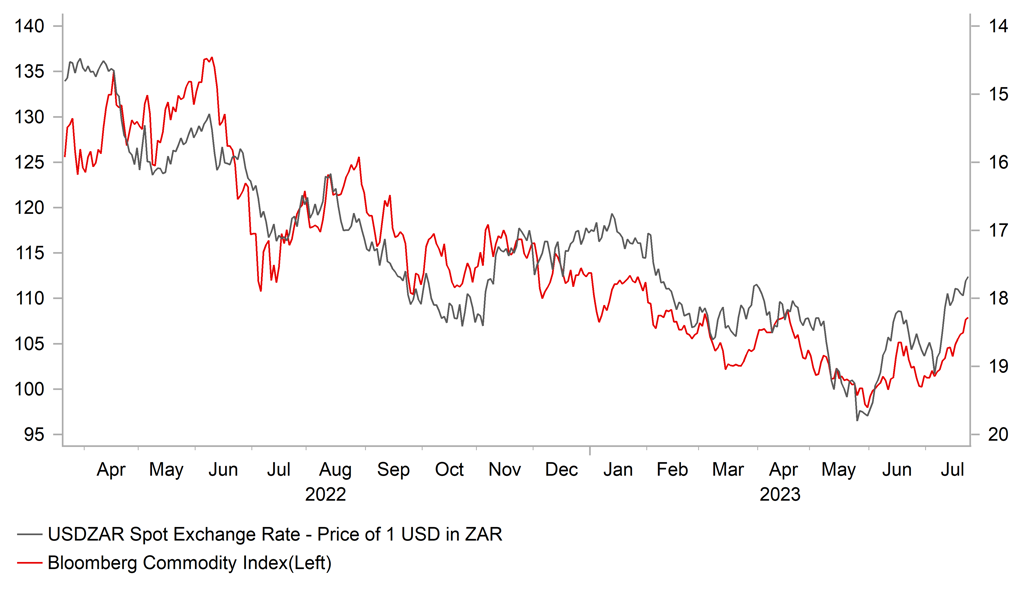

One asset class that has recently been suggesting a strengthening of global demand and/or easing of fears over the risk of harder landing for the global economy has been the commodity market. Bloomberg’s commodity price index (BCOM) has staged a strong rally from the year to date lows at the end May. It has risen by around 10% over that period which is the strongest rally for commodity prices since between July and August of last year, and has been providing more support for commodity-related currencies in the near-term. Since commodity prices bottomed at the end of May, the three best performing currencies have been the Colombian peso (+12.7% vs. USD), the South African rand (+(11.5%), and Brazilian real (+6.9%)

COMMODITY PRICES STAGING REBOUND & FEEDING INTO FX MARKET

Source: Bloomberg, Macrobond & MUFG GMR

EUR & GBP: PMI surveys dampen expectations BoE & ECB hike expectations

The euro and pound have continued to trade at modestly weaker levels against the US dollar after correcting lower yesterday following the release of the weaker than expected PMI surveys from Europe. EUR/USD and cable fell to intra-day lows yesterday of 1.1060 and 1.2798 respectively. The release of the weaker PMI surveys from the euro-zone and UK have helped to dampen expectations for further rate hikes from the ECB and BoE. For the euro-zone the composite PMI fell to 48.9 in July moving down from 49.9 in June. The breakdown continued to reveal that business confidence is extremely weak in the manufacturing sector at 42.7 compared to in the service sector that came in at 51.1. The surveys suggest that economic activity has weakened at the start of Q3 after picking up between April and May, and will dampen expectations over the strength of the recovery expected in the second half of this year as the cost of living crisis eases. It was a similar story in the UK where the composite PMI fell back to 50.7 in July from 52.8 in June. There was some good news for the BoE though as there was a notable drop in the services prices charged sub-component.

The weaker PMI surveys have increased the risk of less hawkish policy updates from the ECB (Thurs) and BoE (3rd August). After delivering another 25bps hike this week, the ECB may not commit as strongly to a further hike later this year in September or October. The likelihood of the BoE delivering another larger 50bp hike next week has diminished further. It leaves the euro and pound trading on a softer footing ahead of the ECB’s and BoE’s upcoming policy meetings.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Ifo Business Climate Index |

Jul |

88.0 |

88.5 |

!! |

|

EC |

09:00 |

ECB Bank Lending Survey |

-- |

-- |

-- |

! |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Jul |

-17 |

-15 |

!! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

May |

1.5% |

0.9% |

! |

|

US |

15:00 |

CB Consumer Confidence |

Jul |

111.8 |

109.7 |

!!! |

Source: Bloomberg