FX market in holding pattern ahead of key risks later this week

JPY: Verbal intervention provides only temporary relief for the yen

The major foreign exchange rates have continued to consolidate at the start of this week ahead of the key event risks of the first presidential debate between Joe Biden and Donald Trump on Thursday, the release of the latest US PCE deflator report for May on Friday, and the first round of the French parliamentary elections on 30th June. The US dollar has weakened modestly overnight although remains close to recent highs with the dollar index once again attempting to break above the 106.00-level on a sustainable basis. The modest softening of the US dollar overnight has resulted in USD/JPY falling back to an intra-day low of 159.19. Yesterday’s comments from Japan’s top currency official Kanda and Finance Minister Suzuki have also helped to temporarily dampen upward momentum for USD/JPY as it moves back to within touching distance of the year to date high from 29th April at 160.17. The step up in verbal intervention was evident again overnight in comments from the Japanese government’s top spokesperson Hayashi who in a regular press conference reiterated that Japan is closely watching the foreign exchange market and will respond appropriately to excessive moves.

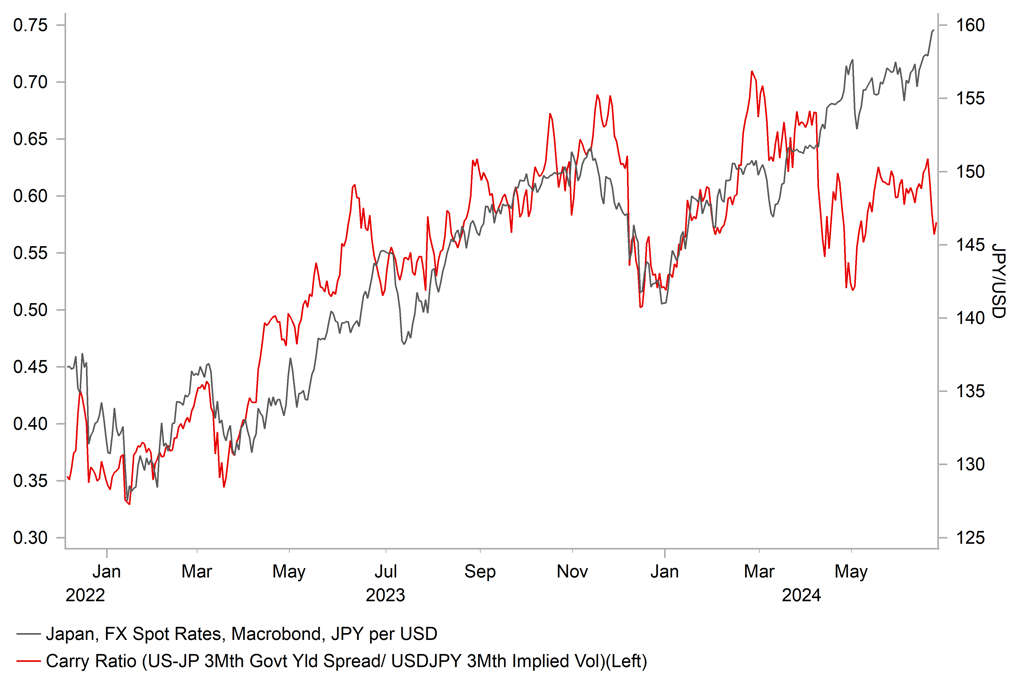

Comments from key Japanese officials at the start of this week have understandably made market participants more wary of the risk of another bout of direct intervention to support the yen should USD/JPY break above the 160.00-level. Yesterday’s comments highlighted that it was more about the pace of the yen sell-off that could trigger intervention rather than breaking a particular level. USD/JPY has been slowly grinding higher for most of this month which would make it harder to justify intervention at the current juncture. Last week’s decision from the US Treasury to add Japan to their monitoring list for foreign exchange practices has also cast some doubt on their willingness to intervene imminently. However, Vice Finance Minister Kanda did state yesterday that his counterparts in Washington don’t have a problem with Japan’s recent intervention, and the most important thing for them is transparency. As we saw before the last bout of intervention in late April/early May, Japan appeared to get the greenlight to intervene from the US. We expect Japan to remain under pressure to intervene again given the lack of fundamental triggers to encourage a reversal of the yen the weakening trend in the near-term. As we have seen over the past month, the yen has continued to weaken even as yield spreads between Japan have been narrowing. The release of the latest IMM report revealed that leveraged funds have been rebuilding short yen positions in recent weeks which have risen back to their highest level since back in 2017.

