USD softens on Bessent pick but unlikely to last

USD: Softer dollar as trade concerns ease – but for how long?

The US dollar has weakened in the early stages of trading this week reflecting some easing concerns over the approach of the Trump administration to implementing trade tariffs following the confirmation from President-elect Trump that Scott Bessent would be his Treasury Secretary. Bessent was not the choice of some prominent Trump supporters with Elon Musk suggesting he would be the “business as usual” choice. Bessent has also in the past indicated a possible more balanced approach to the implementation of trade tariffs. The FX response today was reinforced by comments he made to the Wall Street Journal following his nomination when he stated that his priority would be to deliver on Trump’s various tax-cut pledges, including making the TCJA permanent, and eliminating tax on tips, social security benefits and overtime pay. However, Bessent did add in his comments to the WSJ that enacting trade tariffs and cutting spending would also be a focus as would be “maintaining the status of the dollar as the world’s reserve currency”. Market participants will also remember his comments in an FT interview earlier this year when he suggested tariffs would be a negotiating strategy suggesting the policy might not be to simply implement across the board tariffs in one big swoop. Nonetheless, he also spoke of a strategy of “escalate to de-escalate”! Our view on this selection is that we should not read too much into this choice. The Treasury Secretary position of course is hugely important but is not the person who will design the finer details of the strategy on trade tariff implementation. It is clear he supports trade tariffs and in that regard is aligned with Trump but he won’t be the person driving the strategy.

His comment to the WSJ on maintaining the reserve status of the US dollar is therefore perhaps more important. He views credibility as important and looks set to focus a lot on trying to improve stability and credibility in the US Treasury bond market. He has been advocating a “Three 3s” economic policy – cutting the budget deficit to 3% of GDP by 2028; fuelling real GDP growth of 3% through deregulation; and producing an additional 3mn barrels of oil per day. Those are policies, if achieved, that would certainly help provide considerable support for the dollar.

Even though that “three 3s” policy seems implausible in being achieved, we would be sceptical at this stage of reading this Treasury Secretary selection as dollar bearish. It’s not and it likely means little in terms of the implementation strategy of trade tariffs going forward. We would still expect a quick start to tariffs unlike in Trump’s first term and the correction weaker of the dollar is more a reflection of the scale of the move last week. EUR/USD plunged Friday on weak euro-zone economic data which has lifted the prospect of a 50bp cut from the ECB in December. While that’s still unclear in our view, the divergence momentum is clear and that will keep the dollar well supported into year-end and beyond, into the first quarter of 2025.

LEVERAGED FUNDS RUNNING LARGEST EUR SHORTS SINCE FEB 2022

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Weak PMI surveys reinforce downward momentum

The euro has continued to trade at weaker levels after the sharp sell-off at the end of last week. Euro weakness accelerated on Friday after the release of the much weaker than expected euro-zone PMI surveys for November. The sharp drop in business confidence provided the trigger for EUR/USD to break below the October 2023 low at 1.0448 which open the door for a bigger drop to 1.0335 recorded on Friday. The pair has since retraced most of the move lower on Friday although remains vulnerable to further weakness heading into year end.

