Trump makes his plans clear after Bessent optimism

USD: Day one tariffs highlights aggressive approach

The nomination of Scott Bessent as Treasury Secretary late on Friday had helped fuel optimism in the financial markets that the approach to trade tariffs might be more balanced than expected, which helped fuel a sell-off of the US dollar yesterday. President-elect Trump seems to have not liked that and late last night made it very clear the nomination of Scott Bessent means little to the approach to be taken by the new administration. If Trump’s comments on a 10% tariff on China in response to its failure to stop drugs coming to the US and a 25% tariff on Mexico and Canada for the failure to halt drugs and immigrants are true we can be sure that Trump’s approach to trade tariffs is going to be far different from his approach during his first term. Then, the first tariffs didn’t come until January 2018 and were based more on pure economic grounds. This time around, we will get Executive Orders on day one of the administration and the justification is more about countries securing their borders on the flow of drugs and immigrants. With Mexico and Canada part of the USMCA trade deal agreed toward the end of Trump’s first term, there was a belief that Mexico and Canada could have been treated less aggressively ahead of negotiations at the review stage of the deal in July 2026. So in that sense the reaction for MXN and CAD has been bigger with USD/CAD jumping nearly two big figures to a high not seen since the early stages of the covid pandemic in 2020. These tariffs Trump suggested would be above “any additional tariffs” suggesting for China at least that these actions would not limit additional tariff actions for other reasons.

Regarding tariffs used to halt immigrants and drugs from coming into the US, Trump may well look to the International Emergency Economic Power Act (IEEPA) that Trump threatened to use against Mexico during his first term when he complained about the flow of illegal immigrants. The legislation was signed by President Carter in 1977 and extends executive power over crises during times of peace. Trump also threatened its use against China but refrained from using the IEEPA against both Mexico and China. It looks like Trump will not be so cautious in his second term.

We would view this as a timely intervention from President-elect Trump that sends a very clear signal to the financial markets – that the reaction to the nomination of Scott Bessent was wrong – there will be no soft or balanced approach to trade tariff policy and it is highly likely now that the words of Trump should be taken seriously at least to the extent of making clear that tariffs will be a day one reality no matter who is Treasury Secretary. It points to yesterday’s dollar selling as being fleeting with further dollar strength and increased FX volatility ahead.

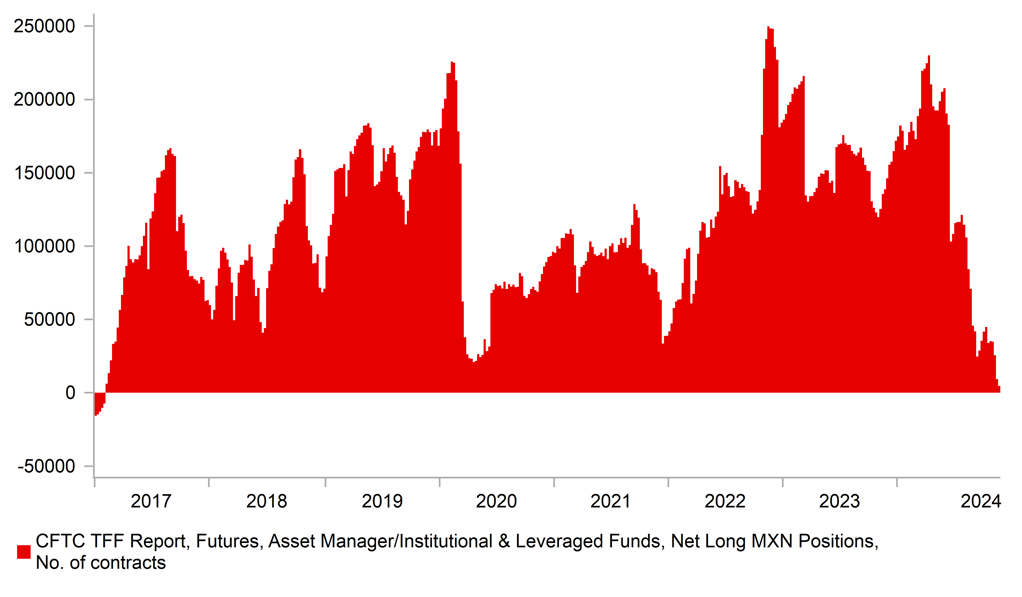

LONG MXN IMM POSITIONING PARED BACK TO JAN 2017 LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Caution remains the key word

The decline of the US dollar yesterday before the Trump-induced rebound was mainly against the euro and the Swiss franc with the pound not really benefitting from the weakness with GBP/USD only marginally higher thus resulting in the pound weakening against the euro. There wasn’t much to drive the pound stronger and the IMM positioning data released last Friday confirmed that the fall of the pound in the recent few weeks of data did not result in selling by Leveraged Funds – GBP long positions held by Leveraged Funds actually increased over the last two weeks – so the election of Trump hasn’t prompted a liquidation like it has for the euro.

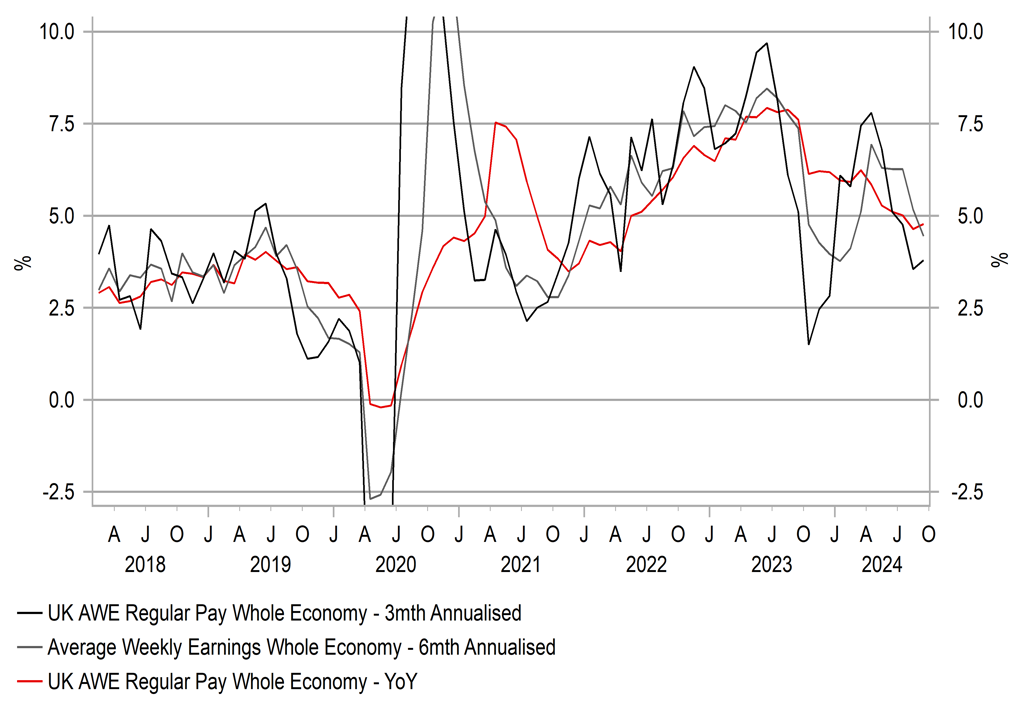

The caution of the BoE relative to the ECB is one possible factor encouraging Leveraged Funds to maintain their long GBP positions. BoE Deputy Governor Lombardelli spoke yesterday at the BoE Watchers’ Conference in London and stated that the BoE was concerned that wage growth was not slowing as much as was hoped.

These signs that the “process of wage disinflation may be slowing” meant that it was too early to declare victory on inflation. While viewing the risks to inflation as “broadly balanced” Lombardelli added that she was more concerned about the consequences if the upside risks materialised. This is complicated for the BoE given the risks appear to be stemming from the jobs market and wages when the quality of the data is clearly being questioned. If the Resolution Foundation is correct and there are potentially 1mn workers missing from the employment total it would certainly help explain some of the stickiness in the slowing of wage growth and justify a much slower pace of monetary easing.

But that caution from the BoE looks well priced at this stage with just about three 25bp rate cuts priced over the next 12mths, which is closely aligned to the pace in the US. The ECB is expected to cut rates by twice as much over the same period. If euro-zone growth is weak enough to justify that one could argue that the UK curve should not be as aligned with the US as it is and the impact of such weak growth in the euro-zone would allow for the UK to ease more than is currently priced.

The UK exported goods and services valued at GBP 188bn to the US in the four quarters to Q2 2024, which equated to 6.8% of UK nominal GDP over the same period. As we have highlighted before, the good news is that two-thirds of that total is services exports meaning goods exports that could be hit by tariffs amounted to 2.1% of GDP, which is smaller than in a number of countries in the euro-zone. The other positive that could gain traction with President-elect Trump is the overall position of trade in goods with the US – the UK 12mth surplus (US deficit) is very small at just GBP 4.6bn and hence Trump is unlikely to focus greatly on the UK-US trade imbalance. These factors could help contain GBP depreciation if the trade conflict escalates in the new year although the risks remain skewed to the downside indirectly via weakening growth in the euro-zone and globally that would see GBP suffer.

BOE CONCERNS AS UK WAGE GROWTH REMAINS ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB's Centeno speaks |

Nov |

-12 |

! |

|

|

EC |

09:15 |

ECB's Villeroy speaks |

!!! |

|||

|

EC |

10:00 |

ECB's Rehn speaks |

!! |

|||

|

UK |

11:00 |

CBI Total Dist Reported Sales |

Nov |

-12 |

!! |

|

|

UK |

11:00 |

CBI Retailing Reported Sales |

Nov |

-15 |

-6 |

!! |

|

EC |

13:00 |

ECB's Muller speaks |

! |

|||

|

CA |

13:20 |

BoC's Deputy Gov Muller speaks |

!! |

|||

|

US |

13:30 |

Philly Fed Non-Manuf. Index |

Nov |

6.0 |

! |

|

|

US |

15:00 |

New Home Sales |

Oct |

725k |

738k |

!! |

|

US |

15:00 |

Consumer Confidence |

Nov |

111.8 |

108.7 |

!!! |

|

US |

15:00 |

Richmond Fed Manuf. Index |

Nov |

-11 |

-14 |

! |

|

UK |

15:00 |

BoE's Huw Pill speaks |

!!! |

|||

|

US |

19:00 |

Fed Minutes |

!!!! |

Source: Bloomberg