YEN SELL-OFF CONTINUES EVEN AS CARRY APPEAL HAS DIMINISHED

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Political risks remain important driver for EM FX in near-term

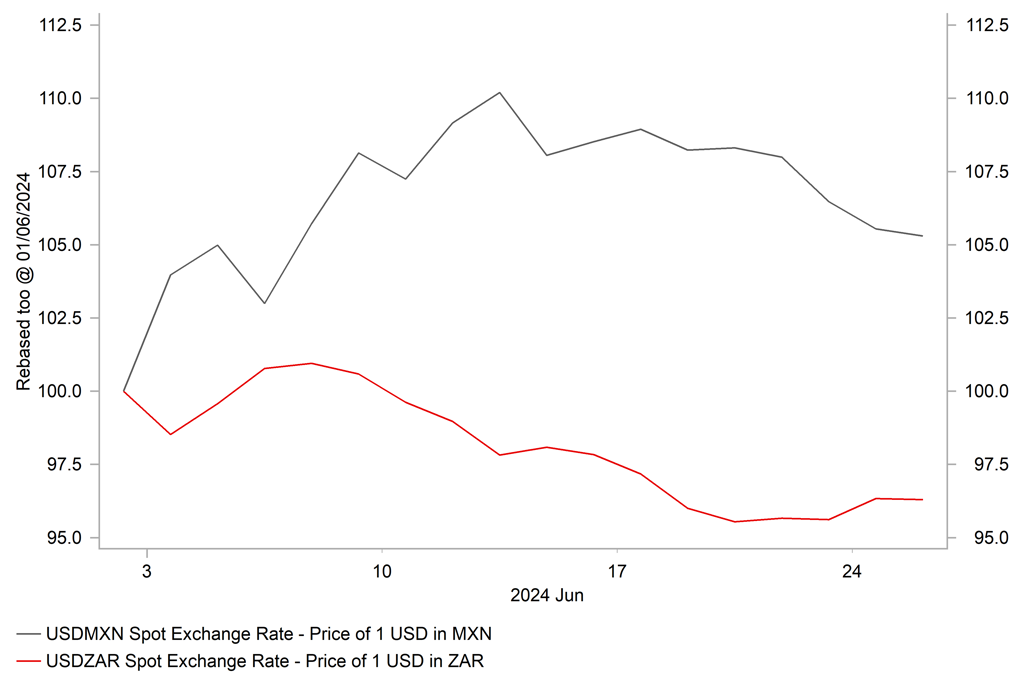

Emerging market currencies continue to trade close to year to date lows against the USD. The worst performing EM currencies year to date have been the TRY (-10.4% vs. USD), BRL (-9.9%), KRW (-7.2%), CLP (-7.1%) and THB (-6.8%). While the RUB (2.6% vs. USD) and ZAR (+1.6%) have been the only two EM currencies that have strengthened against the USD. Over the past week EM currency performance has been more mixed, the best performing currency has been the MXN (+2.7% vs. USD) which has started to rebound following the sharp post-Mexican election sell-off. The price action supports our view that the scale of the MXN sell-off was overdone on the back of heightened fears over constitutional reform in Mexico. In contrast, the RUB (-2.% vs. USD) and TRY (-1.1%) have weakened the most against the USD.

The USD has strengthened for three consecutive weeks even as US yields have been correcting lower. The 10-year US Treasury yield has been consolidating at just above the 4.20% over the past week after hitting a high of 4.74% in late April. The release in the week ahead of the latest US PCE deflator report for May is expected to provide further confirmation that core inflation has slowed in recent months. It has given us more confidence that the Fed will be able to deliver multiple rate cuts in 2H of this year. US economic data surprises continue to surprise to the downside including the recent pick-up in initial claims pointing towards a softening of growth momentum.

However, it has been offset by negative developments outside of the US. Within EMEA FX, the Central European currencies of the CZK, HUF and PLN have underperformed since French President Macron called a snap election with the first round set to take place on 30th June. It has helped to lift EUR/CZK and EUR/HUF up to the 25.000 and 400.00 levels respectively. The PLN has been quicker to stage a tentative rebound over the past week after EUR/PLN failed to sustain levels above 4.3500 and dropped back below 4.3000 yesterday. The Central European currencies could yet weaken further in the week ahead if Le Pen’s RN party and the “Popular Front” alliance of left-wing parties both make it through to the second round of the French parliamentary elections. The best performing EMEA EM currency so far this month and year to date has been the ZAR. The ZAR has recorded strong gains in recent months resulting USD/ZAR falling from the 19.000-level to briefly below the 18.000-level for the first time since July of last year. It is an important technical support level for USD/ZAR with South African equity markets also testing last year’s highs with both reflecting investor optimism over the implementation of much needed structural reforms under the new government. Please see our latest EM EMEA Weekly for more details (click here).

POLTICAL RISK HAS RESULTED IN BIG DIVERGENCE BETWEEN MXN & ZAR

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

12:00 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

12:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

CA |

13:30 |

CPI (YoY) |

May |

2.6% |

2.7% |

! |

|

US |

14:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Apr |

-- |

0.3% |

! |

|

US |

17:00 |

Fed Governor Cook Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg