Trump’s tariff announcements having less impact on FX market

USD: Muted FX market reaction to President Trump’s auto tariff plans

The main market moving event overnight was the policy announcement from President Trump that he plans to implement a 25% tariff on auto imports. The White House stated that the tariffs would not only apply to fully assembled cars but key automobile parts as well including engines, transmissions, powertrain parts and electrical components. That list could be expanded over time to encompass additional parts. The automobile tariffs will be collected starting from 12.01am Washington time on 3rd April while the tariffs on auto parts will take effect no later than 3rd May. The longer lead time before auto parts tariffs are implemented will allow the Trump administration to develop a plan to deal with parts that cross the border multiple times.

President Trump described the plans as “permanent” putting a dampener on expectations that they could be watered down or reversed before they are implemented. For Canada and Mexico who are part of the USMCA trade agreement, the White house clarified that both countries would be given “the opportunity to certify their US content and systems will be implemented such that a 25% tariff will only apply to the value of their non-US content”. The new tariffs on auto and auto parts will be implemented on top existing tariffs. The White House expects the tariffs to raise new annual revenues of around USD100 billion. According to Reuters, the US imported USD474 billion worth of automotive products in 2024 including passenger cars totalling USD220 billion. Mexico, Japan, South Korea, Canada and Germany were the biggest suppliers who will be hit the hardest the new tariffs.

In response European Commission President Ursula von der Leyen has described the US decision as “regrettable”. She stated that “we will now assess this announcement, together with other measures the US is envisaging in the next days” and “the EU will continue to seek negotiated solutions, while safeguarding its economic interests”. President Trump plans to announce the details of his “reciprocal tariffs” plan on 2nd April. He provided some encouragement that the “reciprocal tariffs” won’t be as disruptive as feared by stating that he’ll “probably be more lenient than reciprocal, because if I was reciprocal, that would be very tough for people” while adding there will be “some exceptions”. A White House official also told CNBC that President Trump may not factor into non-tariff barriers, indirect levies like value-added taxes, into his reciprocal tariffs. 2nd April is also the date when current exemptions on goods from President Trump’s 25% tariffs on imports from Canada and Mexico are due to expire. At the same time President Trump has indicated that he “may give a reduction in tariffs” to China if they play a role in the sale of TikTok.

Finally, President Trump has warned Canada and the EU overnight that he could raise tariffs further if they work together to retaliate. He posted on Truth Social that “if the EU works with Canada in order to do economic harm to the USA, large scale tariffs, far larger than currently planned, will be placed on them both in order to protect the best friend that each of those two countries has ever had!”. Bloomberg has reported that France has urged the European Commission to consider deploying its most powerful retaliatory measure, the so-called anti-coercion instrument for the first time ever. According to the report, imposing retaliatory tariffs is the EU’s preferred response. Canadian Prime Minister Carney described the auto tariffs as a “direct attack” on people who work in the auto industry and violate the USMCA trade agreement but didn’t disclose any immediate retaliatory measures before meeting with cabinet ministers. Japanese Prime Minister Ishiba stated that “we must consider appropriate responses and naturally, all options are on the table” to “consider what will best serve the national interests of Japan”.

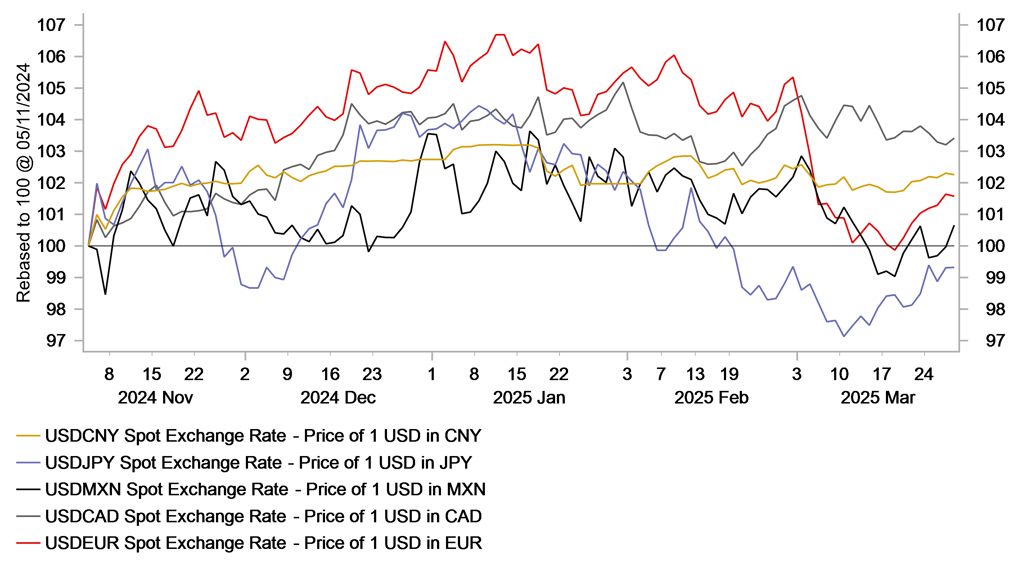

The initial foreign exchange market response to the auto and auto parts tariffs announcement overnight has been relatively muted. The dollar index is still trading close to the highs from this week as it continues to stage a modest rebound in the near-term. The Mexican peso has weakened the most over the last 24 hours by -0.6% against the US dollar while the Canadian dollar and yen have strengthened marginally by +0.2% and the euro is roughly flat. The muted market reaction could reflect a number of factors. Firstly, the reaction for function for the US dollar in response to tariffs has changed recently. With the US slowing down, the tariffs on autos and parts will add to downside for the US economy especially by disrupting the interlinked supply chains in North America which is preventing the US dollar from strengthening further. Secondly, President Trump’s comments that financial markets will be “pleasantly surprised” by his “reciprocal tariffs” plan and holding out the possibility of reversing tariffs on China to encourage a deal for TikTok have provided encouragement that tariffs will be less disruptive than feared. Finally, it could also be an indication that market participants are now waiting more to see evidence of the impact of the tariffs on economic activity and inflation amidst the current elevated level of uncertainty. If evidence begins to emerge that US trading partners are being hurt more by tariffs than the US over the next six to twelve months then the US dollar could strengthen further but for now market participants appear to be in wait and see mode.

PERFORMANCE OF USD SINCE US ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:30 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

! |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.50% |

4.50% |

!! |

|

EC |

09:00 |

M3 Money Supply (YoY) |

Feb |

3.8% |

3.6% |

! |

|

US |

12:30 |

Core PCE Prices |

Q4 |

2.70% |

2.20% |

!! |

|

US |

12:30 |

Goods Trade Balance |

Feb |

-134.60B |

-155.57B |

!! |

|

US |

12:30 |

Initial Jobless Claims |

-- |

225K |

223K |

!!! |

|

US |

14:00 |

Pending Home Sales Index |

Feb |

-- |

70.6 |

! |

|

EC |

17:40 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!! |

|

EC |

18:05 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

20:30 |

Fed's Balance Sheet |

-- |

-- |

6,756B |

!! |

|

US |

20:30 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

JP |

23:30 |

Tokyo CPI (YoY) |

Mar |

-- |

2.9% |

! |

Source: Bloomberg