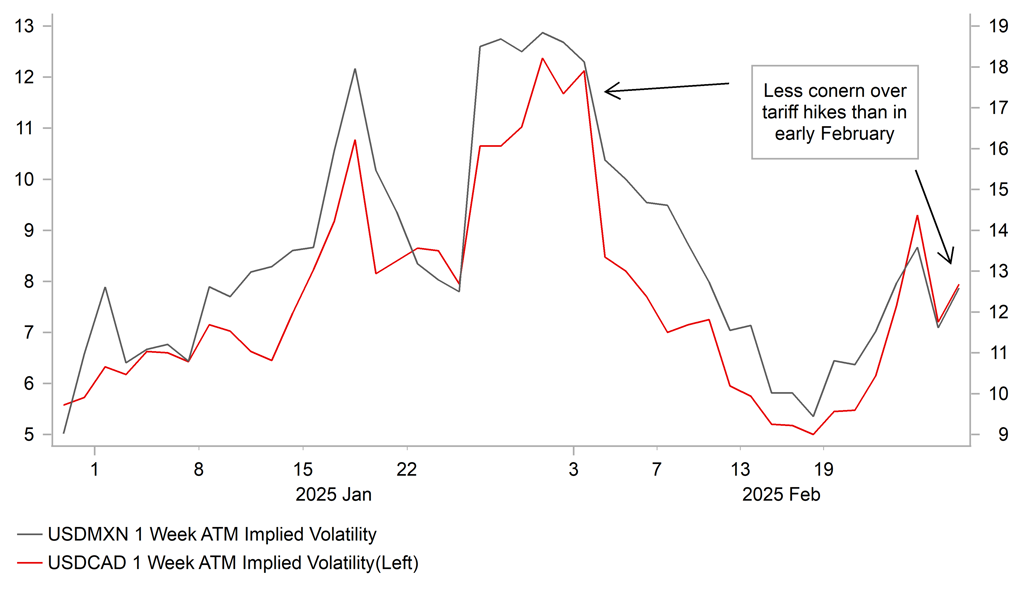

Trump’s trade policy threats having less impact on FX market

USD: President Trump creates more tariff uncertainty

The euro has continued to trade at modestly weaker levels overnight resulting in EUR/USD falling to a low of 1.0459. It follows comments yesterday from President Trump who once again threatened to implement higher tariffs on imports from the EU. When questioned about his plans for EU tariffs at his first cabinet meeting yesterday, he stated that “we have a made a decision and we’ll be announcing it very soon. It’ll be 25% generally speaking, and that will be on cars and all other things”. He did not offer any specific details on his proposed tariffs but continued to criticize the EU for “really taking advantage of us in a different way. They don’t accept our cars. They don’t accept essentially our farm products they use all sorts of reasons why not”. The EU was already a target under President Trump’s previous plans for: i) reciprocal tariffs, ii) aluminium and steel tariffs, and iii) automobiles, semiconductors and pharmaceutical tariffs that are scheduled to take effect in the coming months. It is not clear if President Trump was referring to all those potential tariff hikes when he stated he would implement a 25% tariff hike on the EU generally speaking.

At the same time, President Trump created more uncertainty over the potential implementation of 25% tariff hikes on imports from Canada and Mexico. He had previously planned to implement those tariffs on 4th February with a lower 10% tariff rate for energy imports from Canada but postponed for a month after Canada and Mexico were able to satisfy President Trump’s demand for tighter border controls to stop the flow of illegal drugs and immigrants into the US. The deadline for tariffs was pushed back until next week on 4th March. However, President Trump stated overnight that those tariffs would now not be implemented until 2nd April. A White House official had to clarify later on that the deadline for tariffs on Canada and Mexico remained on 4th March, and that President Trump had not yet decided whether to grant another extension. However, the comments from President Trump if taken at face value provide some comfort that tariff hikes are unlikely to be implemented as early as next week. A development that could help to ease downside risks for the Canadian dollar and Mexican peso in the week ahead.

Canada and Mexico are currently in negotiations with the US to avoid tariffs being implemented next week. It was reported this week that as part of a potential deal Mexico has been asked to implement higher tariffs on imports from China to address US concerns that China is increasingly using Mexico as a backdoor to export into the US and avoid higher tariffs. It has also been suggested that the review of the USMCA trade deal scheduled for 1st July 2026 could be brought forward. The new date President Trump mentioned of 2nd April suggests that Canada and Mexico are more likely to impacted by other tariff plans such as reciprocal tariffs and/or automobiles, semiconductors and pharmaceuticals rather than the country specific tariffs. One thing that’s clear though is that heightened trade policy uncertainty is bad for growth.

CAD & MXN IMPLIED VOLS REMAIN LOWER THAN IN EARLY FEBRUARY

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Will the ECB stick to cutting rates at every meeting going forward?

The ECB’s upcoming policy meeting next week on 6th March is attracting more attention after recent comments from ECB officials. The ECB has already clearly signalled that it plans to deliver another 25bps cut next week lowering the policy rate to 2.50%. However, it is becoming less clear whether the ECB will continue to maintain the current pace of easing after next week by cutting rates at every meeting. The risk of the ECB skipping a meeting and leaving rates on hold at the following meeting in April has been increasing recently. However, the euro-zone rate market is still pricing in a high probability (~68%) another 25bps of cut in the April as well. The looming threat of tariff hikes on the EU in the coming months continues to pose downside risks to growth in the euro-zone and may encourage the ECB to keep lowering rate at every meeting at least until rates move closer to President Lagarde’s estimated range for the neutral rate between 1.75% and 2.25%.

Recent comments from ECB officials have indicated though that views on further policy action are beginning to become more dispersed. Governing Council member Nagel stated that rates are “getting into more into the neutral term” suggesting that the need for further cuts is diminishing. He added that “it’s wise to take one step at a time in terms of monetary policy given the higher level of uncertainty, and emphasized that they are not in a rush to cut rates further. A view that was shared by ECB Executive Board member Schnabel who stated that “we can no longer say with confidence that our policy is restrictive”. She believes that “we are getting closer to the point where we may have to pause or halt our rate cuts”. Governing Council member Wunsch stated that “I’m not pleading for a pause in April but we must not sleepwalk to 2.00% without thinking about it”. Governing Council member Holzmann expressed the view that “a decision in favour of another cut gets harder and harder, both now and beyond March”. The comments suggest to us that it is far from a done deal that the ECB will cut rates both in March and April as currently priced in. It poses one potential upside risk for euro in the near-term although we still expect the policy rate to fall to 2.00% this year.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

08:55 |

German Unemployment Change |

Feb |

-- |

11K |

!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Jan |

3.8% |

3.5% |

! |

|

EC |

10:00 |

Consumer Confidence |

Feb |

-13.6 |

-14.2 |

! |

|

EC |

12:30 |

ECB Publishes Account of Monetary Policy Meeting |

-- |

-- |

-- |

!! |

|

US |

13:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

Jan |

2.0% |

-2.2% |

!! |

|

US |

13:30 |

GDP (QoQ) |

Q4 |

2.3% |

3.1% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

222K |

219K |

!!! |

|

US |

13:30 |

PCE Prices |

Q4 |

2.3% |

1.5% |

! |

|

US |

14:15 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

|

US |

16:45 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

|

US |

20:15 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,782B |

!! |

|

JP |

23:30 |

CPI (YoY) |

Feb |

-- |

1.0% |

!! |

Source: Bloomberg