USD/JPY break higher signals broader upside USD risks

EUR: ECB to hint at increased caution

The OIS market has precisely zero basis points priced for today’s monetary policy meeting with the September policy statement clearly indicating a pause was warranted in order to assess the impact of the monetary tightening taken to date. That tightening amounts so far to ten rate hikes totalling 450bps and a balance sheet that has shrunk in size by EUR 1.8 trillion, or by 20%. The bulk of that shrinkage relates to maturing TLTROs (about EUR 1.7trn) with a far smaller amount of APP-related securities maturing (about EUR 140bn). By our calculations based on current guidance (and an assumption of the APP run-rate being roughly unchanged in Q4 2024), the securities on the ECB’s balance under APP and PEPP will equate to around 31% of the latest 4-quarter GDP total. In the US under current Fed policy, securities held on the Fed’s balance sheet will equate to 23% of GDP.

So there are some within the Governing Council who are likely viewing the current run-rate as too slow and will push for a change in balance sheet policy that results in a faster roll-off of securities held. There are only two ways a faster roll-off rate can be implemented – changing the commitment to reinvest all securities under PEPP through to the end of 20024 or agreeing to commence outright sales of securities under APP. We doubt the ECB will agree to the latter which means a change in PEPP guidance for next year is more likely.

So there are two aspects to today’s ECB meeting which will be important for market participants. Firstly, the guidance in relation to interest rates. We expect a broadly unchanged statement given the new guidance on keeping rates at the current level for a “sufficiently long duration” was only framed at the last meeting. But we do expect also for President Lagarde to take a leaf out of Fed Chair Powell’s book from last week in putting emphasis on market conditions as playing a role in tightening financial conditions. The 10-year Bund yield is about 30bps higher since the last meeting.

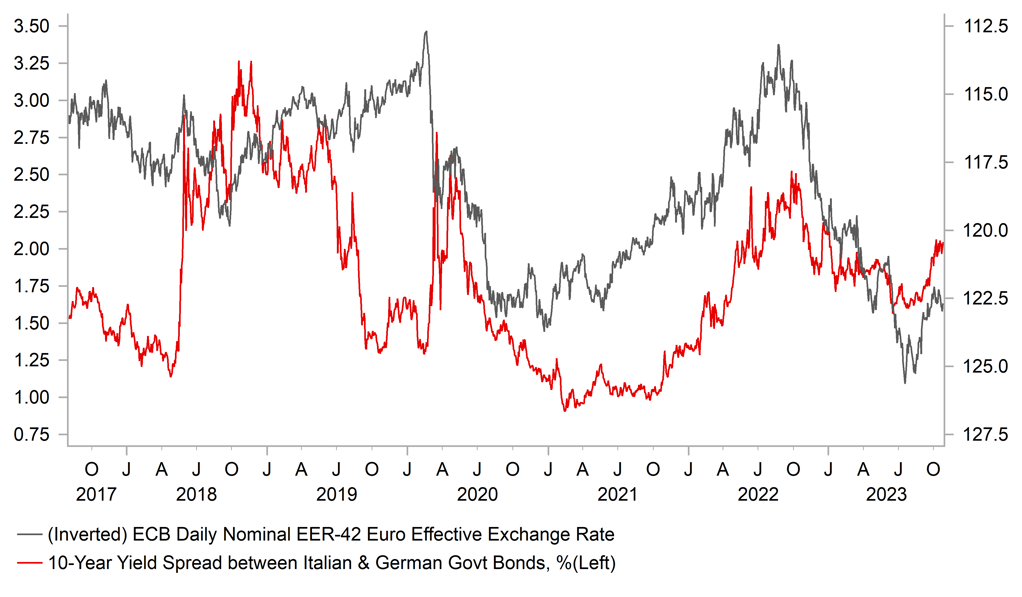

Secondly, there may be an acknowledgement of a discussion on balance sheet policy. That would raise expectations of a change in policy on PEPP to be announced in December. We will also be watching for references in relation to Italy. A question is very likely to be asked in the Q&A given the fiscal policy easing announced that will see the budget deficit in Italy move from 3.7% to 4.3% of GDP next year. Any criticism of Italy or a suggestion of doubts over Italy’s debt sustainability would likely trigger BTP selling and a widening of the BTP/Bund spread, that could act to fuel EUR selling. Debt sustainability is a requirement for the usage of the Transmission Protection Instrument (TPI) created to contain yield spreads if altering the monetary policy transmission. We suspect Lagarde will refrain from anything explicit that would fuel selling but there is a clear risk that view is wrong. The sharp EUR/USD sell-off after the rally on Monday suggests FX positioning is skewed toward a dovish tilt today and/or possibly some ECB-induced BTP selling. After the EUR/USD bounce on Monday, the move now looks more like a false breakout with the technical picture increasingly looking bearish for EUR/USD over the short-term. The window for USD strength that looked to be closing at the start of the week remains open for now.

EUR VS BTP/BUND SPREAD – A DOWNSIDE RISK FOR EUR

Source: Bloomberg, Macrobond & MUFG GMR

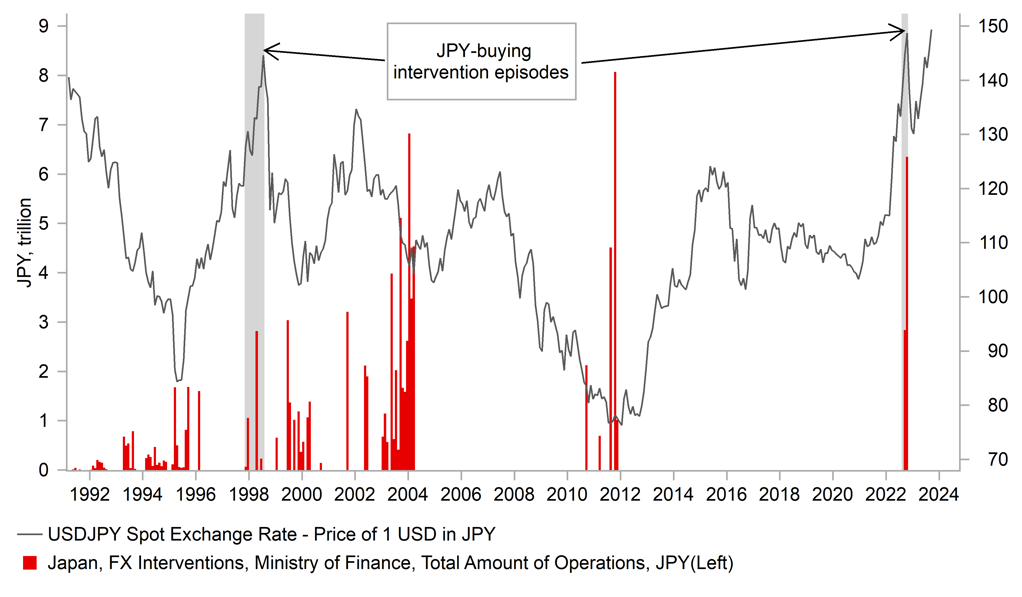

JPY: A break of 150 but market calm maintained for now

USD/JPY is trading at a new high for the day and the highest level since 21st October last year – the last time the Japanese authorities intervened to buy the yen. At the time of writing the price action remains contained with limited sign of disorderly price action.

This break higher could prove key though and may well be a signal for the markets to buy the US dollar more broadly. In that regard, the ECB meeting this afternoon is key. A break of 150.00 this morning and an ECB meeting that fuels EUR selling this afternoon could see US dollar strength extended more broadly.

There were some official comment earlier this morning from Tokyo with Finance Minister Suzuki confirming that he was “watching FX moves with the same sense of urgency”. However, in reality there is not the same sense of urgency and rhetoric in recent days has been less intense given the level. This we think is for good reason. At one stage yesterday, 1-month volatility in USD/JPY had dropped to around 7.6%, the lowest level since March 2022 when the entire USD/JPY move higher first began. Even after this break higher now, vol is well below the 11.2% average over the last 12mths (at 8.8%). When the MoF intervened in September and October last year, vol was trading between 13%-14%. It makes intervention by the MoF/BoJ that bit more difficult for the Japanese authorities given the commitments under G20 agreements. A lack of intervention into the BoJ meeting next Tuesday would raise expectations of a policy change at that meeting – a scenario that is seen as increasingly possible.

That doesn’t rule out intervention but it may mean the MoF waits until we get a sharper move higher. There remains a high risk that we see some sharp stop-loss buying that fuels a bigger move that could then offer the Japanese authorities the opportunity to intervene. FM Suzuki has also blurred the lines on what constitutes “excessive” moves while domestically there is increasing incentive to be seen to act. The LDP performed poorly in recent by-elections with voters unhappy with government policy to protect households from the cost of living crisis. Standing aside and allowing ongoing yen depreciation would only reinforce PM Kishida’s current unpopularity.

INTERVENTION RISKS ELEVATED AHEAD OF BOJ MEETING NEXT WEEK

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

|

SZ |

09:00 |

ZEW Expectations |

Oct |

-- |

-27.6 |

! |

|

|

GE |

09:00 |

German Business Expectations |

Oct |

83.3 |

82.9 |

!! |

|

|

GE |

09:00 |

German Current Assessment |

Oct |

88.5 |

88.7 |

!! |

|

|

GE |

09:00 |

German Ifo Business Climate Index |

Oct |

85.9 |

85.7 |

!! |

|

|

EC |

09:00 |

M3 Money Supply (YoY) |

Sep |

-1.7% |

-1.3% |

! |

|

|

EC |

09:00 |

Loans to Non Financial Corporations |

Sep |

-- |

0.6% |

! |

|

|

EC |

09:00 |

Private Sector Loans (YoY) |

-- |

1.0% |

1.0% |

! |

|

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-6.9% |

! |

|

|

US |

15:00 |

New Home Sales |

Sep |

680K |

675K |

!! |

|

|

CA |

15:00 |

BoC Monetary Policy Report |

-- |

-- |

-- |

!!! |

|

|

CA |

15:00 |

BoC Rate Statement |

-- |

-- |

-- |

!!! |

|

|

CA |

15:00 |

BoC Interest Rate Decision |

-- |

5.00% |

5.00% |

!!! |

|

|

CA |

16:00 |

BoC Senior Deputy Governor Rogers Speaks |

-- |

-- |

-- |

!! |

|

|

CA |

16:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!!! |

|

|

US |

18:00 |

5-Year Note Auction |

-- |

-- |

4.659% |

!! |

|

|

EC |

18:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!! |

|

|

US |

21:35 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

! |

|

|

AU |

23:00 |

RBA Assist Gov Kent Speaks |

-- |

-- |

-- |

!! |

|

|

AU |

23:00 |

RBA Gov Bullock Speaks |

-- |

-- |

-- |

!!! |

|

Source: Bloomberg