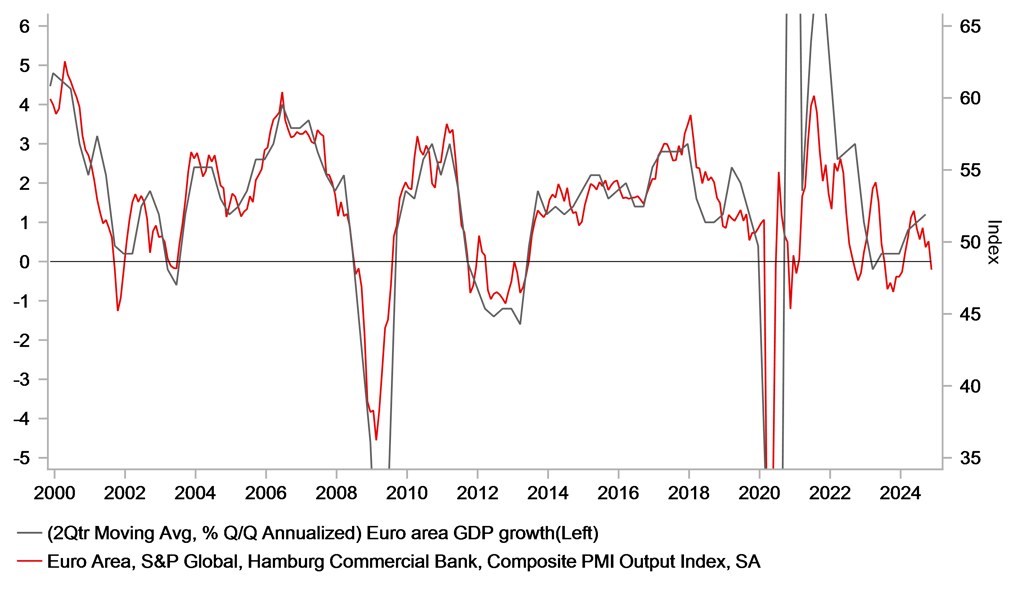

The release of the latest euro-zone PMI surveys for November provided another worrying signal for the outlook for the euro-zone economy. The composite PMI survey declined by 1.9 point to 48.1 in November. It was the weakest reading since January of this year and casts further doubt on the sustainability of this year’s economic recovery. The break down revealed that business confidence dropped sharply in both the manufacturing and service sectors by 0.8 point and 2.4 points respectively. The country-by-country breakdown revealed that the composite PMI measures fell by 3.3 points to 44.8 in France, by 1.3 points to 47.3 in Germany, and for the rest of the euro-zone it fell by 1.6 points to 50.7. At current levels, the composite PMI survey for the euro-zone is pointing towards the risk of renewed economic contraction again at the end of this year. However, the surveys have underestimated economic growth recently. In Q3 the composite PMI averaged 50.3 down from 51.6 in Q2 yet economic growth picked up to 0.4%Q/Q in Q2 from 0.2%Q/Q in Q2. It was the strongest quarter of growth since Q3 2022. It will provide some reassurance that the scale of weakness in the latest PMI surveys does not necessarily mean that the euro-zone economy is likely to contract again in Q4 although the weakening trend is concerning. The US election result likely contributed to the sharper drop in business confidence in November by heightened fears over disruptive trade policies under President elect Donald Trump.

ECB officials speaking last week continued to stick to dovish policy rhetoric signalling another rate cut was very likely at the next policy meeting in December even before the release of the weak PMI surveys for November. The euro-zone rate market has since gone one step further by moving to price back in a higher probability of the ECB delivering a larger 50bps rate cut in December or January. There are currently around 37bps of cuts priced in by December and 71bps of cuts by January. So far there has been strong indication from ECB officials that they are actively considering delivering a larger 50bps cut as soon as next month. The ECB may want to see the weakness in the business surveys replicated in the hard economic activity data as well before delivering a larger 50bps cut especially after the recent wage data from the euro-zone for Q3 picked up significantly to fresh cyclical highs although it has been downplayed as a lagging indicator. We are not yet convinced a larger 50bps cut will be delivered as soon as next month although that could become more likely early next year when ECB officials could have more clarity over Trump’s tariff plans. Overall, we remain comfortable sticking with our short EUR/USD trade recommendation (click here)

PMI SURVEYS SIGNALING RENEWED GDP CONTRACTION IN EURO-ZONE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

IFO Business Climate |

Nov |

86.0 |

86.5 |

!!! |

|

UK |

09:00 |

BoE's Lombardelli speaks |

!!! |

|||

|

UK |

10:30 |

BoE's Dhingra speaks |

!! |

|||

|

GE |

13:00 |

Chicago Fed Nat Activity Index |

Oct |

-0.2 |

-0.28 |

! |

|

EC |

16:30 |

ECB's Lane speaks |

!!! |

|||

|

EC |

17:30 |

ECB's Nagel speaks |

!! |

Source: Bloomberg