Softer CPI but GBP focus on UK Spring Statement

GBP: Credibility important as Reeves set to fill the gap

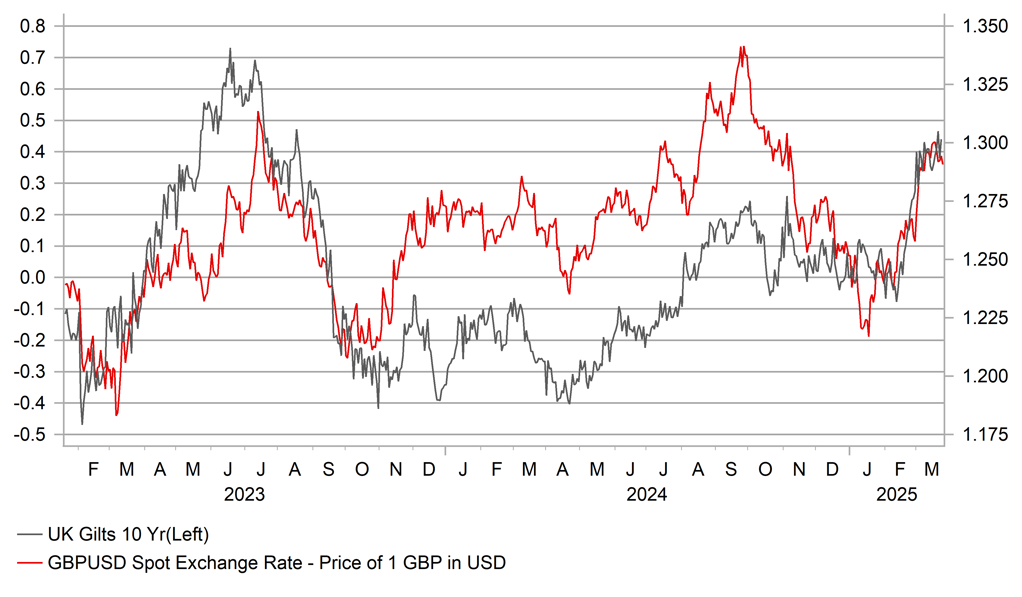

The pound has been performing well of late and since the start of February there has been a return to a positive correlation between Gilt yields and the performance of the pound. In that regard today’s Spring Statement from Rachel Reeves will be important – there is a widespread understanding that this statement has increased in significance given the weaker growth and higher Gilt yields that has seen the government’s fiscal space eroded. That fiscal space needs to be rebuilt in order to restore investor confidence in the government’s projections – and the details today will be important. The performance of the pound has been solid versus the US dollar, but that reflects broader dollar weakness, and performance has been more mixed versus the euro. However, taking the BoE’s trade-weighted index, the pound has advanced 3.3% from the low-point in January following the surge in Gilt yields at the height of the concerns over the credibility of the government’s fiscal plans. Since the end of January, GBP appreciation in TWI terms has coincided with rising Gilt yields – the 10-year Gilt yield has advanced 30bps and GBP TWI is up 2.1%. Today, the focus will be on restoring the GBP 10bn fiscal space from when announced in October plus an additional GBP 5bn deterioration in the finances meaning financial market participants are anticipating measures to raise around GBP 15bn. We already know government spending cuts rather than tax increases will be the source of finding this money.

GBP 5bn of welfare cuts and GBP 2bn of civil service savings by the end of the decade have already ben signalled but the details will be provided today. Finding the balance will be difficult without either hitting confidence over the growth outlook or undermining credibility. The OBR is set to cut the growth projection for 2025 from 2.0% to 1.0% but the OBR’s productivity assumptions over the medium-term are crucial for the government’s finances. A lowering of the assumed rate would be hugely costly. We do not expect any notable change in those assumptions from the OBR.

Some good news for the government came this morning with the CPI data for February coming in weaker than expected and hence raises the chances of the BoE delivering another rate cut in May. Overall we expect the GBP 10bn buffer to be restored with some of the spending cuts front-loaded in order to protect credibility. Assuming today’s announcement helps restore some of the lost credibility we would expect limited moves in Gilt yields and the pound. Gains for the pound also reflect optimism that the UK will avoid the worst of Trump’s reciprocal tariff plan and hence GBP support should be maintained until we get confirmation or not of that next week.

A TIGHT CORRELATION BETWEEN GBP AND THE UK-US 10-YEAR BOND YIELD SPREAD HAS BEEN RESTORED OF LATE

Source: Bloomberg, Macrobond & MUFG GMR

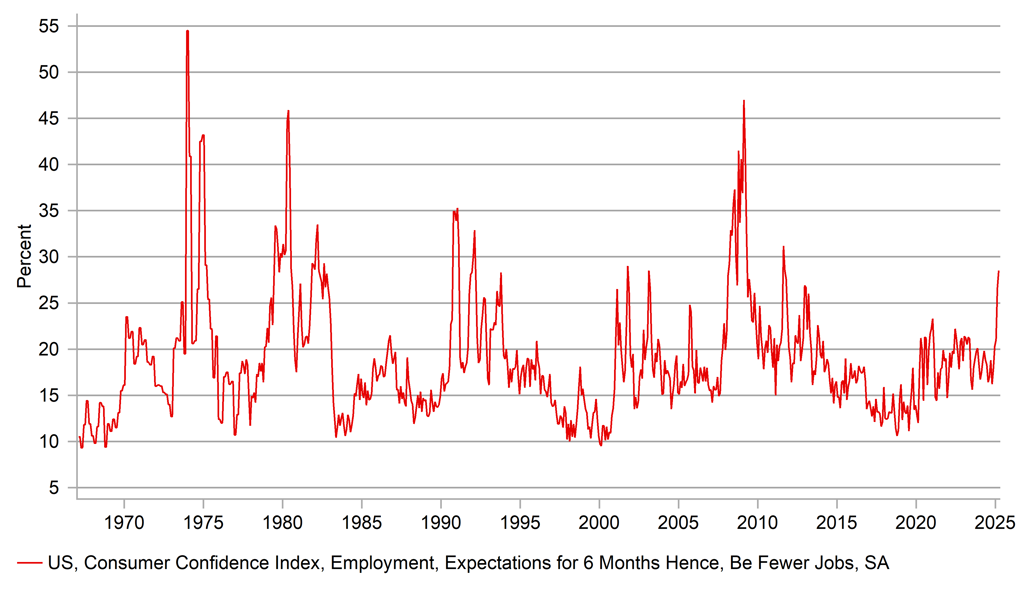

USD: Fiscal risks highlighted by Moody’s

There was another drop in US consumer confidence yesterday, the fourth consecutive drop since peaking in November on optimism following Donald Trump’s election victory. Since then, the realisation of elevated uncertainty and inflation concerns due to trade tariffs has seen a 20ppt drop in consumer confidence. The Expectations Index has fallen more sharply and dropped to levels below the worst post-covid point in 2022 to a level not seen since 2013. In addition to inflation fears (the median 12mth inflation expectation reading hit 5.1%, the highest since May 2023) confidence is likely being undermined by the prospect of large-scale government spending cuts that could undermine labour market conditions. The 6-month expectation component for fewer jobs jumped to 28.5 – the highest level since September 2011 which was just after the debt ceiling crisis and the S&P sovereign ratings downgrade.

The scale of the fiscal problems was highlighted in a fiscal update by Moody’s Ratings yesterday that concluded that the US fiscal position had “deteriorated further” since Moody’s downgraded the sovereign rating outlook for the US in 2023. Moody’s added that “fiscal weakening will likely persist even in very favourable economic and financial scenarios”. The report underlines the importance of the Department of Governor Efficiency (DOGE) in altering this worsening fiscal outlook in order to allow for the additional tax cuts Trump has promised while avoiding a counterproductive rise in long-term rates. The actions required by DOGE is another added uncertainty that is likely undermining confidence.

The dismissal of ‘probationary workers’ (under a year or sometimes two years of employment) at Federal Agencies could feasibly result in 220k job losses according to data from the US Office of Personnel Management while a further 75k have reportedly accepted a buy-out offer. A 300k hit to employment spread over the next 6mths would be a considerable hit to the economy before we even consider the potential loss of jobs related to contractual employment.

We can’t be sure yet how this will unfold over the remainder of this year although of course it is for sure a negative source of uncertainty that was evident in yesterday’s consumer confidence report. This loss of confidence due to greater employment uncertainties will lead to an increased appetite to save and add to factors likely to slow consumer spending this year. Ultimately, developments with the US consumer will be far more important for the Fed when deliberating monetary policy decisions later in the year and only reinforces the prospect of a slowdown becoming more evident as the year unfolds from here. Beyond an initial period of possible US dollar recovery we continue to see scope for further dollar depreciation.

US CONSUMER CONFIDENCE – EXPECTED LABOUR MARKET CONDITIONS IN 6MTHS TIME – FEWER JOBS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SZ |

09:00 |

ZEW Expectations |

Mar |

-- |

3.4 |

! |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

4.4% |

4.6% |

! |

|

UK |

10:00 |

Spring Forecast Statement |

-- |

-- |

-- |

!!!! |

|

US |

11:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-6.2% |

! |

|

US |

12:30 |

Durable Goods Orders (MoM) |

Feb |

-0.6% |

3.1% |

!! |

|

US |

12:30 |

Durables Excluding Defense (MoM) |

Feb |

-- |

3.5% |

! |

|

US |

12:30 |

Core Durable Goods Orders (MoM) |

Feb |

0.4% |

0.0% |

!!! |

|

US |

12:30 |

Goods Orders Non Def Ex Air (MoM) |

Feb |

-0.2% |

0.8% |

!!! |

|

CA |

12:30 |

Wholesale Sales (MoM) |

Feb |

-- |

1.2% |

! |

|

US |

14:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

SZ |

14:00 |

SNB Quarterly Bulletin |

-- |

-- |

-- |

! |

|

US |

15:30 |

Atlanta Fed GDPNow |

Q1 |

-1.8% |

-1.8% |

!! |

|

US |

17:00 |

5-Year Note Auction |

-- |

-- |

4.123% |

!! |

|

CA |

17:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

!! |

Source: Bloomberg