US Real GDP data unlikely to alter momentum for long

USD: US yields to remain under downward pressure

USD/JPY, the major currency pair most sensitive to changes in yields and monetary policy expectations, jumped sharply through the US trading session gaining a full two big figures from the low of 151.94 hit during London morning trading. That low saw USD/JPY complete a ten big figure rout from the high set on 3rd July, prior to the probable intervention that took place on 11th July. The two big figure jump yesterday was triggered by the stronger than expected real GDP for Q2, advancing 2.8% versus the consensus of 2.0%. Stronger than expected consumer spending was a key factor but government spending and capex were also on the stronger side of expectations. While good news, it’s rear-view mirror data and is unlikely to alter the evidence indicating weaker momentum for the economy that suggests the monetary stance has become more restrictive and to a level that warrants some easing.

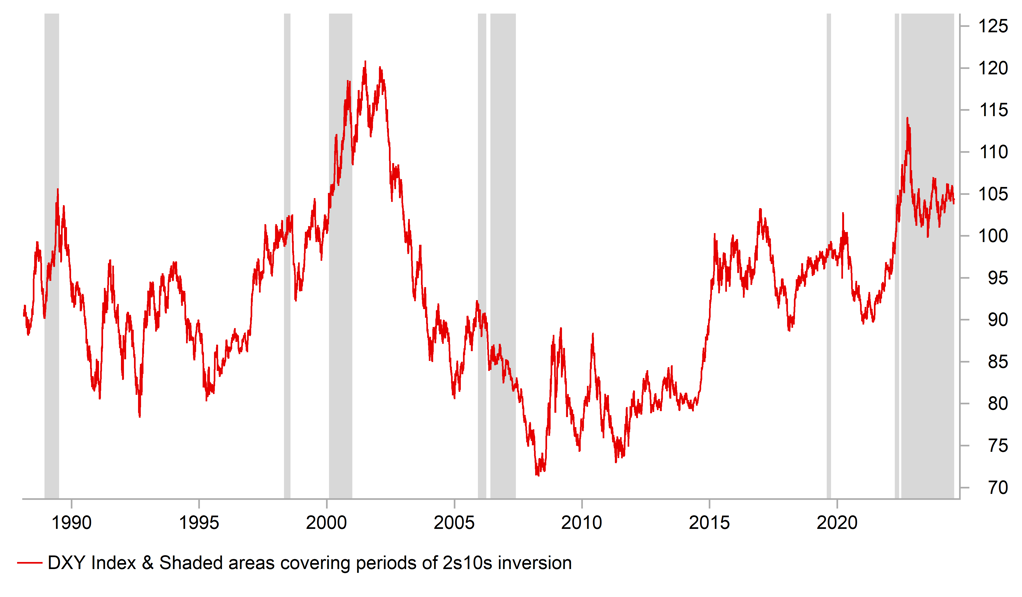

The curve is really important here and the move in 2s10s is exactly what happens as recession approaches. The period of actual 2s10s inversion and the performance of the dollar is mixed but once inversion ends is what tends to more clearly mark when the dollar weakens. There have been exceptions – some inversions were very brief too like prior to covid and then the dollar initially strengthened before then weakening. In 2001 following the curve inversion in 2000, the dollar remained strong mainly due to the very strong FDI inflows. The current inversion is by far the longest – inversion began in July 2022 – and hence will be a notable change in market dynamics when it comes to an end. The 2s10s inversion on Wednesday closed at -15bps, the smallest negative spread since the beginning stages of inversion back in July 2022.

Obviously inversions coming to an end tends to mark increased conviction on rate cuts coming and we doubt that conviction will be threatened by one stronger than expected GDP report. Weaker labour market conditions, easing inflationary pressures, weak consumer and business confidence and signs of renewed weakness in the housing market all are more important for policy deliberations and the prospects remain high that next week Fed Chair Powell will be in a much better position to signal more clearly the scope for rate cuts to come.

