Building concerns over downside risks to growth support CHF & JPY

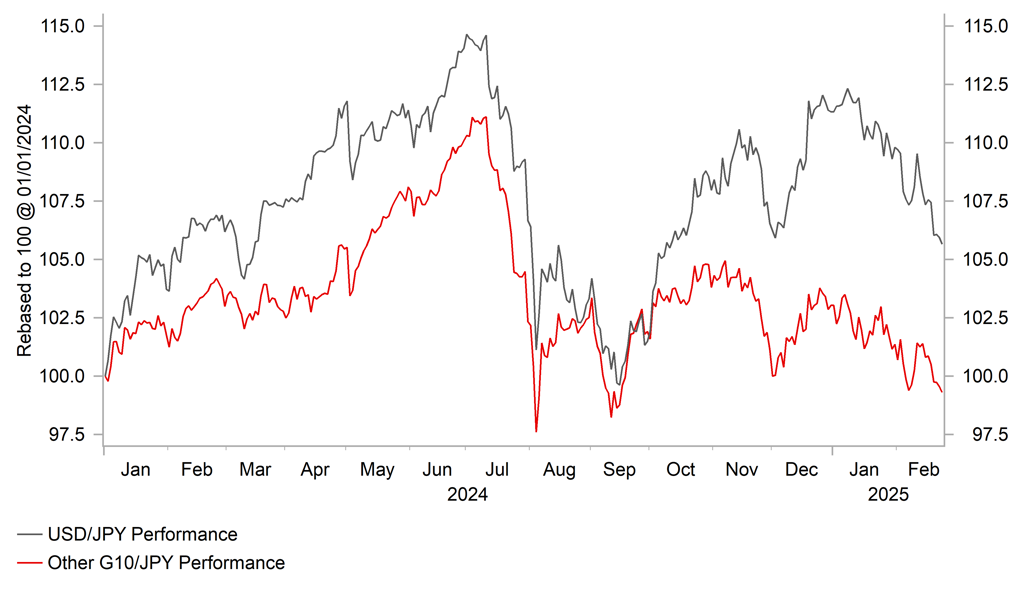

JPY: Growth fears continue to build weighing on yen crosses

The yen has weakened modestly overnight rising back up to 149.50 after hitting a fresh year to date low yesterday at 148.57. Technical support was provided by the early December low of 148.65 that was tested but has held for now. The yen benefitted yesterday alongside the other traditional safe haven currency of the Swiss franc from building investor concerns over the weakening outlook for global growth. It has contributed to the recent underperformance of the commodity-related currencies of the Australian, Canadian and New Zealand dollar that have been the worst performing currencies this week. Similarly, Bloomberg’s commodity price index has corrected lower over the past week after recording strong gains at the start of this year. Investor concerns over slowing global growth were reinforced by the release yesterday of further evidence showing a drop in US consumer confidence. The Conference Board’s expectations measure of consumer confidence dropped sharply by almost 9.3 points in February and hit the lowest level since June of last year. The deterioration in consumer confidence was driven both by building concerns over higher inflation and worsening conditions in the labour market. The average measure of inflation expectations in twelve months rose by 0.8 point to 6.0% which was the highest reading since May 2023. At the same time, the differential between jobs plentiful and jobs hard to get measure fell by a further 2.3 points to 17.1 to the lowest level since February.

The weaker Conference Board measure of consumer confidence follows on from the weaker University of Michigan measure of consumer confidence for February and the weaker US retail sales report for January that are pointing towards a slowdown in US consumer spending at the start of this year. Consumer spending increased robustly by an annualized rate of 4.0% during the 2H of last year so some payback weakness was always likely at the start of this year. However it does not necessarily mean it is the start of a more sustained slowdown in consumer spending. Consumer spending has increased strongly by between 2.5% to 3.0% over the last three years. Nevertheless, the recent run of weaker US economic data releases are weighing heavily on US yields. The 2-year and 10-year US Treasury yields have both fallen by around 25bps and 50bps respectively from the highs recorded in January. Market participants have moved to price in a higher probability of the Fed cutting rates again by the June or July FOMC meetings which is adding to downward pressure on the US dollar in the near-term.

