EUR is proving resilient to weak data flow so far

EUR: Weak euro-zone data flow having limited negative impact so far

It has been a relatively quiet start to the week for the FX majors. The dollar index is holding on to gains from late last week following the release of much weaker than expected euro-zone PMI surveys for June on Friday leaving it roughly in the middle of the range between 100.00 and 105.00 that has been in place for most of this year. The weak run of economic data releases from the euro-zone continued yesterday when the German IFO survey came in below consensus expectations as well. According to Bloomberg, it is the weakest run of negative economic data surprises from the euro-zone since June 2020 when the economy was just beginning to recover from the first COVID shock. The recent run of negative economic data has dampened optimism over a pick-up in growth for the euro-zone economy in the near-term after it was confirmed that it fell into a mild technical recession at the start of this year. The recovery in the service sector (PMI @ 52.4 in June) appears to have lost momentum in recent months while the contraction in the manufacturing sector (PMI @ 43.6 in June) is intensifying.

The deterioration in business confidence in recent months was evident as well in yesterday’s German IFO survey. The headline survey measure and the expectations component have both declined sharply by -8.3 points and 5.0 points respectively over the last couple of months.

The negative impact on the euro has though been relatively limited so far. Wile the euro has lost upward momentum in recent months, it is still only around -0.6% lower than this year’s peak from 26th April against our equally-weighted basket of other G10 currencies. The best performing G10 currencies against the euro since it peaked on 26th April have been the Canadian dollar (+5.0% vs. EUR), GBP (+3.2%), AUD (+2.8%) and the NZD (+2.3%). In contrast, the JPY (-5.9% vs. EUR) and SEK (-2.4%) have continued to weaken against the euro.

The relatively limited negative impact on the euro may reflect in part that expectations for further ECB policy tightening have not been scaled back in response to weaker euro-zone growth. The euro-zone rate market still expects the ECB to deliver two further 25 bps rate hikes this year. There are currently 23bps of hikes priced in for next month’s ECB policy meeting and 48bps of hikes by the end of this year. Another hike in July is viewed as almost a done deal after President Lagarde stated it was “highly likely” at their last policy meeting. In contrast, it remains more uncertain at the current juncture whether a second hike will be delivered later this year. The ECB has signalled it will be watching core inflation closely and it is expected to pick-up heading into the summer which is supporting expectations for a second hike later this year. The developments are helping to keep the euro trading at stronger levels for now despite the run of weak economic data from the euro-zone that has increased downside risks. Market participants will be watching comments from ECB officials this week at their annual Central Bank Conference at Sintra to see if there is any change in tone on monetary policy guidance. President Lagarde is scheduled to speak today.

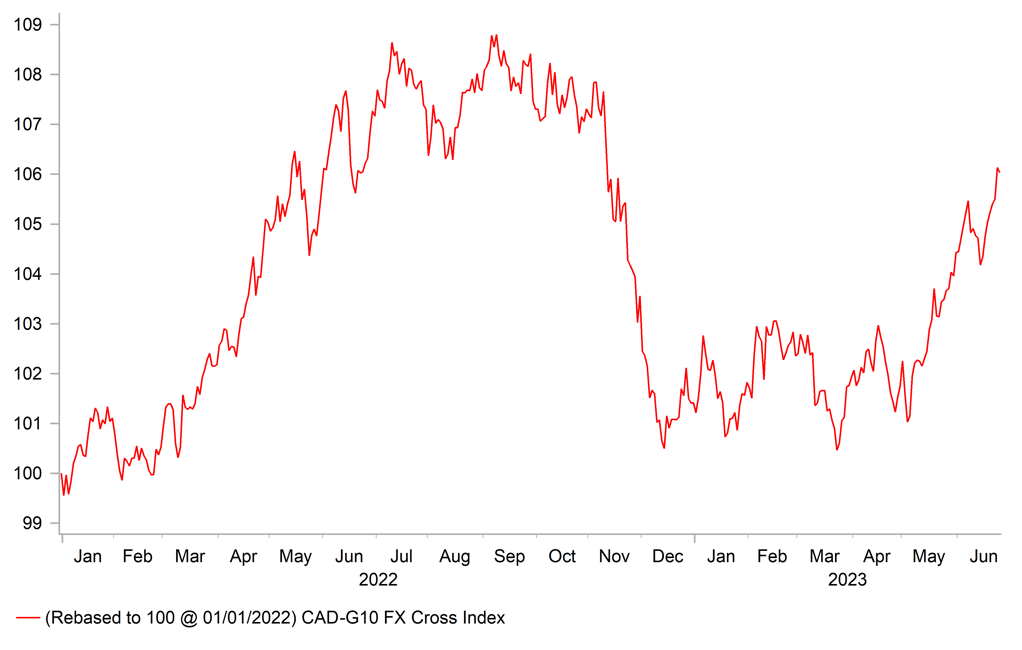

CAD HAS BEEN REVERSING LOSSES FROM END OF LAST YEAR

Source: Bloomberg, Macrobond & MUFG GMR

CAD: Will the BoC deliver back to back rate hikes in July?

In contrast to the euro, the Canadian dollar has been outperforming in recent months. It has strengthened by around +5.5% against our equally-weighted basket of other G10 currencies since the low point this year on 23rd March. The Canadian dollar has been the best performing G10 currency since the 23rd March. The Canadian dollar has been supported both by the improvement in global investor risk sentiment, and by the hawkish repricing of BoC rate hike expectations. The low point for the Canadian dollar this year also coincided with the low point for Canadian rates. The implied yield on the December 2023 Canadian interest rate futures contract hit a low point of 3.96% on 15th March and has since jumped to a peak of 5.70% on 22nd June. The aggressive hawkish repricing of rate expectations was reinforced by the BoC’s surprise decision to resume rate hikes earlier this month bringing an end to the temporary pause that had been in place since late January.

Similar to other G10 central banks, the BoC has become uncomfortable that inflation is proving stickier than expected. At their last policy meeting they cited concern that three-month measures of core inflation have been running in the “3½-4% range for several months and excess demand persisting”. The Canadian economy has proven more resilient than expected at the start of this year. It is placing more pressure on the BoC to keep raising rates further into restrictive territory. The release today of latest Canadian CPI report for May will provide further insight into how sticky inflation is proving to be. The Canadian rate market is currently pricing in around 16bps of hikes for next month’s BoC policy meeting on 12th July with back to back 25bps hikes judged as more likely than not. A weaker than expected CPI report today poses the main risk of a set-back for the Canadian dollar’s recent bull run.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB's Lagarde Speaks in Sintra |

!!! |

|||

|

UK |

09:30 |

BOE's Tenreyro Speaks in Sintra |

!! |

|||

|

CA |

13:30 |

CPI YoY |

May |

3.4% |

4.4% |

!!! |

|

US |

13:30 |

Durable Goods Orders |

May P |

-0.8% |

1.1% |

!! |

|

US |

15:00 |

New Home Sales |

May |

675k |

683k |

!! |

|

US |

15:00 |

Conf. Board Consumer Confidence |

Jun |

103.9 |

102.3 |

!! |

Source: Bloomberg