Banking sector angst, debt ceiling concerns and recession risks

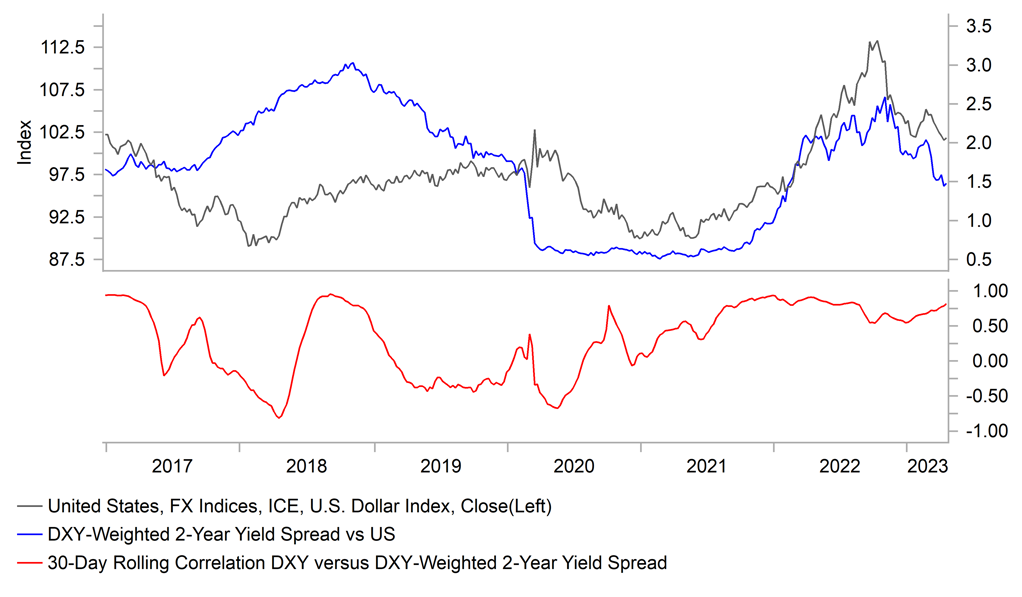

USD: Risk aversion hits yields elsewhere

The list of reasons for investors to reduce their appetite for risk is lengthening – and all of this ahead of the FOMC’s likely rate hike next week. This seems foolish to us and the Fed continues to look in the rear-view mirror to justify another rate hike that looks less and less necessary. The FOMC remains in focus but you can sense investors looking beyond that event already, especially to the event risk that is likely to quickly dominate – the debt ceiling fiasco and the impending moment of reaching the point of exhausting the extraordinary measures to keep the government functioning. In addition to this we have uncertainties over the US banking sector that won’t go away and the mixed economic data that mostly points to recession risks increasing.

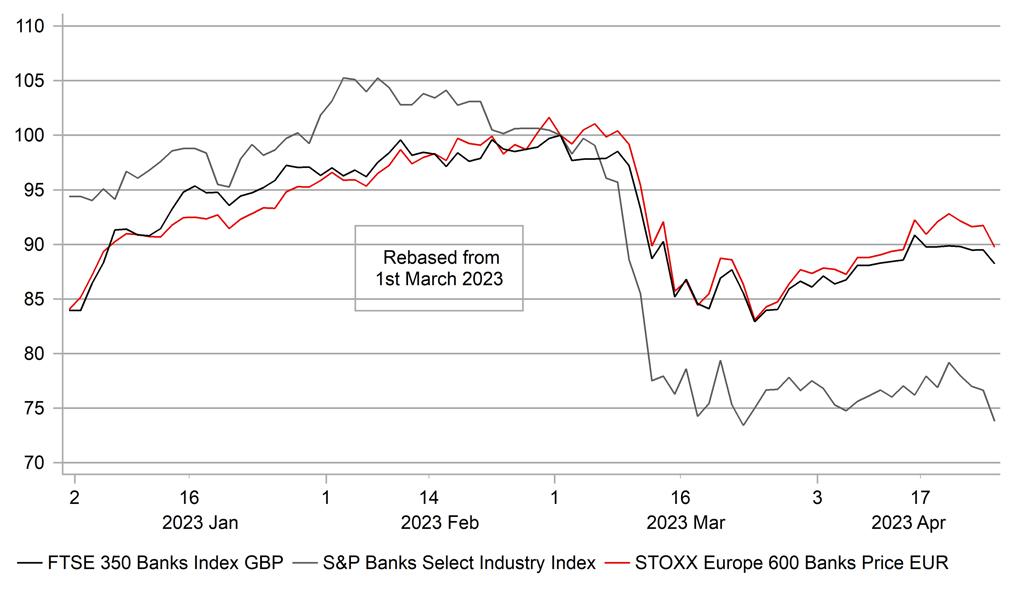

The re-emergence of banking sector risks should certainly worry the Fed and is the factor that has possibly weighed most on sentiment. First Republic shares plunged yesterday on confirmation that its deposits fell by USD 72bn in Q1, which would have been over USD 100bn were it not for the USD 30bn placed by large US banks as a show of support in attempting to halt the deposit flight. Deposits are reported to have stabilised but continue to fall modestly. The US is clearly underperforming here with the S&P 500 Bank Index still down 26% since the start of March, which is just 0.4% above the low in March. The Euro Stoxx Bank Index is up 9.3% from the low in March while the FTSE 350 Bank Index is 6.4% from the low in March. Risks are clearly perceived as higher in the US.

US Treasury Secretary Yellen spoke yesterday at a conference in Washington and warned that the debt ceiling stand-off risks major damage to the US economy if not resolved soon, stating it could lead to “economic catastrophe”. The latest estimate for the US hitting an end-date is expected to be provided to Congress, probably this week or next and the current short-fall in tax receipts likely means that date will be brought forward more firmly into June. If reached the US Treasury would prioritise US Treasury coupon payments at the expense of other payments and that risk will likely increasingly weigh on confidence as the date approaches. It only reinforces the downside economic risks that are building based on incoming economic data.

The debt ceiling issue is clearly a USD negative risk. The dollar rebounded yesterday in part on bigger declines in short-term rates elsewhere but that did not last as US yields fell more notably into the US close. Comments by Philip Lane yesterday did not provide much clarity on whether the ECB will hike by 25bps or 50bps next week. Worsening sentiment in China has hit the higher-beta G10 currencies. But a drift toward “economic catastrophe” would clearly hit short-term yields severely and see a potentially big move weaker for the dollar, certainly versus core G10.

BANKING EQUITY INDICES – US VS EURO-ZONE VS UKX

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Fiscal good news a positive

There was limited reaction in the FX market to the government budget data from the UK yesterday but the data was notable in potentially opening up the prospect of fiscal expansion ahead of the next general election that would well take place toward the end of next year. The data revealed that the government borrowed GBP 139.2bn in the fiscal year that ended in March, which was GBP 13.2bn less than the Office of Budget Responsibility had predicted just last month.

This is quite a divergence given how recent the OBR prediction was and reflected the fact that government spending was some GBP 17.2bn below estimate. The surprise fiscal space that emerged in the data came despite the March borrowing total being the second largest on record back to the start of the current data series in 1993. The government remains on track to take the deficit in GDP terms down to below 3% of GDP over a 5-year period – the current government’s target. The OBR estimates a deficit of 3.1% of GDP in FY24-25.

But the data now opens up the opportunity for the government to announce tax cuts in the Autumn Budget Statement that would become effective possibly in April 2024 ahead of a general election later next year. That could well be a supportive factor for the pound toward the latter part of this year when we expect the Federal Reserve will be cutting rates. A scenario of fresh fiscal stimulus would strengthen the prospect of the BoE being slower to cut rates than the Fed and help propel the GBP/USD rate to levels around 1.3000 or above. In the meantime comments yesterday by BoE MPC members Huw Pill and Ben Broadbent did little to alter the market expectations of another 25bps hike to 4.50% at the meeting in May.

DXY / YIELD CORRELATION REMAINS ELEVATED

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB's Enria Speaks |

-- |

-- |

-- |

!! |

|

SZ |

09:00 |

ZEW Expectations |

Apr |

-36.0 |

-41.3 |

! |

|

UK |

09:30 |

Labour Productivity |

Q4 |

0.3% |

0.9% |

! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

Apr |

9 |

1 |

! |

|

FR |

11:00 |

France Jobseekers Total |

-- |

2,790.0K |

2,781.0K |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-8.8% |

! |

|

EC |

13:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Core Durable Goods Orders (MoM) |

Mar |

-0.2% |

-0.1% |

!!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Mar |

0.7% |

-1.0% |

!! |

|

US |

13:30 |

Durables Excluding Defense (MoM) |

Mar |

0.3% |

-0.5% |

!! |

|

US |

13:30 |

Goods Orders Non Defense Ex Air (MoM) |

Mar |

-0.1% |

-0.1% |

!!! |

|

US |

13:30 |

Goods Trade Balance |

Mar |

-89.00B |

-91.99B |

!! |

|

US |

13:30 |

Retail Inventories Ex Auto |

Mar |

0.1% |

0.3% |

!! |

|

US |

13:30 |

Wholesale Inventories (MoM) |

-- |

-- |

0.1% |

! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

-- |

-0.3% |

-3.6% |

! |

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

3.665% |

!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

Source: Bloomberg