In other news overnight from the US, the Republicans squeezed their budget blueprint through the House by a 217 to 215 vote which was a victory for House Speaker Mike Johnson who united all but one of his GOP members. The House-passed plan calls for USD1.5 trillion to USD2.0 trillion in spending reductions over a decade and USD4.0 trillion to USD4.5 trillion in tax cuts. It now sets up a conflict with the Senate which favours larger tax cuts and plans to alter the House budget plan rather than accept it. Republican leaders emphasized to rank-and-file members in the House that the vote was a procedural step, and not a substantive vote on tax or health policy. Nevertheless it was reassuring that the they were able to come together and pass budget plans despite holding just a slim majority. President Tump has been calling for one big, beautiful bill”. However, the USD4.5 trillion ceiling for tax cuts likely isn’t enough to extend Trump’s tax cuts permanently and achieve all of the Republican’s other tax priorities such as extending taxes on tips and relaxing the cap on the state and local tax deduction.

YEN CONTINUES TO REBOUND AGAINST OTHER G10 FX

Source: Bloomberg, Macrobond & MUFG GMR

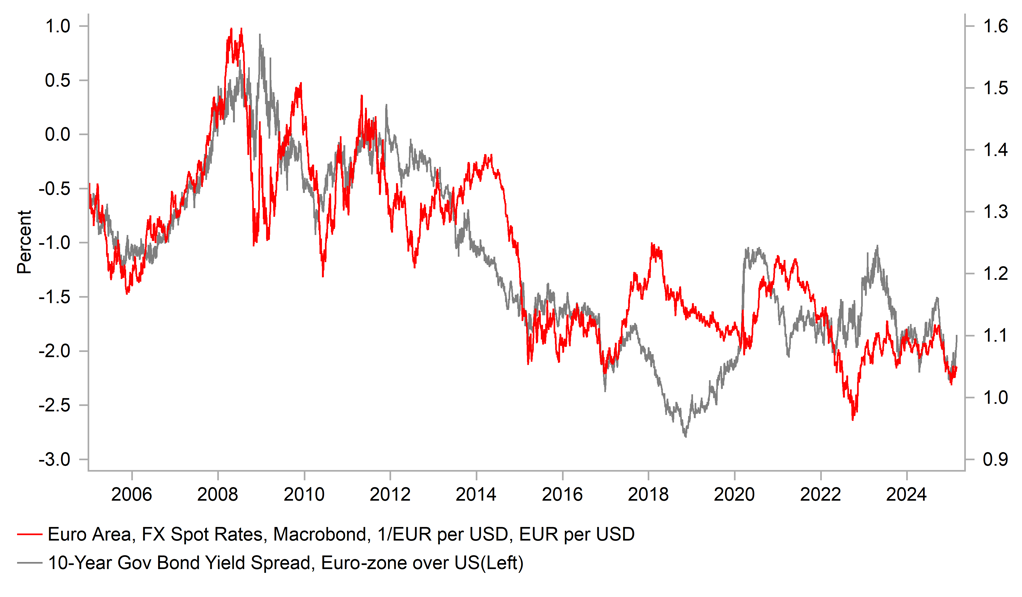

EUR: Optimism over more government spending helping to provide support

The euro is continuing to trade on a stronger footing following the German election results at the weekend. It has helped to lift EUR/USD back above the 1.0500-level with the pair close to recent highs at around 1.0530. The euro was supported yesterday by a Bloomberg report stating that the CDU/CSU parties are discussing plans with the SPD for debt-financed defence spending of up to EUR200 billion with the gaol of securing approval in the current parliament before the new legislature is sworn in next month. New Chancellor in waiting Friedrich Merz told reporters yesterday that “we are talking to each other, but it’s much too early to say something” while adding that “right now, I view it as very difficult”.

Without the required two-thirds majority in the new parliament, the mainstream parties don’t have enough votes to make changes to Germany’s constitutional borrowing limit. But the CDU/CSU and SPD who are expected to form the next coalition government could get around that by attempting to secure lawmaker approval before the Bundestag meets for the first time at the end of March, possibly with the support of the Greens. One idea reported under discussion would be another special fund to finance new military spending and aid for Ukraine. Other options could be to expand the existing EUR100 billion fund for armed forces or tweak the debt brake to allow for additional defence spending but those measures would require a two thirds majority in parliament. Chancellor in waiting Friedrich Merz stated yesterday that “it’s out of the question that we will reform the debt brake in the near future. If it happens at all it will be quite complicated and difficult task”.

The prospect of additional government spending/borrowing in Germany has contributed to the recent underperformance of Bunds. The yield spread between 10-year German and US government bonds has narrowed by around 30 basis points since early this month, and reached the narrowest level since October prior to the US election. A development that is helping to provide more support for the euro against the US dollar.

EUR/USD VS LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:00 |

Building Permits |

Jan |

1.483M |

1.482M |

!! |

|

US |

13:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

New Home Sales |

Jan |

679K |

698K |

!!! |

|

UK |

16:30 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

|

US |

17:00 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg