Modest rebound for USD after heavy sell-off last week

USD1: Weak China PMI surveys dampen tariff optimism

The US dollar has rebounded modestly overnight following a heavy sell-off at the end of last week. After hitting a low of 107.22 on Friday, the dollar index has risen back up to a high overnight of 107.80. Last week’s second consecutive weekly decline for the US dollar was driven mainly by the paring back of fears (click here) over disruption to global trade from President Trump implementing higher tariffs at the start of this second term. At the end of last week the US dollar sell-off was reinforced by comments from President Trump stating that he would prefer not to have to hike tariffs on goods imported from China adding to investor optimism that a tariff hike of 10% will not be implemented as early as threatened from 1st February. The comments helped to lower USD/CNY to a low of 7.2376 on Friday although it has since risen back up to a high overnight of 7.2675. The partial reversal of renminbi gains at the start of this week has been encouraged in part by the release of weaker than expected PMI surveys from China over the weekend.

The official PMI surveys for January signalled that China’s economy unexpectedly lost growth momentum ahead of the Lunar New Year holiday. January business confidence surveys revealed that manufacturing weakened more than the typical seasonal dip during a Lunar New Year month. The manufacturing PMI fell by 1.0 point to 49.1 in January, and hit the lowest level since August. At the same time, the services PMI fell even more sharply by 2.0 points to 50.2 bucking the normal seasonal tendency for a pick-up as the service sector benefits from holiday-related demand. The softer business confidence surveys signal that China’s economy has made a weaker than expected start to the new calendar year and will increase calls for domestic policymakers to step up fiscal and monetary policy support for growth in the coming months. The need for additional stimulus will increase intensify if President Trump follows through with threats to hike tariffs on China. We expect additional stimulus to be implemented after the Lunar New Year holiday break between 28th January to 4th February. The combination of weak growth momentum in China, prospect of further PBoC rate cuts and threat of higher tariffs on goods imported from China continues to support our outlook for the renminbi to weaken this year, and for USD/CNY to move back up towards our forecast of 7.5000.

The threat of tariffs during Trump’s second term as president has been in focus over the weekend. President Trump ordered his administration to impose tariffs and sanctions on Colombia for refusing to allow military planes carrying illegal migrants from landing. In a Truth Social post he threatened to implement an emergency 25% tariff on all imports of goods from Colombia, which would have been raised up to 50% in a week as well as travel curbs and unspecified sanctions. The threat has quickly proved successful in forcing Colombian President Gustavo Petro to “agree to all of President Trump’s terms” without delay. While the tariff hikes will now not be implemented, it will further encourage President Trump to use similar tactics on other countries to bend them to his will. Colombia has historically been one of Washington’s biggest diplomatic allies in Latin America and a major recipient of US aid and military assistance. Emerging market currencies such as the Mexican peso and South African rand have opened up weaker at the start of this week in response.

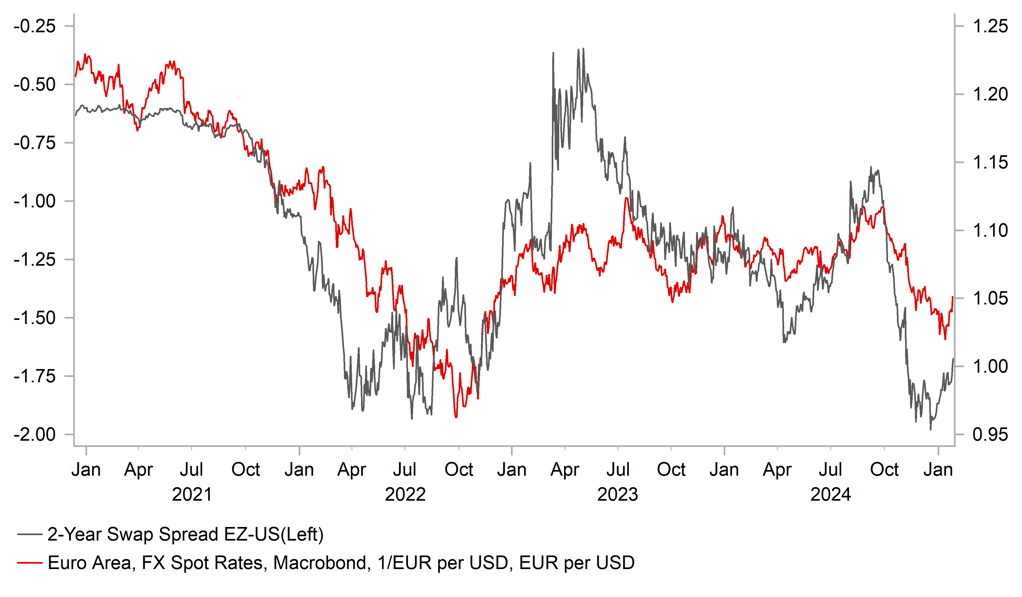

YIELD SPREADS REMAIN SUPPORTIVE FOR STRONG USD

Source: Bloomberg, Macrobond & MUFG GMR

USD2: Fed policy divergence to remain supportive for stronger US dollar

There is a heavy schedule for central bank policy updates this week including the Fed, ECB, BoC and Riksbank amongst G10 central banks. At the last FOMC meeting in December, the Fed sent a clear signal that they plan to take more time to assess how the US economy is evolving and Trump’s policy plans before cutting rates further this year. It has set up the Fed to leave rates on hold this week bringing an end to the run of three consecutive rate cuts delivered since September of last year. Market participants will be watching closely to see if the Fed provides clearer guidance over the potential timing of the next planned rate cut. The US rate market has already moved to price in a longer pause at the start of this year with the next Fed rate cut not expected until May or June. There are currently only around 8bps of cuts priced in for the following FOMC meeting in March.

It is a view we broadly agree with given evidence of stronger US employment growth since the US election that will make it harder to justify continuing to cut rates even as inflation slowed at the end of last year. Trump’s plans to tighten immigration will also play into more Fed unease over inflation risks from the labour market. Still, we acknowledge that an earlier cut in March can’t be completely ruled out and poses the main downside risk for the US dollar this week if the Fed provides a signal in that direction. In contrast, we remain more confident that the other major central banks of the ECB, BoE and PBoC will cut rates further at the start of this year. Policy divergence at the start of this year is supportive for a stronger US dollar and should dampen downside risks from slower tariff implementation.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:10 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

GE |

09:00 |

German Ifo Business Climate Index |

Jan |

84.9 |

84.7 |

!! |

|

US |

13:00 |

Building Permits |

Dec |

1.483M |

1.493M |

!! |

|

US |

15:00 |

New Home Sales |

Dec |

669K |

664K |

!!! |

|

EC |

15:35 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

SZ |

21:25 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg