BoJ meeting outcome provides green light to yen selling

JPY: BoJ fails to arrest JPY slide, over to the MoF

The BoJ policy decision has provided little in the way of a hawkish shift with a far more simplified statement now that QQE has been abandoned with the MPM confirming the BoJ would guide the policy rate to remain in a 0.0%-0.10% range and that asset purchases would continue in line with the details outlined in the March statement. The BoJ also released it updated “Outlook for Economic Activity and Prices” report and in general the details on the economy were similar to the descriptions used in the statement in March. The descriptions of the general economy was the same (“recovered moderately but some weakness has been seen in part”) as was other specific aspects of the economy and the global economy.

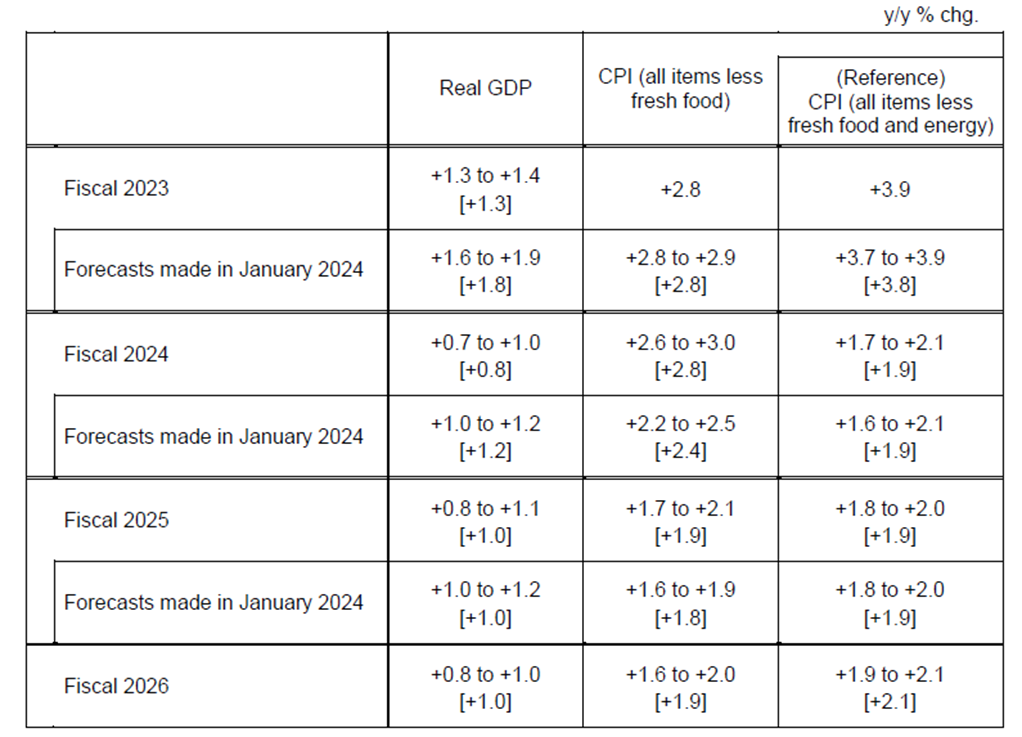

However, the most obvious area of change was in regard to inflation with the BoJ now indicating higher inflation than before. This though was expected given the rate rise in March. The core nationwide YoY CPI was revised up more than expected though in FY2024 from 2.4% to 2.8%. The revision to FY2025 was +0.1ppt to 1.9% and the first estimate for FY2026 was put at 1.9% as well. We would argue that estimate is a little on the cautious side and implies a level of confidence in achieving the inflation goal that warrants continued caution. Inflation risks are skewed to the upside for the current fiscal year but are balanced in the period after again arguing against any urgent need for monetary policy tightening. The economy and inflation risks laid out in the updated outlook report were the exact same as those laid out in the last report in January.

Governor Ueda is now talking in the press conference and the tone of the comments are again similar to those made in March. Ueda has confirmed that JGB buying would continue as indicated in the March statement (JPY 6trn p mth) and that the BoJ would adjust the “degree of monetary easing if the price trend rises”. Ueda as expected reiterated monetary policy would not be used to control FX but that it could be a “vital factor” in the inflation outlook. Similar to March Ueda confirmed that the “certainty of hitting the price target is rising gradually” and the final paragraph of the outlook report on the guidance of policy indicates the bias to hike again by “adjusting the degree of monetary accommodation”. The BoJ also confirmed that the “virtuous cycle” (wages and prices) continues to gradually intensify which leaves open the scope for a rate hike in July, the MUFG current view.

But it’s no surprise that the yen is weaker in the aftermath of the BoJ announcement and press conference to date given there is no shift in communication on when the next rate hike may come. We see this as a “green light” for the market to continue selling the yen and means intervention by the MoF will be required. This remains an event that could and likely will take place very soon and possibly today. The authorities we believe are now compelled to act after such sustained warnings and given the joint statement issued with the US and South Korea. The yen slide is politically damaging for the government and it is negative for economic growth from the perspective of consumer spending. There is a growing risk of a general election in the summer and letting the yen continue breaking fresh lows after persistent and strong warnings against such a move would be very damaging to the government’s credibility.

BOJ UPDATED GDP AND INFLATION FORECASTS APRIL 2024

Source: BoJ Outlook for Economic Activity and Prices April 2024

USD: Real GDP slows but inflation stronger

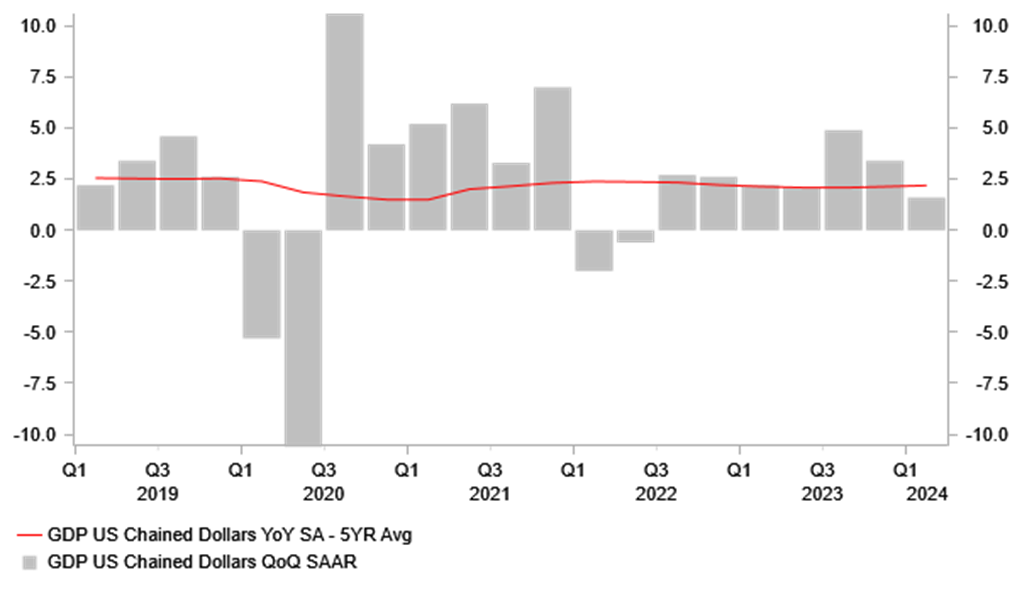

As is often the case with the GDP data it was a mixed picture with the weaker than expected Q/Q SAAR of 1.6% down in part to the weakness in the volatile components – inventories and net trade. Those are components that could easily reverse the following quarter or be revised in the next estimated data at the end of May. If we ignore those components and look at real final sales to private domestic purchasers, growth was impressive at 3.1%, down marginally from 3.3%.

But there was still a clear slowdown in consumer spending from 3.1% in Q4 last year to 2.5%. It’s too soon to say but this could mark a turning point given the excess savings support for consumption is no longer going to be the driver of consumption growth which we believe leaves the US economy more vulnerable to a slowdown as the monetary policy transmission continues to feed into the economy.

The focus of investors though was on the stronger than expected PCE inflation reading and the 3.7% Q/Q increase in the core PCE points to today’s March MoM increase coming in north of 0.3%. Still, today guide for that reading should mean there is less market reaction to this this afternoon.

The market reaction to the data has been interesting and certainly looks to us like indicating limits to further US dollar strength at this point. UST bond yields out to 10yrs shifted higher by about 6bps in response to the data with the focus on the PCE. Yields abroad shifted by less and the US dollar weakened marginally on the day. There were plenty of reports citing stagflation concerns that could undermine confidence in the US if the data continues to slow. We are not in the camp of stagflation and still see US CPI moving lower but over the short-term if US activity weakens further the concerns over stagflation will likely increase. We doubt we are about to see any sustained turn in the recent dollar strength but the price action does suggest it will take more than divergence speculation to drive EUR/USD down and say below the 1.0500 level, especially given the US curve is now already priced showing the first full 25bps cut is now priced for after the presidential election in November, some five FOMC meetings away. A lot can happen to alter expectations by then.

US GDP GROWTH DECELERATES FURTHER AND TO A LEVEL BELOW 5YR AVERAGE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

SNB Board Member Jordan Speaks |

-- |

-- |

-- |

!!! |

|

EC |

09:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Mar |

0.5% |

0.4% |

! |

|

EC |

09:00 |

Loans to Non-Financial Corporations |

Mar |

-- |

0.4% |

! |

|

EC |

09:00 |

Private Sector Loans (YoY) |

-- |

0.3% |

0.3% |

! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Mar |

0.3% |

0.3% |

!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Mar |

2.6% |

2.8% |

!!! |

|

US |

13:30 |

PCE Price index (YoY) |

Mar |

2.6% |

2.5% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

Mar |

0.3% |

0.3% |

!! |

|

US |

13:30 |

Personal Income (MoM) |

Mar |

0.5% |

0.3% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Mar |

0.6% |

0.8% |

!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

-- |

-- |

0.7% |

! |

|

CA |

13:30 |

Wholesale Sales (MoM) |

-- |

-- |

0.0% |

!! |

|

US |

14:00 |

Dallas Fed PCE |

Mar |

-- |

3.40% |

! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Apr |

3.1% |

2.9% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Apr |

3.0% |

2.8% |

!!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Apr |

77.0 |

77.4 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Apr |

77.8 |

79.4 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Apr |

79.3 |

82.5 |

! |

Source: Bloomberg