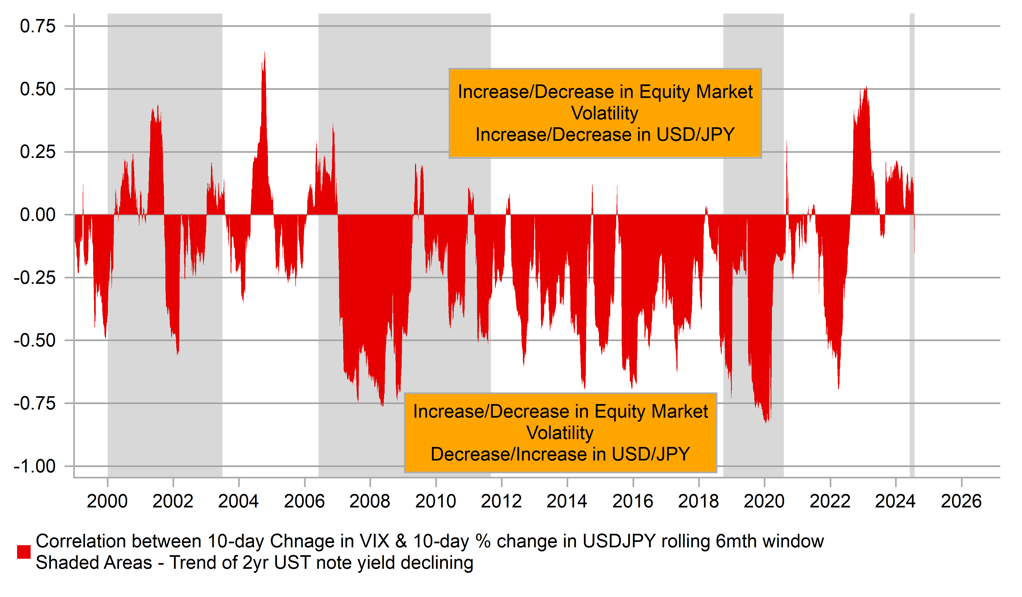

That scenario will certainly leave USD/JPY more vulnerable and means it is much more likely that this correction lower will not be retraced the way other corrections have been. USD/JPY was very much about elevated front-end yields in the US and the yen lost it’s safe-haven status due to higher inflation and higher yields often being the catalyst of risk-off. If front-end US yields sustain this move lower the yen/risk correlation will revive. It is of course early days but the 10-day rolling correlation of USD/JPY and VIX has turned negative again, for five consecutive days and by the most since 2022 when the correlation was gradually moving from negative to positive. When front-end yields are declining (shaded areas) the negative correlation tends to be strongest and reflects higher VIX and lower USD/JPY.

DXY & PERIODS OF 2S10S CURVE INVERSION

Source: Macrobond & Bloomberg

USD: 100-days with plenty of potential for political shifts in expectations

Sunday, this weekend will mark 100 days to the US presidential and congressional elections on 5th November. There is certainly enough time remaining for Kamala Harris to become better known and to reinforce her key policy focuses and differences from former President Trump. The latest update from The Economist today does provide some good news for Harris with her net favourability rating having jumped significantly in July as support for Biden faded after his infamous TV debate. The latest reading shows the narrowest margin between Trump and Harris since the beginning of the year and clearly underlines the recent positive momentum for Harris. Trump still leads in most of the key swing states and that is where Harris will have to make advances over the coming weeks to really shift expectations with the consensus still pointing to a Trump win on 5th November. Predicitit still shows a probability of Trump winning of 56% although this is well down from a high of 69%, and what Biden stepping down has done is bring the probability back to where we were when the TV debate took place in June.

We will be covering the financial market implications in more detail over the coming months ahead of the election but our current forecasts indicate we do not assume a Trump victory will lead to a surge in the US dollar. There are many factors that differ today compared to 2016 which means the response could be quite different. Firstly, a Trump victory will not be the shock it was in 2016. Secondly, the Fed in 2016 was in the early stages of a monetary tightening cycle in sharp contrast to likely being in the early stages of an easing cycle now. That means the economy will be weaker. Policy sequencing is also important and difficult to predict. Does he immediately introduce widespread tariffs with inflation still a risk to the economy? He waited in 2016, the dollar weakened notably in 2017 and only in 2018 did Trump focus on trade and tariffs. Finally, the US sovereign debt profile is markedly different and that could well threaten dollar performance, especially if Trump is verbally complaining about dollar strength and calling for weakness. So we remain unconvinced that the dollar is set to strengthen in the period following a Trump victory in November.

ROLLING CORRELATION – DAILY % CHANGE IN USD/JPY AND VIX AND SHADED AREAS SUSTAINED MOVES LOWER IN 2YR US YIELD

Source: Macrobond, Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE Quarterly Bulletin |

-- |

-- |

-- |

! |

|

IT |

09:00 |

Italian Business Confidence |

Jul |

86.9 |

86.8 |

! |

|

IT |

09:00 |

Italian Consumer Confidence |

Jul |

98.0 |

98.3 |

! |

|

UK |

11:00 |

CBI Distributive Trades Survey |

-- |

-- |

-24 |

! |

|

US |

13:30 |

Core PCE Price Index (MoM) |

Jun |

0.2% |

0.1% |

!!!!! |

|

US |

13:30 |

Core PCE Price Index (YoY) |

Jun |

2.5% |

2.6% |

!!!! |

|

US |

13:30 |

PCE Price index (YoY) |

Jun |

2.4% |

2.6% |

!! |

|

US |

13:30 |

PCE price index (MoM) |

Jun |

0.1% |

0.0% |

!!! |

|

US |

13:30 |

Personal Income (MoM) |

Jun |

0.4% |

0.5% |

! |

|

US |

13:30 |

Personal Spending (MoM) |

Jun |

0.3% |

0.2% |

!!! |

|

US |

14:00 |

Dallas Fed PCE |

Jun |

-- |

1.40% |

! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

Jul |

2.9% |

2.9% |

!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

Jul |

2.9% |

2.9% |

!! |

|

US |

15:00 |

Michigan Consumer Expectations |

Jul |

67.2 |

67.2 |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Jul |

66.0 |

66.0 |

!! |

|

US |

15:00 |

Michigan Current Conditions |

Jul |

64.1 |

64.1 |

! |

Source: Bloomberg