Japan is moving closer to intervening again to support JPY

JPY: Verbal intervention steps up another notch

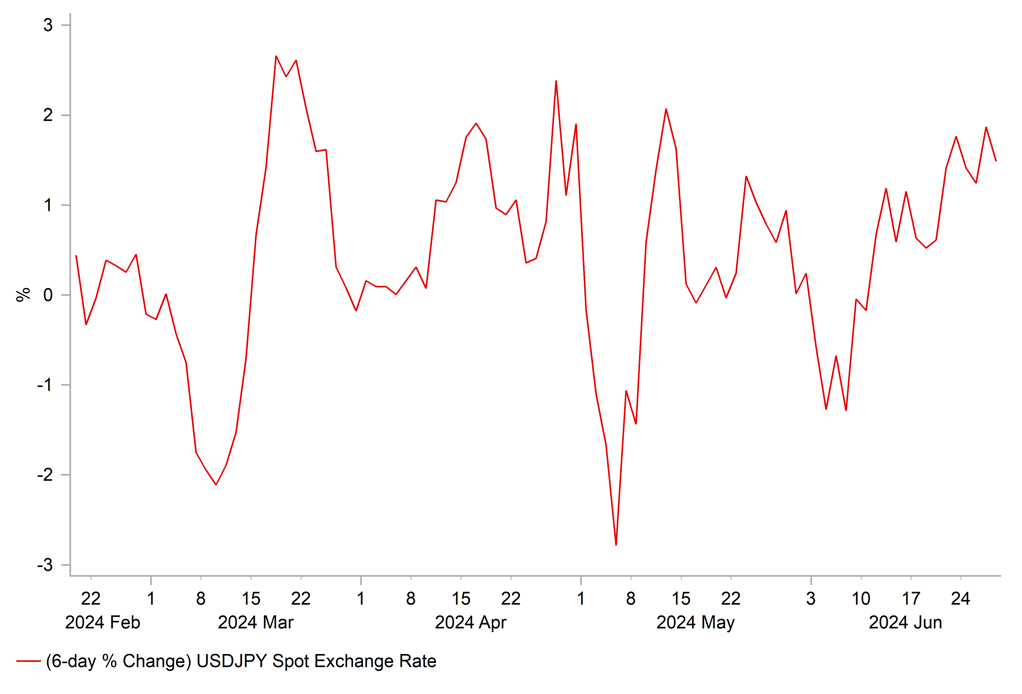

The yen continued to trade at weaker levels overnight after USD/JPY hit a fresh year to date high at 160.87. Yen weakness has drawn a greater concern from Japanese officials who have attempted to slow down the pace of the yen’s decline. Japan’s top currency official Kanda warned clearly yesterday that “I have serious concern about the recent rapid weakening of the yen and we are closely monitoring market trends with a high sense of urgency. We will take necessary actions against any excessive movements”. It quickly follows on from his comments earlier in the week when he warned that Japan can intervene at any time. Together the comments send a clear signal that Japan will intervene soon if the recent pace of yen weakness continues. Those comments have been reinforced further by comments from Finance Minister Suzuki overnight who stated that he is strongly concerned by the FX impact on the Japan’s economy from one-sided moves in the foreign exchange market that are not desirable. While the step up in verbal intervention may help to slow the pace of yen weakness in the near-term, it will have to be backed up again by direct intervention to purchase the yen. At the same time, it is hard to see what another bout of intervention can achieve other than buying more time to allow for a change in fundamentals to trigger a reversal of yen weakness. After the last bout of record intervention from Japan to support the yen in late April/early May, it took around two months for USD/JPY fully recover intervention driven losses and to rise to fresh highs this week.

With the Fed unlikely to begin cutting rates until September at the earliest point and the US rate market already almost pricing in 50bps of cuts from the Fed by the end of this year, it will likely require evidence of sharper slowdown for the US economy to trigger a reversal of yen weakness and to encourage the US rate market to price in a much faster pace of rate cuts. On the other hand, we expect the BoJ to hike rates further next month by 15bps alongside unveiling plans to slowdown the pace of JGB purchases. The developments continue to place upward pressure on yields in Japan with the 10-year JGB yield rising back closer towards the year to date high at 1.10% overnight. However, with yield still well below levels in the US and other major economies and Japan’s real policy rate adjusted for inflation still deeply in negative territory, the ongoing adjustment higher in Japanese yields is not yet sufficient to trigger a reversal of yen weakness either. We doubt that the BoJ will send a hawkish message alongside hiking rates next month to signal that it will speed up the pace of hikes as well.

PACE OF JPY SELL-OFF ATTRACTING MORE CONCERN

Source: Bloomberg, Macrobond & MUFG GMR

EUR/GBP: Political risks remain in focus ahead of upcoming elections

In contrast to yen performance, the other major currency pairs have remained more stable so far this week ahead of the upcoming key event risks including tonight’s first US Presidential debate, the release tomorrow of the latest US PCE deflator report for May, the first round of the French election on 30th June and then next week’s UK election held on 4th June and second round of the French election on 7th June. Political risk in Europe is clearly having a bigger impact on the performance of the euro more than the pound. EUR/USD has fallen back towards the middle of the current 1.0500 to 1.1000 trading range and EUR/GBP has broken below support at the 0.8500-level which had remained in place for over a year prior to the pick-up in political risk in France. After threatening to break above the 1.2800-level earlier this month cable has also dropped back towards support at closer to the 1.2600-level.

Unlike the upcoming elections in France, the results of the UK election are not expected to have a significant impact in pound performance next week. The Labour party continue to hold on to a strong lead in the opinion polls and are widely expected to win a large majority in parliament. The final TV debate between Labour leader Starmer and PM Sunak overnight appears unlikely to prove decisive. The snap YouGov poll showed that there was no clear winner. Market participants remain comfortable with the prospect of a big Labour majority which could bring more stability to UK politics and open up the potential for relations between the EU and UK to improve in the coming years. A bigger pound reaction could be triggered if Labour performs worse than expected by the polls and there is a hung parliament scenario which could trigger a pound sell-off but that scenario appears unlikely.

In contrast, we continue to believe that the upcoming elections in France will be more important for euro performance. The far-right RN party remain on track to be the biggest party in parliament after the upcoming elections. Jonathan Bardella of the RN party has been interviewed by the FT in which he promised “a lot of pragmatism” on the economy if he wins. He stated that “I think economic policy consists of a handful of core convictions and lot of pragmatism to ensure trust and stability for the business community”. His first move if the RN wins power would be to cut VAT on energy and petrol which he says would cost EUR12 billion/year which he would look to offset by taxing windfall profits on energy companies, closing tax loopholes on maritime shipping companies and cutting France’s annual contribution to the EU budget by EUR2 billion. It would place France on a more confrontational path with the EU, although he noted that “I do not intend to go to war with Brussels…I just want France to defend its interests”. Overall, the comments are helping to ease some concerns over the RN’s policy agenda as they water down some of their proposals. The 10-year yield spread between France and Germany has started to stabilize between 75-80bps over the past week in the run up to the French elections. On balance we still believe that risks remain tilted to the downside for the euro heading into the French election both against the US dollar and pound.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

M3 Money Supply (YoY) |

May |

1.5% |

1.3% |

! |

|

UK |

10:00 |

BoE Financial Stability Report |

-- |

-- |

-- |

!! |

|

UK |

10:30 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

EC |

11:00 |

Euro Summit |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Durable Goods Orders (MoM) |

May |

-0.5% |

0.7% |

!! |

|

US |

13:30 |

GDP (QoQ) |

Q1 |

1.3% |

3.4% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

236K |

238K |

!!! |

|

US |

15:00 |

Pending Home Sales (MoM) |

May |

0.6% |

-7.7% |

!! |

|

US |

21:30 |

Fed Bank Stress Test Results |

-- |

-- |

-- |

!! |

Source: Bloomberg