USD continues to recover lost ground after heavy sell-off

USD: US growth slowdown fears ease helping to support US dollar

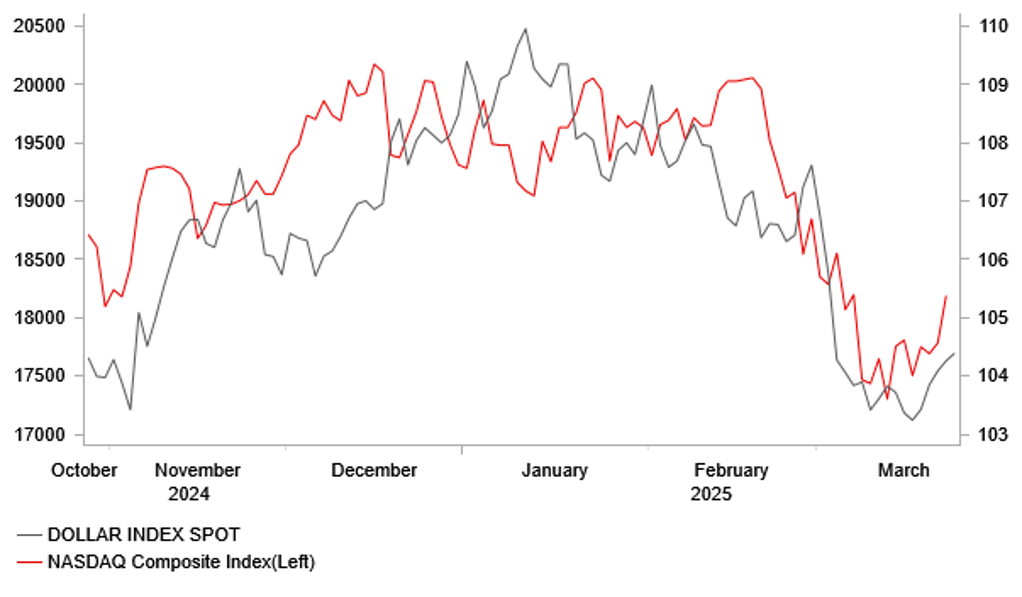

The US dollar has continued to strengthen at the start of this week resulting in the dollar index recording its fourth consecutive day of gains yesterday. It helped to lift USD/JPY back above the 150.00-level and EUR/USD below the 1.0800. The US dollar has been supported both the by the pick-up in US yields and strong gains for the US equity markets. The Nasdaq composite index closed sharply higher by 2.3% yesterday rising back above the 18,000-level for the first time early March adding to investor confidence that a near-term bottom is now in place after the recent heavy sell-off. The strong improvement in investor confidence came on the day that it was reported President Trump would take a more targeted approach for “reciprocal tariffs” which would help to ease the risk of economic disruption. President Trump stated as well that “I may give a lot of countries breaks” indicating that he may grant possible exemptions or reductions in tariff rates for chosen countries.

However, he still emphasized that the tariffs will be “substantial” when they are announced on 2nd April. Furthermore, he confirmed that he plans to proceed with sector-specific tariffs on lumber and semiconductors “down the road”. Tariffs on pharmaceuticals and autos sound like they will be implemented quicker. He stated tariffs on pharmaceutical drugs would come in the “very near future”, and tariffs on autos could come “fairly soon, over the next few days”. He also announced “secondary tariffs” of 25% that would apply to any country who purchase oil from Venezuela although the global impact is expected to be limited. Our commodity analyst has highlighted that seaborne crude exports equalled 0.24 million barrels/day to the US and 0.59 million barrels/day to the world excluding the US which are negligible amounts. The mixed messaging from President Trump over his tariff plans will help to policy uncertainty unusually elevated although on balance there more optimism that the hit to global growth from tariffs won’t be as bad as initially feared.

At the same time, US yields and the US dollar were supported yesterday by the release of the better than expected US PMI surveys for March. The services PMI survey jumped higher by 3.3 points to 54.3 March helping to lift the composite PMI to 53.5. It more than offset the negative impact from the drop in the manufacturing PMI survey by 2.9 points to 49.8. The rebound in the services PMI reversed just over half of the sharp drop in the first to months of this year and has helped to ease some of the recent build up in concerns over a more sustained slowdown for the US economy. The composite PMI has moved back closer into line with the average from last year of 53.7 when the Us economy expanded strongly by 2.8%. Business confidence also improved in Europe in March. The euro-zone composite PMI increased modestly by 0.2 point to 50.4 reaching the highest level since August, and the UK composite PMI increased more strongly by 1.5 points to 52.0. Overall, the latest PMI surveys point towards more resilience for the global economy in the face of heighted US policy uncertainty providing support for higher beta currencies.

US TECH STOCKS REBOUND ALONGSIDE USD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Limited spill-overs from Turkey into other emerging markets

Emerging market currencies have weakened modestly against the USD over the past week having lost upward momentum. The worst performing emerging market currencies have been the TRY (-3.4% vs. USD), RUB (-3.2%), HUF (-1.9%) and BRL (-1.6%). In contrast, the INR has clearly outperformed (+0.9% vs. USD) strengthening alongside the MYR (+0.2%) against the USD.

The bullish trend for EM FX against the USD has been displaying signs of exhaustion after sharp gains since the start of this month. It has been notable that the USD has rebounded over the past week even after the dovish Fed’s policy update pulled down US yields. Fed Chair Powell indicated that the Fed is willing to look through higher inflation this year from tariffs based on the belief that it is likely to prove transitory. FOMC participants’ forecasts for inflation in 2026 and 2027 were left unchanged. As a result, the Fed is sticking to plans to cut rates further later this year by 50bps in response to expectations for the labour market to loosen as the unemployment rate rises up to 4.4% by year end. Another unfavourable development for the USD have been reports that President Trump’s plans for tariffs on 2nd April won’t be as disruptive as feared. A more targeted approach for reciprocal tariffs and not following through at least initially on plans for sector-specific tariffs would help ease downside risks for global growth and emerging market currencies.

The TRY has been the worst performing currency over the past week triggered by the latest domestic political developments in Turkey. USD/TRY initially jumped above the 41.000-level but has since dropped back below the 38.000-level. It marks a step up in the pace of TRY depreciation which had been declining by an annualized rate of around -15% against the USD. The main trigger for the faster TRY sell-off has been the detention and formal arrest of Istanbul Mayor Ekrem Imamoglu who was jailed on corruption charges on Sunday. The case has the potential to keep Imamoglu behind bars for years and prevent hm running from running against President Erdogan in the next election. His arrest came on the same day that he was scheduled to be declared the presidential candidate for the main opposition Republican People’s Party, CHP. Turkey’s market regulator has since announced steps on Sunday including a ban on short-selling, more relaxed conditions for share buybacks and a reduction of the minimum equity capital protection requirement for margin trading. The Central Bank of Turkey also raised the overnight lending rate by 2 percentage points to 46.00% to tighten monetary policy and provide more support for the TRY.

According to reports, Turkey’s top economic officials will speak with foreign investors today in the latest attempt by the government to calm financial markets. Finance Minister Simsek and CBRT Governor Karahan are both scheduled to speak at 1pm London time according to the Treasury website. President Erdogan emphasized yesterday that he will maintain more investor-friendly policies that have been put in place since Simsek became Finance Minister in 2023. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German Ifo Business Climate Index |

Mar |

86.8 |

85.2 |

!! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Mar |

-28 |

-23 |

! |

|

US |

12:00 |

Building Permits |

Feb |

1.456M |

1.473M |

!! |

|

US |

12:40 |

FOMC Member Kugler Speaks |

-- |

-- |

-- |

! |

|

US |

13:00 |

S&P/CS HPI Composite - 20 s.a. (MoM) |

Jan |

-- |

0.5% |

! |

|

US |

13:05 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

US |

14:00 |

CB Consumer Confidence |

Mar |

94.2 |

98.3 |

!!! |

|

US |

14:00 |

New Home Sales |

Feb |

682K |

657K |

!!! |

|

GE |

16:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

18:35 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg